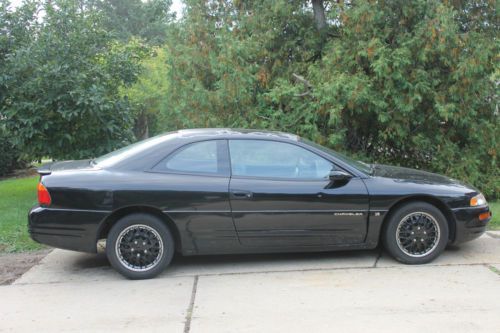

2000 Chrysler Sebring Jxi Convertible 2-door 2.5l on 2040-cars

Jasper, Georgia, United States

|

SANDLEWOOD CLOTH TOP,ALL SERVICES PERFORMED AT DEALERS,HAS HAD TIMING BELT ,WATER PUMP,AUX BELTS,TUNE UP

,DIST CAP AND ROTOR,WIRES,NEW LOWER CONTROL ARMS,REGULAR OIL CHANGES,TRANS FLUSH ,AND COOLING SERVICE RUNS AND DRIVE LIKE NEW ,EVERYTHING WORKS AS DESIGNED |

Chrysler Sebring for Sale

2005 touring used 2.7l v6 24v automatic fwd convertible(US $6,895.00)

2005 touring used 2.7l v6 24v automatic fwd convertible(US $6,895.00) Only 44023 miles! 97' chrysler sebring convertible jxi v6! this car is great!(US $5,995.00)

Only 44023 miles! 97' chrysler sebring convertible jxi v6! this car is great!(US $5,995.00) 1999 chrysler sebring lxi coupe 2-door 2.5l(US $1,250.00)

1999 chrysler sebring lxi coupe 2-door 2.5l(US $1,250.00) Bentley conversion kit on a sebring convertible

Bentley conversion kit on a sebring convertible 2003 chrysler sebring lxi convertible 2-door 2.7l,leather, no reserve,low miles

2003 chrysler sebring lxi convertible 2-door 2.7l,leather, no reserve,low miles 1996 convertible sebring jx maroon 2.5l nice sound system motor runs great(US $1,500.00)

1996 convertible sebring jx maroon 2.5l nice sound system motor runs great(US $1,500.00)

Auto Services in Georgia

Wheel Wizard ★★★★★

Uzuri 24-HR Plumbing ★★★★★

Used tires Atlanta ★★★★★

ultimateworks ★★★★★

Tyrone Auto Mobile Repair ★★★★★

Top Quality Car Care ★★★★★

Auto blog

Hyundai reportedly eyeing a takeover of FCA

Fri, Jun 29 2018The CEO of Hyundai Motor Group plans to launch a takeover bid for Fiat Chrysler ahead of the planned retirement of FCA Chief Executive Sergio Marchionne next spring, Asia Times reports, citing unnamed sources close the situation. CEO Chung Mong-koo will wait for an expected decline in the Italian-American automaker's shares to make his move. Hyundai isn't commenting on the rumors, unsurprisingly, but would presumably stand to benefit by gaining Chrysler's dealer network and the lucrative Jeep brand and probably Ram, too. An FCA spokeswoman in Auburn Hills told Autoblog the company had no comment. But like any story about a possible takeover, this one gets complicated with inside players — and President Trump's posturing on international trade issues. FCA has been the subject of takeover interest before, including by Hyundai, but Marchionne has denied a merger was likely, instead saying his company was in talks with the Korean automaker about a technical partnership. In 2015, Marchionne lobbied General Motors hard, but unsuccessfully, for a tie-up; he was also spurned by Volkswagen. Marchionne had repeatedly stressed the need for car companies to merge to decrease overcapacity and better afford the massive investments needed for things like autonomous and electric vehicles. In the case of Hyundai's reported interest, there is a cast of characters. One is Paul Singer, principal of the hedge fund Elliott Management, an activist shareholder with a $1 billion stake in Hyundai and a major owner of equities in Fiat's home turf of Italy. Then there is FCA Chairman John Elkann, who reportedly disagrees with Marchionne on a successor as CEO of Fiat Chrysler but has little interest in running the company himself and would prefer a merger. Compounding things is what the Trump administration would think of a further blending of Fiat Chrysler's international DNA, though a deal with a Korean automaker is thought to be more palatable to the president and members of Congress than by a Chinese conglomerate like Great Wall Motor, which has confirmed its interest in taking over all or parts of FCA. The full Asia Times piece is here. Related Video: News Source: Asia TimesImage Credit: REUTERS/Rebecca Cook Chrysler Fiat Hyundai Jeep RAM Sergio Marchionne FCA merger takeover

Stellantis and Foxconn's new joint venture will focus on connectivity

Wed, May 19 2021MILAN — Carmaker Stellantis and TaiwanÂ’s Foxconn announced plans to develop a jointly operated automotive supplier focusing on technology to make vehicles more connected, including artificial intelligence-based applications and 5G communications. Stellantis CEO Carlos Tavares said the services that will be developed through the tie-up “will mark the next great evolution of our industry,” alongside fully electrified and hybrid powertrains. The deal brings together Stellantis, the worldÂ’s 4th-largest automaker formed this year by the merger of Fiat Chrysler Automobiles and PSA Peugeot, and Foxconn, a major supplier of iPhones. The companies said the venture would focus on such services as infotainment, the integration of telecommunications and computer systems, artificial intelligence-based applications, 5G communications, e-commerce channels and smart cockpit integration. The companies announced a non-binding memorandum of understanding to form a 50-50 joint venture called Mobile Drive, which will be based in the Netherlands and function as an automotive supplier also to other carmakers. The new venture will combine advanced consumer electronics, Human-Machine Interfaces (HMI) to create new services “that will exceed customer expectations,” the companies said in a release. “Customers today and, in the future, demand and expect ever-increasing software-driven and creative solutions to connect the drivers and passengers with the vehicle inside and out,Â’Â’ Foxconn Chairman Young Liu. Alfa Romeo Chrysler Dodge Ferrari Fiat Jeep RAM Citroen Opel Peugeot 5g Connectivity Stellantis Foxconn

Fiat Chrysler agrees to new $3.8 billion credit facility with banks

Thu, Mar 26 2020MILAN — Fiat Chrysler said on Thursday it has agreed a new credit facility with two banks, at a time when major carmakers are having to shut down plants, losing revenue as demand slumps in the wake of the coronavirus. Most of FCA's plants around the world are currently shut in response to the virus emergency. Italian investment firm Exor, which controls FCA, said on Wednesday that the temporary closures might continue and increase depending on how the coronavirus outbreak develops. FCA said the credit facility would be available "for general corporate purposes and for working capital needs" of the group and that it was structured as a "bridge facility" to support its access to capital markets. "This transaction confirms the continued strong support of FCA's international key relationship banks in the current extraordinary circumstances," the automaker said in a statement, without making any explicit link between the new facility and the impact the virus is having on the global economy. The facility can be drawn in a single tranche of 3.5 billion euros ($3.8 billion), with an initial 12-month term which can be extended for further six months. It adds to existing credit facilities worth 7.7 billion euros, including lines for 1.5 billion euros that the company has started to draw down, FCA said. FCA is in merger talks with Peugeot owner PSA to create the world's fourth biggest carmaker. The deal is expected to be finalized by the first quarter of next year. Equita's analyst Martino De Ambroggi said that, based on his new assumption of a 10% drop of global auto market this year, the crisis triggered by the coronavirus would impact the merged automaker's free cash flow by over 5 billion euros. Earlier this week, General Motors announced it will draw about $16 billion from its credit lines in a bid to beef up liquidity amid rising business impact from the fast-spreading coronavirus outbreak. And last week, rival Ford abandoned its 2020 forecast and said it was drawing down $15.4 billion from two credit facilities to bolster its balance sheet. Related Video: