2003 Chrysler Sebring Lxi Convertible on 2040-cars

Windber, Pennsylvania, United States

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Engine:2.7 liter 2 cv 6

Sub Model: LXI

Make: Chrysler

Model: Sebring

Trim: LXi Convertible 2-Door

Drive Type: Front Wheel Drive

Mileage: 81,235

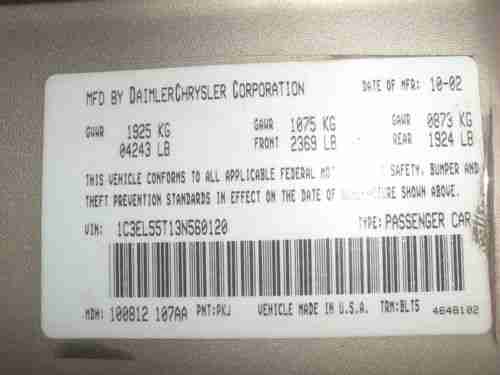

You are looking at a 2003 Chrysler Sebring LXI Convertible with 81,235 miles. Overall, the car is in good condition and can be driven home. We went over this vehicle and the only thing we could find wrong is that the air bag light is on. We did not check into it any further as to what the failure may be. It will be sold to the highest bidder, so good luck bidding. All pre-inspections are welcomed and encouraged. We are a small family owned car dealership and we do have clear title in hand.

I will require a $200 deposit (preferably through Paypal) within 48 hours of close of auction. The balance is to be paid by certified funds within 7 days of close of auction. This item is being sold "as-is" and "where-is". THANK YOU FOR CHECKING OUT OUR AUCTION...

Chrysler Sebring for Sale

2003 chrysler sebring lx convertible 2-door 2.7l(US $3,250.00)

2003 chrysler sebring lx convertible 2-door 2.7l(US $3,250.00) 2005 chrysler sebring touring convertible 2-door 2.7l low miles!(US $8,500.00)

2005 chrysler sebring touring convertible 2-door 2.7l low miles!(US $8,500.00) 2000 chrysler sebring jxi convertible 2-door 2.5l

2000 chrysler sebring jxi convertible 2-door 2.5l Beautiful 2006 chrysler sebring limited convertible good condition clean title

Beautiful 2006 chrysler sebring limited convertible good condition clean title 2007 chrysler sebring sedan automatic save big rebuilt rebuildable salvage!!(US $6,999.99)

2007 chrysler sebring sedan automatic save big rebuilt rebuildable salvage!!(US $6,999.99) Super low mileage 44,411 convertible southern california beauty corrosion free(US $7,777.77)

Super low mileage 44,411 convertible southern california beauty corrosion free(US $7,777.77)

Auto Services in Pennsylvania

Walburn Auto Svc ★★★★★

Vans Auto Repair ★★★★★

United Automotive Service Center LLC ★★★★★

Tomsic Motor Co ★★★★★

Team One Auto Group ★★★★★

Suburban Collision Specs Inc ★★★★★

Auto blog

Auto bailout cost the US goverment $9.26B

Tue, Dec 30 2014Depending on your outlook, the US Treasury's bailout of General Motors, Chrysler (now FCA) and their financing divisions under the Troubled Asset Relief Program was either a complete boondoggle or a savvy move to secure the future of some major employers. Regardless of where you fall, the auto industry bailout has officially ended, and the numbers have been tallied. Of the $79.69 billion that the Feds invested to keep the automakers afloat, it recouped $70.43 billion – a net loss of $9.26 billion. The final nail in the coffin for the auto bailout came in December 2014 when the Feds sold its shares in Ally Financial, formerly GMAC. The deal turned out pretty good for the government too because the investment turned a 2.4 billion profit. The actual automakers have long been out of the Treasury's hands, though. The current FCA paid back its loans six years early in 2011, the Treasury sold of the last shares of GM in late 2013. According to The Detroit News, the government's books actually show an official loss on the auto bailouts of $16.56 billion. The difference is because the larger figure does not include the interest or dividends paid by the borrowers on the amount lent. While it's easy to see fault in any red ink on the Feds' massive investment, the number is less than some earlier estimates. At one time, deficits around $44 billion were thought possible, and another put things at a $20.3 billion loss. Outside of just the government losing money, the bailouts might have helped the overall economy. A study from the Center for Automotive Research last year estimated that the program saved 2.6 million jobs and about $284.4 billion in personal wealth. It also indicated that the Feds' reduction in income tax revenue alone from Chrysler and GM going under could have been around $100 billion for just 2009 and 2010, significantly more than any loss in the bailout.

Fiat shareholders green-light Chrysler merger, end of an Italian era

Fri, 01 Aug 2014Fiat has just taken a major step away from its Italian heritage, as shareholders officially approved the company's merger with Chrysler. That move will lead to the formation of Fiat Chrysler Automobiles NV, a Dutch company based in Great Britain and listed on the New York Stock Exchange, according to Automotive News Europe.

The company captured the two-thirds majority at a special shareholders meeting, although there are still a few situations that could defeat the movement. According to ANE, roughly eight percent of shareholders opposed the merger, which is a group large enough to defeat the plan, should they all exercise their exit rights outlined in the merger conditions.

Meanwhile, Fiat Chairman John Elkann (pictured above, right, with CEO Sergio Marchionne and Ferrari Chairman Luca Cordero di Montezemolo), the great-great-grandson of Fiat founder Giovanni Agnelli, reaffirmed his family's commitment to the company beyond the merger. Exor, the Agnelli family's holding company, still maintains a 30-percent stake in Fiat.

Chrysler set to make $266M-investment into 8-speed transmission production

Wed, Dec 10 2014Chrysler will shortly make a significant $266-million investment into its Kokomo, IN transmission factory in a bid to expand production of its eight-speed automatic transmissions. The gearboxes, which are built under license from Germany's ZF Friedrichshafen, have been well received by customers and critics, and according to an SEC filing obtained by Automotive News, the transmissions will eventually find their way to all of Chrysler's rear-drive offerings (Viper and heavy-duty Ram models, aside). According to AN, a Chrysler spokesman says the investment has not been confirmed, but once it is, it'll mark the company's latest in a growing line of investments at the facility. Chrysler has poured $1.5 billion into Kokomo since 2009.