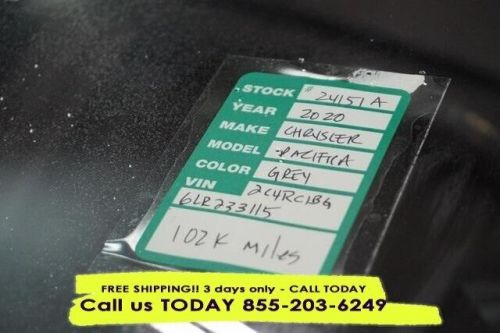

2020 Chrysler Pacifica Touring L on 2040-cars

Tomball, Texas, United States

Engine:6 Cylinder Engine

Fuel Type:Gasoline

Body Type:--

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 2C4RC1BG6LR233115

Mileage: 103282

Make: Chrysler

Trim: Touring L

Drive Type: FWD

Features: --

Power Options: --

Exterior Color: Gray

Interior Color: Black

Warranty: Unspecified

Model: Pacifica

Chrysler Pacifica for Sale

2017 chrysler pacifica(US $13,900.00)

2017 chrysler pacifica(US $13,900.00) 2017 chrysler pacifica touring l(US $15,000.00)

2017 chrysler pacifica touring l(US $15,000.00) 2022 chrysler pacifica touring l(US $18,393.90)

2022 chrysler pacifica touring l(US $18,393.90) 2020 chrysler pacifica touring l / advanced safety and technology group(US $18,995.00)

2020 chrysler pacifica touring l / advanced safety and technology group(US $18,995.00) 2020 chrysler pacifica touring l(US $17,241.70)

2020 chrysler pacifica touring l(US $17,241.70) 2020 chrysler pacifica touring(US $16,264.50)

2020 chrysler pacifica touring(US $16,264.50)

Auto Services in Texas

Wolfe Automotive ★★★★★

Williams Transmissions ★★★★★

White And Company ★★★★★

West End Transmissions ★★★★★

Wallisville Auto Repair ★★★★★

VW Of Temple ★★★★★

Auto blog

The next steps automakers could take after sales drop again in April

Tue, May 2 2017DETROIT (Reuters) - Major automakers on Tuesday posted declines in U.S. new vehicle sales for April in a sign the long boom cycle that lifted the American auto industry to record sales last year is losing steam, sending carmaker stocks down. The drop in sales versus April 2016 came on the heels of a disappointing March, which automakers had shrugged off as just a bad month. But two straight weak months has heightened Wall Street worries the cyclical industry is on a downward swing after a nearly uninterrupted boom since the Great Recession's end in 2010. Auto sales were a drag on U.S. first-quarter gross domestic product, with the economy growing at an annual rate of just 0.7 percent according to an advance estimate published by the Commerce Department last Friday. Excluding the auto sector the GDP growth rate would have been 1.2 percent. Industry consultant Autodata put the industry's seasonally adjusted annualized rate of sales at 16.88 million units for April, below the average of 17.2 million units predicted by analysts polled by Reuters. General Motors Co shares fell 2.9 percent while Ford Motor Co slid 4.3 percent and Fiat Chrysler Automobiles NV's U.S.-traded shares tumbled 4.2 percent. The U.S. auto industry faces multiple challenges. Sales are slipping and vehicle inventory levels have risen even as carmakers have hiked discounts to lure customers. A flood of used vehicles from the boom cycle are increasingly competing with new cars. The question for automakers: How much and for how long to curtail production this summer, which will result in worker layoffs? To bring down stocks of unsold vehicles, the Detroit automakers need to cut production, and offer more discounts without creating "an incentives war," said Mark Wakefield, head of the North American automotive practice for AlixPartners in Southfield, Michigan. "We see multiple weeks (of production) being taken out on the car side," he said, "and some softness on the truck side." Rival automakers will be watching each other to see if one is cutting prices to gain market share from another, he said, instead of just clearing inventory. INVESTORS DIGEST BAD NEWS Just last week GM reported a record first-quarter profit, but that had almost zero impact on the automaker's stock. The iconic carmaker, whose own interest was once conflated with that of America's, has slipped behind luxury carmaker Tesla Inc in terms of valuation.

Scandal-rocked UAW extends Ford, FCA contracts, prepares to strike GM

Fri, Sep 13 2019DETROIT — Leaders of the United Auto Workers union have extended contracts with Ford and Fiat Chrysler indefinitely, but the pact with General Motors is still set to expire Saturday night. The move puts added pressure on bargainers for both sides as they approach the contract deadline and the union starts to make preparations for a strike. The contract extension was confirmed Friday by UAW spokesman Brian Rothenberg, who declined further comment on the talks. The union has picked GM as the target company, meaning it is the focus of bargaining and would be the first company to face a walkout. GMÂ’s contract with the union is scheduled to expire at 11:59 p.m. Saturday. ItÂ’s possible that the four-year GM contract also could be extended or a deal could be reached, but itÂ’s more likely that 49,200 UAW members could walk out of GM plants as early as Sunday because union and company demands are so far apart. Picket line schedules already have been posted near the entrance to one local UAW office in Detroit. Art Wheaton, an auto industry expert at the Worker Institute at Cornell University, expects the GM contract to be extended for a time, but he says the gulf between both sides is wide. “GM is looking through the windshield ahead, and it looks like nothing but land mines,” he said of a possible recession, trade disputes and the expense of developing electric and autonomous vehicles. “I think thereÂ’s really going to be a big problem down the road in matching the expectations of the union and the willingness of General Motors to be able to give the membership what it wants.” Plant-level union leaders from all over the country will be in Detroit on Sunday to talk about the next steps, and after that, the union likely will make an announcement. But leaders are likely to face questions about an expanding federal corruption probe that snared a top official on Thursday. Vance Pearson, head of a regional office based near St. Louis, was charged with corruption in an alleged scheme to embezzle union money and spend cash on premium booze, golf clubs, cigars and swanky stays in California. ItÂ’s the same region that UAW President Gary Jones led before taking the unionÂ’s top office last year. Jones and other union executives met privately at a hotel at Detroit Metropolitan Airport on Friday. After the meeting broke up, JonesÂ’ driver and others physically blocked an AP reporter from trying to approach him to ask questions.

Italy reportedly guarantees $7.1 billion loan to Fiat Chrysler

Wed, Jun 24 2020ROME — Italy has approved a decree offering state guarantees for a 6.3-billion euro ($7.1 billion) loan to Fiat Chrysler's (FCA)Â Italian unit, a source said, paving the way for the largest crisis loan to a European carmaker. The source said Italy's audit court had signed off on the decree, in a final step of what had been a lengthy and contested process to get the loan approved. The court's approval follows an earlier endorsement by the economy ministry. "The audit court authorized the decree," said a source close to the matter, asking not to be named because of its sensitivity. FCA's Italian division has tapped Rome's COVID-19 emergency financing schemes to secure a state-backed, three-year facility to help the group's operations in the country, as well as Italy's car sector in which about 10,000 businesses operate, weather the crisis triggered by the coronavirus emergency. The loan will be disbursed by Italy's biggest retail bank Intesa Sanpaolo, which has already authorized it pending the approval of guarantees the government will provide on 80% of the sum through export credit agency SACE. The request for state support has sparked controversy because FCA is working to merge with French rival PSA and the holding for the Italian-American carmaker is registered in the Netherlands. FCA's global brands include Fiat, Jeep, Dodge and Maserati. It was not immediately clear what conditions, if any, Italy has set as part of the guarantees and whether they would affect FCA's planned 5.5 billion euro ($6.2 billion) extraordinary dividend, which is a key element in the merger with PSA. FCA, whose shares were down 0.5% by 0908 GMT, had no immediate comment. Â Earnings/Financials Chrysler Fiat Peugeot Italy