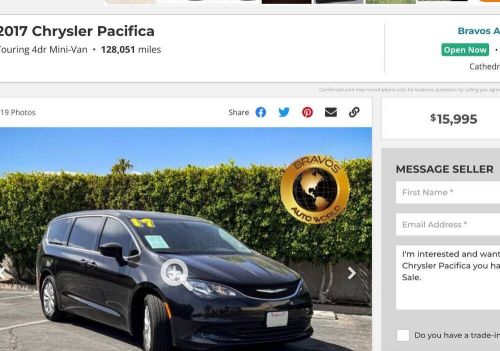

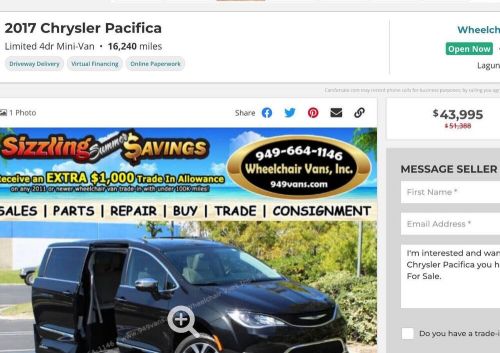

2017 Chrysler Pacifica Touring 4dr Mini Van on 2040-cars

Engine:3.6L V6

Fuel Type:Gasoline

Body Type:Minivan

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 2C4RC1DG5HR623210

Mileage: 72000

Make: Chrysler

Trim: Touring 4dr Mini Van

Drive Type: --

Features: --

Power Options: --

Exterior Color: Charcoal

Interior Color: Gray

Warranty: Unspecified

Model: Pacifica

Chrysler Pacifica for Sale

2024 chrysler pacifica touring l awd(US $41,750.00)

2024 chrysler pacifica touring l awd(US $41,750.00) 2022 chrysler pacifica touring l(US $20,274.00)

2022 chrysler pacifica touring l(US $20,274.00) 2020 chrysler pacifica touring l(US $20,600.00)

2020 chrysler pacifica touring l(US $20,600.00) 2023 chrysler pacifica limited(US $39,914.00)

2023 chrysler pacifica limited(US $39,914.00) 2006 chrysler pacifica limited awd(US $10,450.00)

2006 chrysler pacifica limited awd(US $10,450.00) 2020 chrysler pacifica limited(US $23,388.00)

2020 chrysler pacifica limited(US $23,388.00)

Auto blog

Zombie cars: Discontinued vehicles that aren't dead yet

Thu, Jan 6 2022Car models come and go, but as revealed by monthly sales data, once a car is discontinued, it doesn't just disappear instantly. And in the case of some models, vanishing into obscurity can be a slow, tedious process. That's the case with the 12 cars we have here. All of them have been discontinued, but car companies keep racking up "new" sales with them. There are actually more discontinued cars that are still registering new sales than what we decided to include here. We kept this list to the oldest or otherwise most interesting vehicles still being sold as new, including a supercar. We'll run the list in alphabetical order, starting with *drumroll* ... BMW 6 Series: 55 total sales BMW quietly removed the 6 Series from the U.S. market during the 2019 model year. It had been available in three configurations, a hardtop coupe, a convertible and a sleek four-door coupe-like shape. Â BMW i8: 18 total sales We've always had a soft spot for the BMW i8, despite the fact that it never quite fit into a particular category. It was sporty, but nowhere near as fast as similarly-priced competitors. It looked very high-tech and boasted a unique carbon fiber chassis design and a plug-in hybrid powertrain, but wasn't really designed for maximum efficiency or maximum performance. Still, the in-betweener was very cool to look at and drive, and 18 buyers took one home over the course of 2021. Â Chevy Impala: 750 total sales The Impala represented classic American tastes at a time when American tastes were shifting away from soft-riding sedans with big interior room and trunk space and into higher-riding crossovers. A total of 750 sales were inked last year. Â Chrysler 200: 15 total sales The Chrysler 200 was actually a pretty nice sedan, with good looks and decent driving dynamics let down by a lack of roominess, particularly in the back seat. Of course, as we said regarding the Chevy Impala, the number of Americans in the market for sedans is rapidly winding down, and other automakers are following Chrysler's footsteps in canceling their slow-selling four-doors. Even if Chrysler never really found its footing in the ultra-competitive midsize sedan segment, apparently dealerships have a few leftover 2017 200s floating around. And for some reason, 15 buyers decided to sign the dotted line to take one of these aging sedans home last year.

GM says it favors fuel-efficiency rules based on historic rates

Mon, Oct 29 2018WASHINGTON — General Motors backs an annual increase in fuel-efficiency standards based on "historic rates" rather than tough Obama era rules or a Trump administration proposal that would freeze requirements, according to a federal filing made public on Monday. The largest U.S. automaker said the Obama rules that aimed to hike fleet fuel efficiency to more than 50 miles per gallon by 2025 are "not technologically feasible or economically practicable." The Detroit automaker said that since 1980, the motor vehicle fleet has improved fuel efficiency at an average rate of 1 percent a year. Fiat Chrysler Automobiles NV said in separate comments that the auto industry is complying with existing fuel efficiency requirements by using credits from prior model years. As a result, even if requirements are frozen at 2020 levels, "the industry would need to continue to improve fuel economy" as credits expire, it added, warning if the government hikes standards beyond 2020 requirements "the situation worsens ... without some significant form of offset or flexibility." Fiat Chrysler and Ford urged the government to reclassify two-wheel drive SUVs as light trucks, which face less stringent requirements than cars. A four-wheel drive version of the same SUV is considered a light truck. Ford backs fuel rules "that increase year-over-year with additional flexibility to help us provide more affordable options for our customers." GM's comments said it was "troubled" that President Donald Trump's administration wants to phase out incentives for electric vehicles. The Trump plan's preferred alternative freezes standards at 2020 levels through 2026 and hikes U.S. oil consumption by about 500,000 barrels per day in the 2030s but reduces automakers' collective regulatory costs by more than $300 billion. It would bar California from requiring automakers to sell a rising number of electric vehicles or setting state emissions rules. The administration of former President Obama had adopted rules, effective in 2021, calling for an annual increase of 4.4 percent in fuel-efficiency requirements from 2022 through 2025. GM has been lobbying Congress to lift the existing cap on electric vehicles eligible for a $7,500 tax credit. The credit phases out over a 12-month period after an individual automaker hits 200,000 electric vehicles sold, and GM is close to that point.

Another blow for Canadian autoworkers: FCA to lay off 1,500 at Windsor

Mon, Apr 1 2019Fiat Chrysler says it will cut a third shift at its Windsor Assembly Plant in Ontario, meaning layoffs for 1,500 workers in response to softening sales of the Chrysler Pacifica minivan. Separately, FCA announced it was moving up the scheduled two-week shutdown at the plant by one week, to the weeks of April 1 and 8. It's the latest blow for blue-collar autoworkers in Canada, who have been rocked by the potential closure of GM's assembly plant in Oshawa, Ontario, after production of the Chevrolet Impala and Cadillac XTS ends later this year. It will be the first time since 1993 that FCA's Windsor plant has operated on just two shifts, but the shutdown that began this week marks the third time the plant has been shut down this year. The Detroit News reports that action at the Windsor plant would be effective Sept. 30. It quoted Dave Cassidy, president of Unifor Local 444, at a news conference late last week: "People's lives — 1,500 direct families — depend on us," he said. "We're going to do everything possible to make sure we maintain three shifts. Everyone knows our product in Windsor is No. 1, and if you want to build it right, you want to build it in Windsor." FCA says it's making the cutback to better align production with demand. Through the first two months of 2019, U.S. sales of the Pacifica were down 24 percent to 14,817, with sales of the Grand Caravan, which is also built in Windsor, down 27 percent to 19,634. For the full-year 2018, Pacifica sales were flat at 118,322, while Grand Caravan sales rose 21 percent to 151,927. In Canada, the Pacifica saw a 3 percent drop in 2018 to just 5,999. FCA says it plans to offer retirement packages to eligible employees and will try to place laid-off hourly workers in open positions elsewhere as they become available. The company in February announced plans to invest $4.5 billion across the river to build a new assembly plant in Detroit and expand production at five other local plants in a move that will see it create 6,500 new jobs, pending certain assistance from the city of Detroit. The new Detroit plant will transform the existing Mack Avenue Engine facility into a production site for the next-generation Jeep Grand Cherokee and a new three-row Jeep SUV. That plan alone is said to involve 3,850 new jobs.