No Reserve All Power Lift Gate Leather 7 Seats Heated Fr. & Rear Seats New Tires on 2040-cars

Philadelphia, Pennsylvania, United States

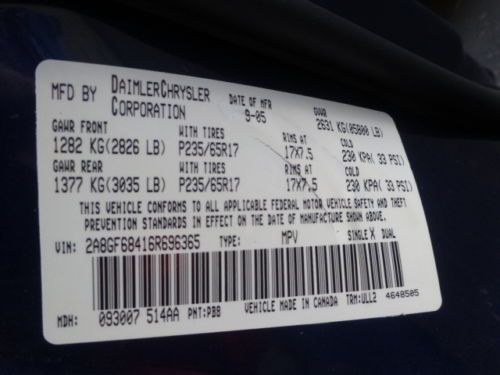

Chrysler Pacifica for Sale

2007 chrysler pacifica touring all wheel drive lthr moonroof dvd no reserve

2007 chrysler pacifica touring all wheel drive lthr moonroof dvd no reserve X clean 2006 chrysler pacifica touring sport utility 4-door 3.5l,dvd,leather 3r(US $4,900.00)

X clean 2006 chrysler pacifica touring sport utility 4-door 3.5l,dvd,leather 3r(US $4,900.00) 2004 chrysler pacifica base sport utility 4-door 3.5l(US $4,800.00)

2004 chrysler pacifica base sport utility 4-door 3.5l(US $4,800.00) Beautiful chrysler pacifica

Beautiful chrysler pacifica 2006 chrysler pacifica touring sport utility 4-door 3.5l(US $4,850.00)

2006 chrysler pacifica touring sport utility 4-door 3.5l(US $4,850.00) 2006 chrysler pacifica touring sport utility 4-door 3.5l(US $6,200.00)

2006 chrysler pacifica touring sport utility 4-door 3.5l(US $6,200.00)

Auto Services in Pennsylvania

Valley Tire Co Inc ★★★★★

Trinity Automotive ★★★★★

Total Lube Center Plus ★★★★★

Tim Howard Auto Repair ★★★★★

Terry`s Auto Glass ★★★★★

Spina & Adams Collision Svc ★★★★★

Auto blog

Waymo bids its self-driving bubble cars farewell

Tue, Jun 13 2017Say goodbye to Waymo's quirky bubble-shaped autonomous cars. Google's former self-driving car division is retiring its fleet of "Fireflies" - also known as "koalas" and "gumdrops," among many other nicknames - to focus on integrating its technology into more traditional vehicles. It particularly aims to give more people access to its self-driving technology through a fleet of 600 Chrysler Pacifica minivans, which the team has equipped with its latest custom-built radar, lidar and vision systems. The minivans also come with Waymo's newest AI platform that can see farther and more clearly. Plus, they run like normal vehicles do, unlike the Fireflies, which are limited to 25mph. This move doesn't exactly come as a surprise. A report from late 2016 said Alphabet's Larry Page scrapped Waymo's plans to manufacture bubble-shaped driverless vehicles to make the company's strategy more feasible. It said Page's new plan involves collaborating with automakers to design and make cars with no pedals and steering wheels that use Google's self-driving tech. Shortly after that report came out, Waymo introduced its heavily modified Chrysler Pacificas with altered electrical, powertrain, chassis and structural system to accommodate the extra weight of the company's equipment. While Waymo will no longer use its Fireflies for future tests, you can still catch a glimpse of the cute bubble cars in various locations. This August, they'll be on display at the Arizona Science Center in Phoenix before making their way to the The Thinkery in Austin, Texas, this October. You'll also find a Firefly at the Computer History Museum in Mountain View, California and another at the Design Museum in London.Written by Mariella Moon for Engadget. Waymo Related Video:

GM says it favors fuel-efficiency rules based on historic rates

Mon, Oct 29 2018WASHINGTON — General Motors backs an annual increase in fuel-efficiency standards based on "historic rates" rather than tough Obama era rules or a Trump administration proposal that would freeze requirements, according to a federal filing made public on Monday. The largest U.S. automaker said the Obama rules that aimed to hike fleet fuel efficiency to more than 50 miles per gallon by 2025 are "not technologically feasible or economically practicable." The Detroit automaker said that since 1980, the motor vehicle fleet has improved fuel efficiency at an average rate of 1 percent a year. Fiat Chrysler Automobiles NV said in separate comments that the auto industry is complying with existing fuel efficiency requirements by using credits from prior model years. As a result, even if requirements are frozen at 2020 levels, "the industry would need to continue to improve fuel economy" as credits expire, it added, warning if the government hikes standards beyond 2020 requirements "the situation worsens ... without some significant form of offset or flexibility." Fiat Chrysler and Ford urged the government to reclassify two-wheel drive SUVs as light trucks, which face less stringent requirements than cars. A four-wheel drive version of the same SUV is considered a light truck. Ford backs fuel rules "that increase year-over-year with additional flexibility to help us provide more affordable options for our customers." GM's comments said it was "troubled" that President Donald Trump's administration wants to phase out incentives for electric vehicles. The Trump plan's preferred alternative freezes standards at 2020 levels through 2026 and hikes U.S. oil consumption by about 500,000 barrels per day in the 2030s but reduces automakers' collective regulatory costs by more than $300 billion. It would bar California from requiring automakers to sell a rising number of electric vehicles or setting state emissions rules. The administration of former President Obama had adopted rules, effective in 2021, calling for an annual increase of 4.4 percent in fuel-efficiency requirements from 2022 through 2025. GM has been lobbying Congress to lift the existing cap on electric vehicles eligible for a $7,500 tax credit. The credit phases out over a 12-month period after an individual automaker hits 200,000 electric vehicles sold, and GM is close to that point.

Minivan market not what it used to be, but margins make up for it

Thu, 05 Jun 2014

Residual values for last year's minivans are higher than they were in 2000.

Much like the station wagon was the shuttle of Baby Boomer generation, the minivan has been the primary means of transport for Generations X and Y. Just as the boomers abandoned the Country Squire, though, those kids that were toted around in Grand Caravans and Windstars are adults, and they certainly don't want to be seen in the cars their parents drove.