2008 Chrysler Town And Country on 2040-cars

Sayville, New York, United States

Body Type:Minivan, Van

Vehicle Title:Clear

Engine:3.8

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Chrysler

Model: Town & Country

Trim: Touring

Options: Sunroof, Leather Seats

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Mileage: 126,000

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Exterior Color: Blue

Interior Color: Blue

Number of Cylinders: 6

Drive Type: front wheel drive

Chrysler Town & Country for Sale

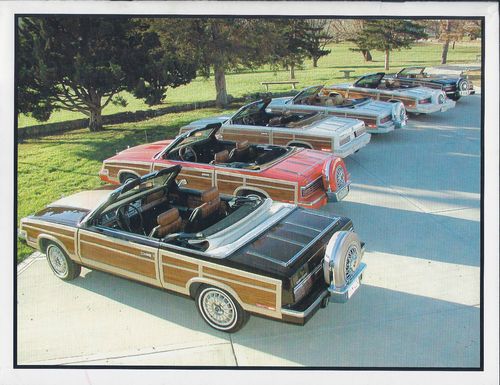

1983 chrysler town & country convertible

1983 chrysler town & country convertible 2006 chrysler town & country

2006 chrysler town & country 2012 chrysler town & country wheelchair handicapped mobility van(US $26,900.00)

2012 chrysler town & country wheelchair handicapped mobility van(US $26,900.00) Silver van clean title finance touring leather dvd xm hard disc drive power air

Silver van clean title finance touring leather dvd xm hard disc drive power air 2012 chrysler town country touring 31k leather dual dvd stow and go(US $20,495.00)

2012 chrysler town country touring 31k leather dual dvd stow and go(US $20,495.00) 2003 chrysler town & country 4dr limited fwd handicap conversion low miles(US $18,900.00)

2003 chrysler town & country 4dr limited fwd handicap conversion low miles(US $18,900.00)

Auto Services in New York

Wheel Fix It Corp ★★★★★

Warner`s Auto Body ★★★★★

Vision Kia of Canandaigua ★★★★★

Vision Ford New Wholesale Parts Body Shop ★★★★★

Vince Marinaro Automotive Inc ★★★★★

Valu Muffler & Brake ★★★★★

Auto blog

Fiat board makes Chrysler merger official, approves $5.4B bond sale

Mon, 16 Jun 2014Fiat's board of directors has officially approved the merger plan that will see the conglomerate's automotive operations merged with Chrysler into the new Fiat Chrysler Automobiles.

The plan essentially provides a road map for the structure of the new company. It includes provisions for Fiat shareholders - one Fiat share will translate to one share of FCA common stock. The new company will also include a loyalty voting structure, which will provide for shareholders of Fiat stock or those that have held FCA stock for at least three years. According to the plan, these shareholders would see their voting power double, with two votes for every share of FCA's common stock. The overall merger plan still needs to be approved by the company's shareholders.

In other Fiat-related news, the company's board has announced a bond issuance of four billion euro ($5.4 billion). The new bonds should provide the company with a degree of flexibility in refinancing debts associated with the merger plan.

Stellantis moves to set up its own lending unit

Sat, Sep 4 2021Stellantis is buying Houston-based auto lender First Investors Financial Services Group to set up its own finance arm in the U.S., a move that should support sales and eventually boost profit. The only major traditional automaker in the U.S. without its own finance company agreed to pay $285 million to a group of investors led by Gallatin Point Capital and Jacobs Asset Management, according to a statement. The transaction is expected to close by year-end. Stellantis was formed via the merger between Fiat Chrysler and PSA Group early this year. Carlos Tavares, the PSA boss who became the combined company’s chief executive officer, called the deal to acquire First Investors a milestone that will increase earnings and enhance customer loyalty. “Direct ownership of a finance company in the U.S. is a white-space opportunity which will allow Stellantis to provide our customers and dealers a complete range of financing options,” Tavares said Wednesday in the statement. Having an in-house finance company has helped rivals General Motors Co. and Ford Motor Co. pad profits, especially during the global semiconductor shortage that has limited production and crimped sales. GM bought subprime lender AmeriCredit Corp. in 2010 and renamed it GM Financial. The operation generated a $2.76 billion profit in the first half -- roughly a third of the companyÂ’s adjusted earnings before interest and taxes. Trouble for Santander? The First Investors acquisition could spell trouble for Chrysler Capital, the operation that Santander Consumer USA Holdings Inc. and Chrysler set up in 2013 before the U.S. automaker completed its merger with Fiat. In a statement, Santander Consumer said itÂ’s committed to supporting Stellantis through the term of their existing agreement and its transition. Santander Consumer will also have “ongoing conversations with Stellantis about long-term mutually beneficial opportunities beyond 2023,” the company said, adding that its consumer business remains strong and has “delivered solid results for our shareholders.” This, along with support from its parent company, will allow the lender to “pursue additional opportunities as they arise.” The lenderÂ’s U.S.-listed stock fell 1.5% in New York trading Wednesday after Bloomberg reported Stellantis was preparing to announce a new finance partner. Stellantis shares rose as much as 1.3% in Paris trading Thursday.

Chrysler taking big risk snubbing NHTSA

Wed, 05 Jun 2013Maker Insists Feds Overstate Risk Of Fires With Grand Cherokee, Liberty Models

It's not often that recall stories make it above the fold, in that old newspaper parlance, but when one shows up as the lead story on the network evening news programs, you know it's something big.

And so it is with Chrysler snubbing its nose at a request by the National Highway Traffic Safety Administration to recall 2.7 million Jeeps the feds insist are at risk of potentially catastrophic fuel tank fires in a rear-end collision.