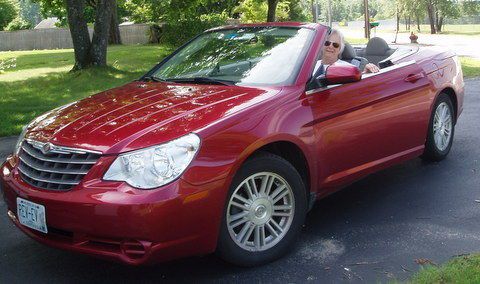

2009 Chrysler Sebring Lx Convertible Cd Aux Port Bluetooth Power on 2040-cars

Fort Worth, Texas, United States

Chrysler Sebring for Sale

2008 chrysler sebring convertible_no reserve_leather_remote start_heated_cooled

2008 chrysler sebring convertible_no reserve_leather_remote start_heated_cooled 2005 chrysler sebring limited convertible 2-door 2.7l(US $3,300.00)

2005 chrysler sebring limited convertible 2-door 2.7l(US $3,300.00) 2002 chrysler sebring limited convertible

2002 chrysler sebring limited convertible 2007 chrysler sebring touring sedan . clean title. 102k . 4cyl(US $5,800.00)

2007 chrysler sebring touring sedan . clean title. 102k . 4cyl(US $5,800.00) 08 sebring touring-114k-special touring group-sat radio-heated seats-leather(US $5,995.00)

08 sebring touring-114k-special touring group-sat radio-heated seats-leather(US $5,995.00) 2008 chrysler sebring touring "z" hardtop convertible inferno red color(US $11,999.99)

2008 chrysler sebring touring "z" hardtop convertible inferno red color(US $11,999.99)

Auto Services in Texas

Whatley Motors ★★★★★

Westside Chevrolet ★★★★★

Westpark Auto ★★★★★

WE BUY CARS ★★★★★

Waco Hyundai ★★★★★

Victorymotorcars ★★★★★

Auto blog

Jeep and Ram could be spun off from FCA, says Marchionne

Thu, Apr 27 2017Jeep is surely the biggest single feather left in the cap of the Fiat Chrysler Automobiles portfolio. Under Sergio Marchionne's leadership, Jeep went from fewer than 500,000 annual sales in 2008 to 1.4 million in 2016, and is on track for 2 million by 2018. Add in the brand's legacy, status as one of the most recognizable nameplates in the world, and rabid fan base, and Jeep has extraordinary monetary value to its parent company. Investors and analysts have certainly noticed Jeep's inherent value. According to The Detroit Free Press, Morgan Stanley's Adam Jonas asked FCA chief Sergio Marchionne if he would ever consider spinning Jeep and Ram, FCA's dedicated truck brand, into a separate corporate entity, and he responded with a simple "Yes." Jonas estimated Jeep's worth in January of this year at $22 billion. Ram was valued at $11.2 billion. Marchionne has a history of spinning off brands while keeping them part of FCA's corporate umbrella. The most noteworthy example of this value maximization was with Ferrari, which now trades on the New York Stock Exchange and rakes in $3.4 billion in annual revenue and close to $435 million in net income, reports the Free Press. Marchionne still serves as chairman and CEO of Ferrari, and Fiat heir John Elkann owns 22 percent of the Italian marque's shares. Even if the offloading of Jeep and Ram into a separate entity would amount to little more than a profit-driven ownership change on paper, it would be huge news to the brands' loyal fanbases. In any case, such a move would likely take years to actually happen and probably wouldn't mean much at all to the products that Jeep and Ram produce. In other words, Jeep fans can keep the pitchforks in the shed ... for now. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Why the Detroit Three should merge their engine operations

Tue, Dec 22 2015GM and FCA should consider a smaller merger that could still save them billions of dollars, and maybe lure Ford into the deal. Fiat-Chrysler CEO Sergio Marchionne would love to see his company merge with General Motors. But GM's board of directors essentially told him to go pound sand. So now what? The boardroom battle started when Mr. Marchionne published a study called Confessions of a Capital Junkie. In it, Sergio detailed the amount of capital the auto industry wastes every year with duplicate investments. And he documented how other industries provide superior returns. He's right, of course. Other industries earn much better returns on their invested capital. And there's a danger that one day the investors will turn their backs on the auto industry and look to other business sectors where they can make more money. But even with powerful arguments Marchionne couldn't convince GM to take over FCA. And while that fight may now be over, GM and FCA should consider a smaller merger that could still save them billions of dollars, and maybe lure Ford into the deal. No doubt this suggestion will send purists into convulsions, but so be it. The Detroit Three should seriously consider merging their powertrain operations, even though that's a sacrilege in an industry that still considers the engine the "heart" of the car. These automakers have built up considerable brand equity in some of their engines. But the vast majority of American car buyers could not tell you what kind of engine they have under the hood. More importantly, most car buyers really don't care what kind of engine or transmission they have as long as it's reliable, durable, and efficient. Combining that production would give the Detroit Three the kind of scale that no one else could match. There are exceptions, of course. Hardcore enthusiasts care deeply about the powertrains in their cars. So do most diesel, plug-in, and hybrid owners. But all of them account for maybe 15 percent of the car-buying public. So that means about 85 percent of car buyers don't care where their engine and transmission came from, just as they don't know or care who supplied the steel, who made the headlamps, or who delivered the seats on a just-in-time basis. It's immaterial to them. And that presents the automakers with an opportunity to achieve a staggering level of manufacturing scale. In the NAFTA market alone, GM, Ford, and FCA will build nearly nine million engines and nine million transmissions this year.

Pentastar Power: A look inside the Detroit factory that pumps out FCA's potent V6

Tue, Mar 14 2017The Mack Avenue Engine Plant is one of Fiat Chrysler Automobiles' most historic and prolific factories. It pumped out 260,000 Pentastar V6 engines last year, providing power for everything from the Jeep Grand Cherokee to the Dodge Challenger. FCA and its predecessor, Chrysler, has owned the factory since 1953 and it briefly built the Dodge Viper in the 1990s. It's made engines since 1998 and began building the Pentastar in 2014. We got an inside look at the mighty Mack, helping to tear down a Pentastar engine and then a tour of the factory floor. This is what it's like. Plants/Manufacturing Chrysler Fiat Videos Original Video pentastar v6