2003 Chrysler Sebring Lx Sedan 4-door 2.7l, No Reserve on 2040-cars

Orange, California, United States

Fuel Type:FLEX

Engine:2.7L 2700CC 167Cu. In. V6 FLEX DOHC Naturally Aspirated

Transmission:Automatic

Vehicle Title:Clear

Make: Chrysler

Model: Sebring

Number of Doors: 4

Trim: LX Sedan 4-Door

Mileage: 128,394

Exterior Color: Gray

Drive Type: FWD

Interior Color: Gray

Number of Cylinders: 6

Warranty: Vehicle does NOT have an existing warranty

Chrysler Sebring for Sale

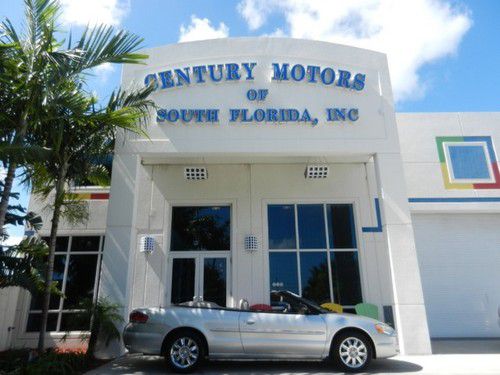

2010 chrysler sebring touring convertible 2-door 2.7l

2010 chrysler sebring touring convertible 2-door 2.7l Lx 2.4l a/c automatic

Lx 2.4l a/c automatic 2012 chrysler 200

2012 chrysler 200 2000 convertible~jxi~leather~new top~new transmission~cold a/c~pwr seat~florida~

2000 convertible~jxi~leather~new top~new transmission~cold a/c~pwr seat~florida~ 2005 chrysler sebring conv 2dr limited 1 owner low miles(US $8,900.00)

2005 chrysler sebring conv 2dr limited 1 owner low miles(US $8,900.00) 2002 chrysler sebring limited convertible 2-door 2.7l(US $3,500.00)

2002 chrysler sebring limited convertible 2-door 2.7l(US $3,500.00)

Auto Services in California

Xtreme Auto Sound ★★★★★

Woodard`s Automotive ★★★★★

Window Tinting A Plus ★★★★★

Wickoff Racing ★★★★★

West Coast Auto Sales ★★★★★

Wescott`s Auto Wrecking & Truck Parts ★★★★★

Auto blog

Junkyard Gem: 1993 Plymouth Sundance Duster

Sat, Apr 3 2021When Chrysler introduced the Plymouth Duster for the 1970 model year, it was a sporty-looking fastback coupe version of the Valiant, itself a twin to the Dodge Dart. The Duster looked cool, didn't cost much, and could be very quick with the right powertrain choices; it stayed in production until the Valiant got the axe in 1976. A few years later, the Duster name went onto a coupe version of the Plymouth Volare, and then the middle 1980s saw the Turismo Duster and its legendary "Cocaine Factory" television commercial. The very last use of the Plymouth Duster name took place during the 1992 through 1994 model years, when the name was applied to a factory-hot-rod version of the Sundance. That's what we've got for today's Junkyard Gem: a purple '93 found in a Denver self-service yard. Because this was the early 1990s, the Sundance Duster got a full complement of dramatic-looking decals in bright colors. Just as was the case with its Valiant, Volare, and Turismo predecessors, the underlying model name itself was downplayed on the car's badging. In fact, the only place I could find the word Sundance was on the dash and in the owner's manual. While technically hatchbacks, the Sundance and its Dodge-badged twin (the Shadow) had a three-box shape that hid frumpy hatchback lines. Sort of a trunk, sort of a hatch, like the hatchback-coupe Chevy Novas of the late 1970s. That made this car a hot hatch, and one that could keep up with the likes of the Volkswagen GTI and Geo Storm GSi. The 3.0-liter Mitsubishi 6G72 V6 engine made 141 horsepower, making this 2,727-pound member of the K-Car family very quick for its cheap sticker price of $10,498 (about $19,360 today). This one even has the five-speed manual transmission, for lots of tire-squealing, torque-steering fun. I've seen a few of these cars on race tracks, and they have no problem reeling in a same-era GTI on a road course. Of course, the 6G72 likes to blow up in spectacular fashion when abused, but you could— and should— say the same about 16-valve Volkswagen engines. The Sundance/Shadow got the axe after 1994, when the Neon appeared as a more modern replacement; that meant the end of Lee Iacocca's Chrysler-rescuing K family in North America. This car started out in Denver and will be crushed in Denver. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Marchionne says no offers are on the table for Fiat Chrysler

Sun, Sep 3 2017MONZA, Italy (Reuters) - Fiat Chrysler (FCA) has not received any offer for the company nor is the world's seventh-largest carmaker working on any "big deal", Chief Executive Sergio Marchionne said on Saturday. Speaking on the sidelines of the Italian Formula One Grand Prix, Marchionne said the focus remained on executing the company's business plan to 2018. Asked whether FCA had been approached by someone or whether there was an offer on the table, he simply said: "No." The company's share price jumped to record highs last month after reports of interest for the group or some of its brands from China. China's Great Wall Motor Co Ltd openly said it was interested in FCA, but had not held talks or signed a deal with executives at the Italian-American automaker. The stock move was also helped by expectations that the company might separate from some of its units. Marchionne reiterated on Saturday that FCA was working on a plan to "purify" its portfolio and that units, such as the components businesses, would be separated from the group. He hopes to complete that process by the end of 2018. "There are activities within the group that do not belong to a car manufacturer, for example the components businesses. The group needs to be cleared of those things," he told journalists. Asked whether an announcement could come this year, Marchionne said it was up to the board to decide and that it would next meet at the end of September. He said the time was not right for a spin-off of luxury brand Maserati and premium Alfa Romeo and the two brands needed to become self-sustainable entities first and "have the muscle to stand on their feet, make sufficient cash". "The way we see it now, it's almost impossible, if not impossible, to see a spin-off of Alfa Romeo/Maserati, these are two entities that are immature and in a development phase," he said. "It's the wrong moment, we are not in a condition to do it." He said the concept of separating the two brands from FCA's mass market business made sense and did not rule out this happening in future, but not under his tenure, which lasts until April 2019. "If there is an opportunity in future, it would certainly happen after I'm gone. It won't happen while Marchionne is around," he said.

Chrysler recalls 2013 Ram pickups, 2014 Jeep Grand Cherokee

Wed, 17 Jul 2013Chrysler's spate of successful products is about to be marred by a trio of recalls. The Pentastar is recalling 51,477 Ram trucks and Jeep SUVs. According to the National Highway Traffic Safety Administration, there have been no reported accidents, injuries or deaths related to the affected vehicles.

The largest action covers the Ram 1500, which is seeing 45,961 trucks being recalled. Models built between June 26, 2012 and February 5, 2013 are being recalled due to a potential software issue in the electronic stability control. Apparently, the system can be randomly deactivated upon vehicle startup.

Chrysler is also recalling 4,458 2014 Jeep Grand Cherokee models. Covering everything but the SRT models, the potentially defective SUVs were built between January 14 and March 20, 2013. This recall focuses on "premium headlights," which means cars equipped with LED running lights. During the switch from the bright daytime running lamp setting to the low-intensity parking light setting, an electrical spike can cause one of the Jeep's computers to go into a safe mode, turning off the LEDs. This violates Federal Motor Vehicle Safety Standards.