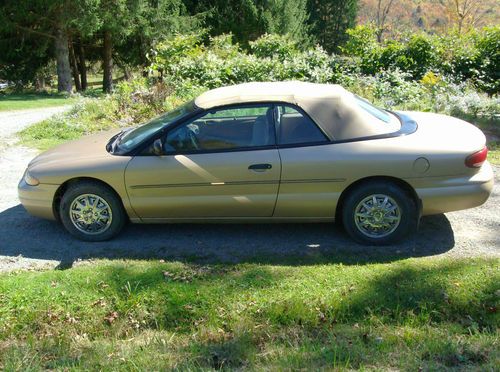

1997 Chrysler Sebring Jx Convertible 2-door 2.5l on 2040-cars

Hancock, New York, United States

Engine:2.5L 2497CC 152Cu. In. V6 GAS SOHC Naturally Aspirated

Vehicle Title:Clear

Transmission:Automatic

For Sale By:Private Seller

Body Type:Convertible

Make: Chrysler

Number of Doors: 2

Model: Sebring

Mileage: 183

Trim: JX Convertible 2-Door

Exterior Color: Tan

Interior Color: Tan

Drive Type: FWD

Number of Cylinders: 6

Options: Convertible

1997 conv runs just needs little work.just took it off the road to many cars here.any ? feel free to ask

Chrysler Sebring for Sale

2004 chrysler sebring limited coupe 2-door 3.0l(US $5,500.00)

2004 chrysler sebring limited coupe 2-door 3.0l(US $5,500.00) 2006 chrysler sebring touring convertible only 40k miles xtra clean and serviced(US $9,990.00)

2006 chrysler sebring touring convertible only 40k miles xtra clean and serviced(US $9,990.00) 2007 chrysler sebring limited sedan 4-door 3.5l(US $4,800.00)

2007 chrysler sebring limited sedan 4-door 3.5l(US $4,800.00) 2004 silver lx!, super clean,sunroof(US $3,495.00)

2004 silver lx!, super clean,sunroof(US $3,495.00) 2006 chrysler sebring touring convertible 2-door v6 2.7l automatic transmission

2006 chrysler sebring touring convertible 2-door v6 2.7l automatic transmission 1996 chrysler sebring jxi convertible 2-door 2.5l(US $1,450.00)

1996 chrysler sebring jxi convertible 2-door 2.5l(US $1,450.00)

Auto Services in New York

West Herr Chrysler Jeep ★★★★★

Top Edge Inc ★★★★★

The Garage ★★★★★

Star Transmission Company Incorporated ★★★★★

South Street Collision ★★★★★

Safelite AutoGlass - Syracuse ★★★★★

Auto blog

FCA to skip summer shutdowns as automakers rev up U.S. assembly lines

Thu, Jun 18 2020DETROIT — Several of FCA's facilities will skip their usual summer shutdowns to get a jump on rebuilding inventory, the company confirmed early Wednesday. The plants that will remain open include three in the United States (Jefferson North in Detroit, Toledo Assembly in Ohio, and Sterling Heights Assembly in suburban Detroit), one in Canada (Brampton Assembly in Ontario) and two in Mexico (Saltillo Truck Assembly and Saltillo Van Assembly). This will allow dealers to address depleted inventory of popular trucks and muscle cars, Automotive News reports. Other facilities not named will observe their normal one- and two-week breaks. Automakers are speeding up U.S. assembly lines to meet recovering demand, increasingly confident coronavirus safety protocols are working to prevent outbreaks in their plants but wary of the challenges workers face outside. Screening workers for COVID-19 using temperature scans and questionnaires, the automakers have detected some people who reported for work despite being sick. Some plants have been briefly shut down for disinfection, but so far, there has not been a major outbreak within a U.S. auto plant since most reopened May 18, company and United Auto Workers union officials said. The risk of an infection picked up outside a plant spreading along assembly lines remains a prime concern, however. An outbreak could shut down a factory costing a manufacturer millions of dollars a day. The disruption caused by the pandemic is creating other challenges as well. At Ford Motor Co's F-series pickup truck plant in Louisville, Kentucky, the company has given more than 1,000 workers leave related to COVID-19 concerns. It hired temporary workers to fill their jobs as the plant accelerates production of trucks critical to Ford's financial recovery. Demand for pickup trucks helped boost U.S. auto sales in May, and contributed to stronger than expected overall U.S. retail sales for the month. Officials of UAW Local 862, which represents workers at the Louisville plant, said a lack of child care was a significant issue for members. It had led many to stay away from the plant and collect increased unemployment benefits provided under the federal CARES coronavirus relief act. Ford has now begun arranging subsidized child care for UAW workers, Gary Johnson, the automaker's head of manufacturing told Reuters.

Fiat Chrysler to pay $40 million fine for inflating sales numbers

Fri, Sep 27 2019DETROIT — Fiat Chrysler is paying $40 million to settle with U.S. securities regulators who say the automaker misled investors by overstating its monthly sales numbers over a five-year period. The Italian-American company inflated sales by paying dealers to report fake numbers from 2012 to 2016, the U.S. Securities and Exchange Commission alleged in a complaint. Fiat Chrysler agreed to pay the civil penalty and to stop violating anti-fraud, reporting and internal accounting control regulations, the SEC said Friday in a statement. The automaker did not admit or deny the agency's allegations, the statement said. "This case underscores the need for companies to truthfully disclose their key performance indicators," Antonia Chion, associate director in the SEC's Enforcement Division, said in the statement. She noted that the new vehicle sales figures give investors insight into the demand for an automaker's products, a key to assessing the company's performance. Fiat Chrysler said it has reviewed and refined its sales reporting procedures. It said the payment will not have a large impact on its financial statements. The agency said the automaker boasted about a streak of year-over-year sales increases into 2016, when the streak actually was broken in September of 2013. When the company disclosed the sales scheme in 2016, it said that it had a "reserve" stock of cars that had been shipped to big fleet buyers such as rental car companies but not recorded as sales. The SEC said employees called this database of actual but unreported sales the "cookie jar." The company dipped into those sales to stop the streak from ending, or when it would have missed other sales targets. Fiat Chrysler said it now records sales as soon as vehicles are shipped to customers. It has also take steps to ensure that a sale is immediately subtracted from its books when it finds out the deal was scuttled because the buyer backed out or couldn't get financing. The SEC probe is another in a long string of legal troubles for Fiat Chrysler. It also faces federal investigations into illegal payments to union officials through a training center, and a criminal probe into allegations that its diesel-powered trucks were programmed to cheat on emissions tests. The company has denied cheating, but federal prosecutors charged an engineer earlier this week and said he conspired with others. In June, Fiat Chrysler's U.S.

Fiat Chrysler profit up as it closes in on retiring its debt

Thu, Apr 26 2018MILAN — Fiat Chrysler Automobiles reduced its debt by more than expected in the first quarter, putting the carmaker well on course to become cash positive later this year. Chief Executive Sergio Marchionne expects to cancel all debt during 2018 — possibly by the end of June — and generate around 4 billion euros ($5 billion) in net cash by the end of the year. Marchionne has said that forecast does not include any one-off measures, nor the impact of the planned spinoff of parts maker Magneti Marelli, which he hopes to execute by early 2019. The world's seventh-largest carmaker said on Thursday net debt had fallen to 1.3 billion euros ($1.6 billion) by the end of March, well below a consensus forecast of 2.6 billion euros in a Thomson Reuters poll of analysts. FCA said capital spending fell 900 million euros in the quarter due to "program timing," which analysts said implied higher investments for the rest of the year. The Italian-American group said first-quarter operating profit rose 5 percent to 1.61 billion euros, below a consensus forecast of 1.74 billion, as a weaker performance from its North American profit center weighed. Shipments there were higher due to the new Jeep Wrangler and Compass models. But currency moves hit revenues and earnings, and costs related to new product launches added to the pressure. FCA's shift to sell more trucks and SUVs boosted margins yet again in North America to 7.4 percent from 7.3 percent in the same quarter a year ago, although they were down from the 8 percent recorded in the preceding three months. Marchionne, preparing to hand over to an internal successor next year, is close to his goal of ending a margin gap with larger U.S. rivals General Motors and Ford. The 65-year-old has said becoming debt free and being able to compete on a par with U.S. peers would mean FCA no longer needed a partner to survive and could well succeed on its own. The CEO has previously said tying up with another carmaker would help to meet the huge costs in an industry investing in electric vehicles and automated driving. FCA shares fell immediately after the results, but recovered to trade up 3 percent at 19.71 euros by 1150 GMT, outperforming a 0.4 percent rise in Europe's blue-chip stock index. ($1 = 0.8214 euros) Reporting by Agnieszka FlakRelated Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.