2002 Chrysler Sebring Lxi Convertible, 97k, Does Not Run, Needs Repair on 2040-cars

Carmel, Indiana, United States

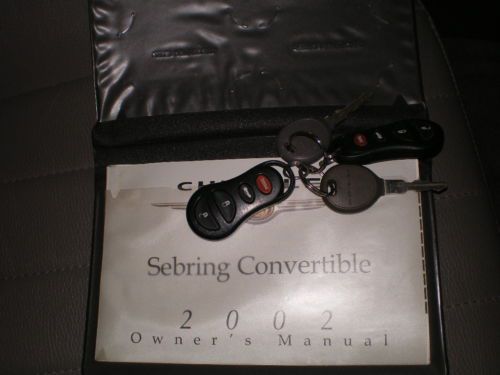

2002 CHRYSLER SEBRING LXi CONVERTIBLE, SILVER, GREY LEATHER, BLACKTOP, 2.7Lt., AUTOMATIC, ALL POWER OPTIONS INCLUDING TOP AND DRIVER'SSEAT, ALUMINUM WHEELS, REMOTE ENTRY (2 KEYS & 2 REMOTES PRESENT),2 OWNER CAR (2ND OWNER SINCE 10/03/2002) WITH CLEAN AUTOCHECK, VERYGOOD CONDITION COSMETICALLY WITH ABSOLUTELY NO RUST ISSUES, NEEDSA VALVE JOB. THE WATER PUMP SPROCKET SEIZED AND THE OWNERREPLACED THE TIMING CHAIN, RAILS, AND THE WATER PUMP, ONLY TOREALIZE THAT IT HAD JUMPED TIMING AND BENT SOME IF NOT ALL VALVES.THE ENGINE IS COMPLETE AS CAN BEEN SEEN IN THE PICTURES AND ALLREPLACED OLD PARTS ARE PRESENT WITH THE CAR. MILEAGE IS 97,000, CLEARTITLE. |

Chrysler Sebring for Sale

Florida~convertible~2-owner~new tires~pristine~02 03 04(US $5,990.00)

Florida~convertible~2-owner~new tires~pristine~02 03 04(US $5,990.00) 2004 chrysler sebring lx 4 door(US $4,000.00)

2004 chrysler sebring lx 4 door(US $4,000.00) 2005 chrysler sebring 2.7 l limited(US $5,500.00)

2005 chrysler sebring 2.7 l limited(US $5,500.00) Touring convertible coupe no reserve

Touring convertible coupe no reserve 2007 chrysler sebring limited sedan low mileage(US $8,750.00)

2007 chrysler sebring limited sedan low mileage(US $8,750.00) Chrysler sebring 2001 - only 122k miles.(US $2,500.00)

Chrysler sebring 2001 - only 122k miles.(US $2,500.00)

Auto Services in Indiana

Westfalls Auto Repair ★★★★★

Trinity Body Shop ★★★★★

Tri-County Collision Center & Towing ★★★★★

Tom O`Brien Chrysler Jeep Dodge Ram-In ★★★★★

TJ`s Auto Salvage ★★★★★

Tire Central and Service Southern Plaza ★★★★★

Auto blog

Apple picks up former FCA quality boss Doug Betts

Wed, Jul 22 2015Apple made a significant personnel move that further signals its entry into the automotive world, hiring former Fiat Chrysler executive Doug Betts for an unspecified role. The information was obtained by The Wall Street Journal, which cites Betts' LinkedIn page. His career included stints at Toyota and Nissan before joining Chrysler Group (now FCA US LLC) in 2007, although his time there didn't end well. He left FCA, where he served as the automaker's head of quality, after the company's dismal showing in Consumer Reports' 2014 Annual Auto Reliability Survey. According to Betts' LinkedIn profile, which has since been pulled down, his job title reads "Operations – Apple Inc" in the San Francisco Bay area. Apple, meanwhile, was unwilling to divulge anything to the WSJ, although there's plenty to infer based on the hire. Betts wasn't the only big auto-related hire. According to the WSJ, Cupertino also lured an unnamed but "leading" autonomous vehicle researcher from Europe, who will be part of a team being setup to study driverless systems. Related Video:

China's Great Wall confirms its interest — in Jeep, or all of FCA

Tue, Aug 22 2017HONG KONG/SHANGHAI — Chinese automaker Great Wall Motor reiterated its interest in Fiat Chrysler Automobiles NV on Tuesday, but said it had not held talks or signed a deal with executives at the Italian-American automaker. China's largest sport utility vehicle manufacturer made a direct overture to Fiat Chrysler on Monday, with an official saying the company was interested in all or part of FCA, owner of the Jeep and Ram truck brands. Automotive News first reported the news, quoting Great Wall Motor President Wang Fengying as saying she planned to contact FCA to discuss acquiring the Jeep brand specifically. Those comments sent FCA shares higher but also raised questions over the ability of China's seventh-largest automaker by sales to buy larger Western rival FCA, or even Jeep, which some analysts value at as much as one-and-a-half times FCA. Great Wall sought to dampen speculation on Tuesday. It confirmed it had studied Fiat Chrysler, but said there was "no concrete progress so far" and "substantial uncertainty" over whether it would eventually bid. "The company has not built any relationship with the directors of FCA nor has the company entered into any discussion or signed any agreements with any officer of FCA so far," the company said in an English-language stock exchange filing. It did not give further detail. Fiat Chrysler stock dipped on the statement on Tuesday. Great Wall said trading in its Shanghai-listed shares would resume on Wednesday after having been suspended. Fiat Chrysler declined to comment on Great Wall's statement. On Monday, it said it had not been approached and was fully committed to implementing its current business plan. FLUSHING OUT RIVALS? Great Wall Motor, which was early to spot China's love of SUVs, had revenue of $14.8 billion last year and sold 1.07 million vehicles - but that compares with FCA's 2016 revenue of 111 billion euros ($130.6 billion). Analysts said Great Wall would need to raise both debt and equity to complete any deal, meaning its chairman Wei Jianjun could lose majority control. One possible scenario, according to analysts at Jefferies, would see Wei keeping a roughly 30 percent stake, while Great Wall would raise $10-$14 billion in debt and $10 billion in equity - hefty for a group currently worth just $16 billion. Ultimately, politics could be the clincher.

The Chrysler brand could be axed under Stellantis management

Sun, Jan 3 2021MILAN — While running NissanÂ’s North American operations from 2009 to 2011, Carlos Tavares had a reputation for closely watching costs with little tolerance for vehicles or ventures that didnÂ’t make money. Experts say that means Tavares, currently the head of PSA Group, is likely to follow that blueprint when he becomes leader of a merged PSA and Fiat Chrysler Automobiles. The low-performing Chrysler brand might get the axe as could slow-selling cars, SUVs or trucks that lack potential. Already the companies are talking about consolidating vehicle platforms — the underpinnings and powertrains — to save billions in engineering and manufacturing costs. That could mean job losses in Italy, Germany and Michigan as PSA Peugeot technology is integrated into North American and Italian vehicles. “You canÂ’t be cost efficient if you keep the entire scale of both companies,” said Karl Brauer, executive analyst for the iSeeCars.com auto website. “WeÂ’ve seen this show before, and weÂ’re going to see it again where they economize these platforms across continents, across multiple markets.” Shareholders of both companies are to meet Monday to vote on the merger to form the worldÂ’s fourth-largest automaker, to be called Stellantis. The deal received EU regulatory approval just before Christmas. Tavares, who for years has wanted to sell PSA vehicles in the U.S., wonÂ’t take full control of the merged companies until the end of January at the earliest. He likely will target Europe for consolidation first, because thatÂ’s where Fiat vehicles overlap extensively with PSAÂ’s, said IHS Markit Principal Auto Analyst Stephanie Brinley. Europe has been a money-loser for FCA, and factories in Italy are operating way below capacity — a concern for unions, given FiatÂ’s role as the largest private sector employer in the country. “We are at a crossroads,Â’Â’ said Michele De Palma of the FIOM CGIL metalworkersÂ’ union. “Either there is a relaunch, or there is a slow agonizing closure of industry, in particular the auto industry, in Italy.” ItalyÂ’s hopes lie with the luxury Maserati and sporty Alfa Romeo brands, but De Palma said investments are needed to bring hybrid and electric technology up to speed. FiatÂ’s Italian capacity stands at 1.5 million vehicles, but only a few hundred thousand are being produced each year. Most factories were on rolling short-term layoffs due to lack of demand, even before the pandemic.