Low Miles Satellite Radio Factory Warranty Cruise Control Off Lease Only on 2040-cars

Lake Worth, Florida, United States

Body Type:Sedan

Vehicle Title:Clear

Engine:4

Fuel Type:Gas

For Sale By:Dealer

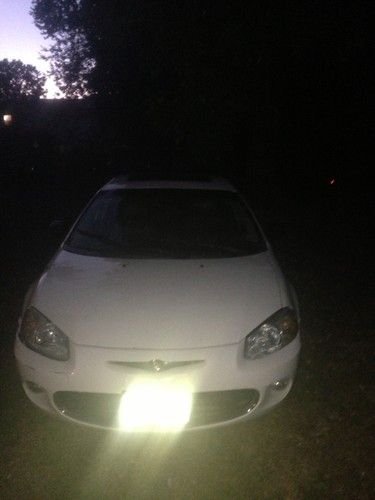

Make: Chrysler

Model: Sebring

Mileage: 8,203

Sub Model: Touring Stk# 56624

Disability Equipped: No

Exterior Color: White

Doors: 4

Interior Color: Black

Drivetrain: Front Wheel Drive

Chrysler Sebring for Sale

2001 chrysler sebring lx convertible 2-door 2.7l(US $1,999.00)

2001 chrysler sebring lx convertible 2-door 2.7l(US $1,999.00) 2001 chrysler sebring lxi limited convertible 2-door 2.7l clean! look!

2001 chrysler sebring lxi limited convertible 2-door 2.7l clean! look! 2002 chrysler sebring lxi coupe 2-door 3.0l 62,800 actual miles !!!

2002 chrysler sebring lxi coupe 2-door 3.0l 62,800 actual miles !!! 1997 chrysler sebring convertible - jx runs good

1997 chrysler sebring convertible - jx runs good 2001 chrysler sebring lx sedan 4-door 2.7l

2001 chrysler sebring lx sedan 4-door 2.7l 2006 chrysler sebring convertible !! priced to sell !!

2006 chrysler sebring convertible !! priced to sell !!

Auto Services in Florida

Your Personal Mechanic ★★★★★

Xotic Dream Cars ★★★★★

Wilke`s General Automotive ★★★★★

Whitehead`s Automotive And Radiator Repairs ★★★★★

US Auto Body Shop ★★★★★

United Imports ★★★★★

Auto blog

Why a Renault-FCA merger could be good news for Nissan, Mitsubishi

Fri, May 31 2019TOKYO — Nissan's advanced technologies including platforms and electric powertrains could give it leverage in a merger involving Renault and Fiat Chrysler, thanks to a royalty system it has with the former, two people with knowledge of the matter said. A merged Renault-Fiat Chrysler could face an extra hurdle each time it uses technology developed by Nissan or Mitsubishi Motors, while the two Japanese automakers stand to gain a client in Fiat Chrysler (FCA), one of the people said. Both sources declined to be identified because of the sensitivity of the matter. Nissan's technology, particularly in electrification and emissions reduction, could give it some sway in the $35 billion potential tie-up between Renault and FCA, even as its stake in the newly formed company would be diluted. Currently Renault SA pays less for technology developed by Nissan than the Japanese automaker pays for French technology, a third person said. This has long been a sticking point for Nissan, and an area where Nissan could seek more favorable terms. "Whenever Nissan transfers platform, powertrain or other technology to Renault, there is a margin or royalty which Renault has to pay for use of that tech," one of the people said. "In that sense, FCA, if everything went well, would become another 'client' of ours and that's good. More business for us." A Nissan spokesman declined to comment on its royalty system. The potential Renault-FCA deal has complicated the Japanese automaker's already uneasy alliance with Renault. A further deal with Fiat Chrysler looks likely at least in the near term to weaken Nissan's influence in the 20-year-old partnership. Renault owns a 43.4% stake in Nissan and is its top shareholder. Nissan holds a 15% non-voting stake in Renault and would see that diluted to 7.5% after the FCA deal, albeit with voting rights. The imbalance between the two has long rankled Nissan, which is by far the larger company. Alliance imbalance Renault had previously angled for a merger with Nissan but has been rebuffed by CEO Hiroto Saikawa. Securing benefits from the merger deal will be important for Saikawa, who is grappling with poor financial performance while he struggles to right the company after the ouster of former chairman Carlos Ghosn last year.

Chrysler de Mexico to sell rebadged Mitsubishi model in shades of Colt deal

Wed, 02 Jul 2014Chrysler and Mitsubishi have had a close relationship since the early '70s. Back then, they partnered up to sell the Japanese brand's models under American names as captive imports in the US. Vehicles like the Dodge Colt, Eagle Summit, and eventually the 3000GT/Stealth twins and lots of other cars and trucks became the fruits of that alliance. In fact, the two companies still maintain a good rapport, as evidenced by reports of a new deal to sell the Mitsubishi Attrage, also known the Mirage G4, in Mexico starting in November.

The Attrage is a small, four-door sedan that borrows many of the mechanical bits from the Mitsubishi Mirage hatchback. According to Automotive News, the deal allows Chrysler to sell the model in Mexico for the next five years. The deal could be a win-win for both companies. Mitsubishi gets to use more capacity at its Laem Chabang, Thailand factory where the car is made, and Chrysler gets a new vehicle for a growing market with almost zero development costs. At this time, there's no indication of the new model's name in Mexico, though.

There's also still a chance the Attrage might make it to the US market as well. The automaker showed off the sedan as the Mirage G4 at the 2014 Montreal Motor Show ahead of promised sales in small-car-friendly Canada. The Mirage hatchback was introduced to the US in a similar way, debuting in Canada first and then crossing the border. While reviews for the Mirage have been pretty atrocious, it would still be interesting to see Mitsubishi further expanding its lineup in North America.

Next-gen Jeep Wrangler to pack 300-hp Hurricane turbo four

Mon, May 9 2016Fiat Chrysler has been working for some time now on a new turbocharged four-cylinder engine. Dubbed "Hurricane," the engine is now said to produce nearly 300 horsepower. And its first application could be in the next-generation Jeep Wrangler. With that much power coming from such a small engine, the Hurricane would offer an even higher level of specific output than the 1.75-liter engine in the Alfa Romeo 4C – one of FCA's highest-stressed engines – far eclipsing the 4C's 120 horsepower per liter with 150 hp/l. By way of comparison, the latest 2.0-liter, four-cylinder version of Ford's EcoBoost engine produces "only" 245 hp (122.5 hp/l). The 2.0-liter turbo four in the latest Mercedes-AMG CLA45 and GLA45, however, produces 375 hp. To get so much out of so little an engine, FCA will utilize a twin-scroll turbocharger and variable valve timing. That could make it ideally suited towards a compact performance model, but according to Automotive News, its first application could be in the new the Wrangler. The larger 3.6-liter Pentastar V6 produces 285 hp, nearly as much as the Hurricane will. But with a smaller engine, an eight-speed transmission, and aluminum construction, the new Jeep will likely benefit from dramatically-improved fuel consumption. Related Video: