2008 Chrysler Sebring Lx on 2040-cars

Schenectady, New York, United States

Fuel Type:Gasoline

For Sale By:Private Seller

Vehicle Title:Clean

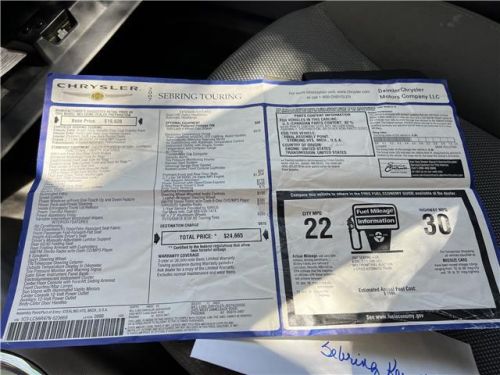

Engine:2.4L Gas I4

Year: 2008

VIN (Vehicle Identification Number): 1C3LC46K98N188623

Mileage: 19993

Trim: LX

Number of Cylinders: 4

Make: Chrysler

Drive Type: FWD

Model: Sebring

Exterior Color: Black

Chrysler Sebring for Sale

2008 chrysler sebring touring 2dr convertible(US $7,995.00)

2008 chrysler sebring touring 2dr convertible(US $7,995.00) 2008 chrysler sebring touring 2dr convertible(US $4,999.00)

2008 chrysler sebring touring 2dr convertible(US $4,999.00) 1998 chrysler sebring jxi(US $6,500.00)

1998 chrysler sebring jxi(US $6,500.00) 2004 chrysler sebring lxi(US $4,500.00)

2004 chrysler sebring lxi(US $4,500.00) 2007 chrysler sebring touring(US $2,495.00)

2007 chrysler sebring touring(US $2,495.00) 2008 chrysler sebring. one owner(C $9,000.00)

2008 chrysler sebring. one owner(C $9,000.00)

Auto Services in New York

Walton Service Ctr ★★★★★

Vitali Auto Exchange ★★★★★

Vision Hyundai of Canandaigua ★★★★★

Tony B`s Tire & Automotive Svc ★★★★★

Steve`s Complete Auto Repair ★★★★★

Steve`s Auto & Truck Repair ★★★★★

Auto blog

FCA employees likely to reject UAW contract

Wed, Sep 30 2015For a brief, blissful glimmer of time, it seemed like we might have a period of labor harmony here in the Motor City. The United Auto Workers and Fiat Chrysler Automobiles, the UAW's lead bargaining company, came to a pending agreement that seemed promising enough that union president Dennis Williams, shown above with FCA boss Sergio Marchionne, thought it'd be ratified by the membership. Well, he was wrong. It's widely expected that FCA's rank-and-file workforce will vote against the deal, which gave workers a raise, would establish a VEBA-style healthcare pool, and deliver a $3,000 bonus for signing the agreement, while retaining the much-hated two-tier wage system. According to The Detroit News, it'd be the first time in over three decades the union's general population didn't follow its leadership's recommendation. Two of FCA's big US facilities, Toledo Assembly and Sterling Heights Assembly, overwhelmingly voted no, with The News saying they "mathematically sealed the deal's fate." According to The News, UAW Local 1700 President Charles Bell said roughly 90 percent of SHAP's 3,000-plus union workforce voted "no" on the deal. Should the pending agreement fail as it's expected to, there are three potential avenues for the union. First, as The News details, both sides could return to the bargaining table. Second, FCA workers could hit the picket line. Finally, union leadership may opt to focus its firepower on General Motors or Ford. It's a good thing we aren't the gambling sort, because those all seem very much within the realm of possibility. Not surprisingly, rank-and-file UAW members have taken issue with the survival of the two-tier wage structure, while others simply think that union employees deserve a wage hike. There was also, we're betting, some serious concerns over the reshuffling of production that would come with a new FCA/UAW deal. As previously reported, no fewer than four UAW facilities would have their vehicle lines shuffled around, including both SHAP and Toledo. Expect more news as soon as the UAW formally announces the results of its FCA voting. News Source: The Detroit NewsImage Credit: Paul Sancya / AP Plants/Manufacturing UAW/Unions Chrysler Fiat FCA toledo sterling heights

2018 wrap-up, Ford Ranger and Mercedes A-Class | Autoblog Podcast #566

Fri, Dec 21 2018In the final Autoblog Podcast of 2018, Editor-in-Chief Greg Migliore is joined by Senior Editor Alex Kierstein and Associate Editor Reese Counts. They kick off the conversation by talking about a couple of hot new vehicles: the Ford Ranger and Mercedes-Benz A 220 4Matic. Then they round up the biggest stories of 2018 before helping a listener choose a new car in the "Spend My Money" segment. Thanks for listening, and happy holidays. The Autoblog Podcast will be back next year. Autoblog Podcast #566 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Driving the 2019 Ford Ranger Driving the 2019 Mercedes-Benz A-Class 2018 news roundup The ups and downs of Tesla and Elon Musk Losing Sergio Marchionne and the arrest of Carlos Ghosn Lots of layoffs Trump and tariffs Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video:

Weekly Recap: Obama reflects on the auto bailout's legacy

Sat, Jan 23 2016President Obama took a victory lap of sorts this week at the Detroit Auto Show, lauding the industry's progress and reflecting on the decision to bail out General Motors and Chrysler seven years ago. While the rescue was controversial at the time, historians will likely judge the president's actions to help save two of America's industrial symbols in a positive light. Much like Theodore Roosevelt's trust-busting tactics were controversial in the early 20th century, Obama's plan drew fire from critics who argued the free market should be left to its own devices. But providing financial aid and forcing the automakers to restructure had an enduring impact on the US economy. The auto industry has added more than 646,000 jobs since the companies emerged from bankruptcy, including manufacturing and retail positions. Make no mistake, GM and Chrysler were nearly dead in 2009. Now, GM is a powerhouse that's set to capitalize on a market that could see 18 million vehicles sold this year. Chrysler, which was renamed FCA US, survived as part of the Italian-American Fiat Chrysler Automobiles conglomerate. It's also performed well amid the strong industry conditions, though CEO Sergio Marchionne very publicly went looking for alliance partners last year, something from which he's since backed off. While Obama can claim a win, the bailout was actually started by George W. Bush, who provided short-term loans to GM and Chrysler in December 2008. Without that, they might not have made it much past Obama's inauguration. NEWS & ANALYSIS News: Spy Shooters captured the next-gen BMW Z4 during extreme cold weather testing. Analysis: The upcoming Z4 (which might be called the Z5) looks sharp. But the big deal is that BMW's much-anticipated sports-car project with Toyota is coming to fruition. Refresher: BMW and Toyota agreed to work together back in December 2011 and then announced an expansion of that deal to include sports cars in June 2012. Ultimately, it will provide BMW with a new Z4 and Toyota with another sports car, perhaps the Supra replacement. BMW is developing the platform, while Toyota is expected to chip in with hybrid technology. Big picture, this project is a good thing. It's providing enthusiasts with two modern sports cars that Toyota and BMW might not chose to develop on their own. This template has been shown to work, as the Fiat-Mazda alliance produced the MX-5 Miata and 124 Spider. News: The Jeep Grand Cherokee Hellcat was also spied, briefly.