2013 Chrysler Town & Country Touring-l on 2040-cars

Engine:V6

Fuel Type:Gasoline

Body Type:4D Passenger Van

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 2C4RC1CG9DR610262

Mileage: 166816

Make: Chrysler

Model: Town & Country

Trim: Touring-L

Features: --

Power Options: --

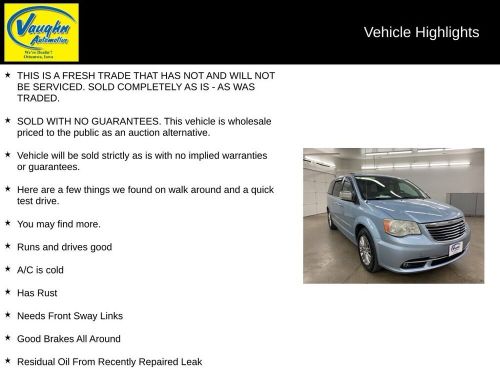

Exterior Color: Blue

Interior Color: Black

Warranty: Unspecified

Chrysler Town & Country for Sale

2013 chrysler town & country limited minivan 4d(US $6,499.00)

2013 chrysler town & country limited minivan 4d(US $6,499.00) 2015 chrysler town & country touring-l(US $10,999.00)

2015 chrysler town & country touring-l(US $10,999.00) 2012 chrysler town & country 4dr wgn touring(US $6,950.00)

2012 chrysler town & country 4dr wgn touring(US $6,950.00) 2014 chrysler town & country touring-l(US $8,900.00)

2014 chrysler town & country touring-l(US $8,900.00) 2010 chrysler town & country(US $4,500.00)

2010 chrysler town & country(US $4,500.00) 2013 chrysler town & country touring minivan 4d(US $9,999.00)

2013 chrysler town & country touring minivan 4d(US $9,999.00)

Auto blog

Judge refuses to reconsider GM lawsuit against Fiat Chrysler

Sat, Aug 15 2020A federal judge in Detroit said Friday that he will not reconsider his July dismissal of General Motors’ racketeering lawsuit against Fiat Chrysler Automobiles. U.S. District Judge Paul Borman wrote in an opinion that new evidence presented by GM regarding bribes and foreign bank accounts “is too speculative to warrant reopening” the case. Borman also ruled that the earlier dismissal of the case was not done in legal error. GM alleged that FCA used foreign bank accounts to pay bribes to former United Auto Workers Presidents Dennis Williams and Ron Gettelfinger, as well as Vice President Joe Ashton. It also alleges that money was paid to GM employees including Al Iacobelli, a former FCA labor negotiator who was hired and later released by GM. GM said the payments were made so the officials would saddle GM with more than $1 billion in additional labor costs. “Even if the affidavits establish that these foreign bank accounts exist, that fact does not rise to the inference advanced by GM, that FCA was more-than-likely using the bank accounts to bribe UAW officials,” BormanÂ’s order stated. GM said Friday that it would appeal BormanÂ’s ruling to the Sixth Circuit Court of Appeals. “TodayÂ’s decision is disappointing, as the corruption in this case is proven given the many guilty pleas from the ongoing federal investigation,” GM said in a statement. “GMÂ’s suit will continue — we will not accept corruption.” FCA lawyers wrote in court documents that allegations it bribed union officials are “preposterous” and read like a script from a “third-rate spy movie.” Gettelfinger denied the allegations in a statement and said he had no foreign accounts. WilliamsÂ’ California home was raided by federal agents but he has not been charged. Iacobelli, who is awaiting sentencing in the federal corruption probe, also denied the claims. “Judge BormanÂ’s ruling this morning once again confirms what we have said from the beginning — that GMÂ’s lawsuit is meritless and its attempt to submit an amended complaint under the guise of asking the court to change its mind was nothing more than a baseless attempt to smear a competitor that is winning in the marketplace,” FCA said Friday in a statement. Related Video: Government/Legal Chrysler Fiat GM

EIB ups financing for Fiat Chrysler's electric vehicles to $949 million

Sat, Sep 19 2020MILAN — The European Investment Bank (EIB) has increased to almost 800 million euros ($949 million) its funding to Fiat Chrysler Automobiles (FCA) to support production of electric and hybrid vehicles, they said in a joint statement. Investments to manufacture battery electric vehicles and plug-in hybrid electric vehicles will be mainly directed at FCA plants located in southern Italy, supporting employment and compliance with the strictest environmental criteria. To improve capacity utilization at FCA's Italian plants, the group has announced a 5 billion euro investment plan for the country through 2021 which envisages the launch of new electric and hybrid models. EIB and FCA had sealed 300 million euros in financing before the summer to fund investments for plug-in hybrid electric vehicle production lines at plants in Melfi, in the southern Basilicata region, and battery electric vehicles at Fiat's historic Turin plant of Mirafiori over the 2019-2021 period. FCA has now finalized a 485 million euro deal with EIB to support both an innovative line of plug-in hybrid electric vehicles at the Pomigliano plant in the southern Campania region as well as R&D activities at FCA laboratories in Turin. The EIB credit line covers 75% of the total value of FCA's investment in the project for the 2020-2023 period. Earnings/Financials Green Plants/Manufacturing Chrysler Fiat

Analysts wary over FCA lawsuit but say emissions not as bad as VW

Wed, May 24 2017MILAN - Any potential fines Fiat Chrysler (FCA) may need to pay to settle a US civil lawsuit over diesel emissions will unlikely top $1 billion, analysts said, adding the case appeared less serious than at larger rival Volkswagen. The US government filed a civil lawsuit on Tuesday accusing FCA of illegally using software to bypass emission controls in 104,000 vehicles sold since 2014, which it said led to higher than allowable levels of nitrogen oxide (NOx) that are blamed for respiratory illnesses. FCA's shares dropped 16 percent in January when the U.S. Environmental Protection Agency (EPA) first raised the accusations, adding the carmaker could face a maximum fine of about $4.6 billion. The stock has been under pressure since. Volkswagen agreed to spend up to $25 billion in the United States to address claims from owners, environmental regulators, U.S. states and dealers. FCA, which sits on net debt of 5.1 billion euros ($5.70 billion), lacks VW's cash pile but analysts said its case looked much less severe. While VW admitted to intentionally cheating, Fiat Chrysler denies any wrongdoing. Authorities will have to prove that FCA's software constitutes a so-called "defeat device" and that it was fitted in the vehicles purposefully to bypass emission controls. Even if found guilty, the number of FCA vehicles targeted by the lawsuit is less than a fifth of those in the VW case. Applying calculations used in the German settlement, analysts estimate potential civil and criminal charges for Fiat Chrysler of around $800 million at most. Barclays has already cut its target price on the stock to take such a figure into account. Analysts also noted that FCA's vehicles are equipped with selective catalytic reduction (SCR) systems for cutting NOx emissions, so it is likely that any problem could be fixed through a software update. "Should this be the case, we estimate a total cost per vehicle of not more than around $100, i.e. around $10 million in aggregate," Evercore ISI analyst George Galliers said in a note. The estimates exclude any additional investments FCA may be asked to make in zero emissions vehicles infrastructure and awareness as was the case with VW. FCA said last week it would update the software in the vehicles in question, hoping it would alleviate the regulators' concern, but analysts said it may have been too little too late. The carmaker is also facing accusations over its diesel emissions in Europe.