2006 Chrysler Pacifica Touring Sport Utility 4-door 3.5l on 2040-cars

Montrose, Michigan, United States

|

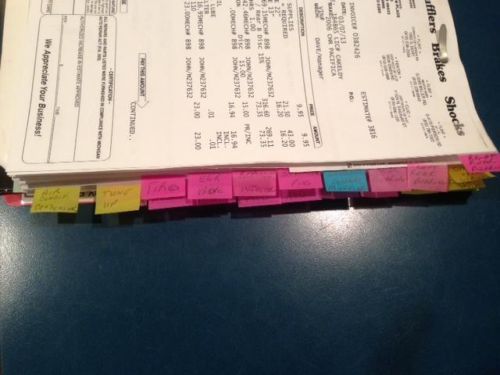

All paperwork from original purchase to every oil change. Oil Changed every 3000 miles. Excellent condition, no accidents, no rust! Well maintained inside, outside and under the hood with all records . Mostly highway miles. Very clean interior, leather seats are in great condition. Aftermarket Remote Starter. 6 CD changer. 200 Watt amplifier. Video output. L/R Inputs. Sirius Radio (must subscribe). Front Wheel Drive. Dual Zone Temperature control. Power 8 Way Driver & 4 way Front Passenger Seats. Power heated fold away mirrors, Rear Window Wiper/Washer. Adjustable Roof Rail Crossbars. Rear 65/35 Split Folding Bench Seat. |

Chrysler Pacifica for Sale

Super clean, nice, beautiful, sporty, roomy, crossover, power, awesome

Super clean, nice, beautiful, sporty, roomy, crossover, power, awesome 4dr wagon touring fwd automatic gasoline 3.5l v6 cyl black(US $4,944.00)

4dr wagon touring fwd automatic gasoline 3.5l v6 cyl black(US $4,944.00) 2006 chrysler pacifica

2006 chrysler pacifica Touring suv 4.0l cd 7 speakers am/fm compact disc w/changer control am/fm radio

Touring suv 4.0l cd 7 speakers am/fm compact disc w/changer control am/fm radio 2004 chrysler pacifica base sport utility 4-door 3.5l

2004 chrysler pacifica base sport utility 4-door 3.5l 2006 chrysler pacifica 3.5l v6 cruise ctrl alloy wheels texas direct auto(US $6,980.00)

2006 chrysler pacifica 3.5l v6 cruise ctrl alloy wheels texas direct auto(US $6,980.00)

Auto Services in Michigan

Van Buren Motor Supply Inc ★★★★★

Van 8 Collision ★★★★★

Upholstery Barn ★★★★★

United Auto & Collision ★★★★★

Tuffy Auto Service Centers ★★★★★

Superior Collision ★★★★★

Auto blog

UAW warns automakers: Restarting U.S. plants is 'too soon and too risky'

Fri, Apr 24 2020WASHINGTON/WARREN, Mich. — The head of the United Auto Workers union on Thursday said it was "too soon and too risky" to reopen auto plants and Michigan's economy in early May, citing insufficient scientific data and coronavirus testing to assure workplaces are safe. The warning from UAW President Rory Gamble on Thursday afternoon came as General Motors Co , Ford Motor Co and Toyota Motor Corp took new steps toward reopening North American vehicle manufacturing operations in an environment where consumer demand is uncertain and worker safety paramount. The union has said that 24 of its members have died from Covid-19, though it was unclear whether they might have become infected in the workplace. Unionized Detroit automakers and non-union German and Asian automakers have been preparing to restart U.S. vehicle making operations by early May. Companies have shifted reopening dates amid uncertainty about government stay-at-home orders. Gamble's statement appeared to derail plans by the Detroit Three to start bringing UAW workers back to vehicle manufacturing jobs on May 4. The longer the automakers cannot produce profitable U.S.-made trucks and sport utility vehicles, the longer they burn cash. The UAW leader's statement was also aimed at Michigan Gov. Gretchen Whitmer, who has come under pressure from conservative groups and President Donald Trump to ease coronavirus stay-at-home restrictions. "At this point in time, the UAW does not believe the scientific data is conclusive that it is safe to have our members back in the workplace. We have not done enough testing to really understand the threat our members face," Gamble said. "We strongly suggest to our companies in all sectors that an early May date is too soon and too risky to our members, their families and their communities." Gamble said the union was "happy with the auto companiesÂ’ response and cooperation on working through the health and safety protocols we will need in the workplace when it is appropriate to restart." Earlier Thursday, GM began notifying front line managers to come back to work next week to get trained on new safety protocols designed to prevent the spread of the novel coronavirus as workers return to plants.

Mopar teases a big Hemi crate engine for SEMA

Wed, Oct 24 2018Mopar has released a new video teaser hinting at the release of a large and powerful crate Hemi engine at SEMA later this month in Las Vegas. The video functions like a lesson on symbolism in an English lit class. It opens with smoke and settles on a pair of backlit, large-clawed paw prints that look to be feline in origin. Then we hear earth-shaking pounding sounds of something larger than the paw prints that stomps over them. Then cue an overhead shot of what looks to be a vintage-model Dodge Charger and its growly Hemi engine entering the frame and then gunning the engine. Mopar already offers three crate Hemi V8 engines, topped by the 6.2-liter supercharged Hellcat, good for 707 horsepower and 650 pound-feet of torque, found in the Dodge Charger SRT Hellcat and marketed for pre-1976 classic muscle cars. So promising that "Something big is coming" is really saying something. Could it be a crate version of the 808-hp Hemi 6.2 that was found in the Dodge Demon, which was rated at 840 hp on racing fuel? Or is it something different? Curiously, Mopar says its reveal is planned for Tuesday, Oct. 30 at the odd time of 4:26 p.m. Could that time be a reference to the 426 Hemi — and specifically the Generation III 426 Hemi "Elephant" that Chrysler made several years ago? That technically qualifies as "bigger," and it would also align with both the muscle car-era Charger and round, earth-shaking footprints shown in the video. Time will prove whether we were right. Related Video: Image Credit: Mopar SEMA Show Chrysler Dodge Performance Classics dodge demon dodge charger srt hellcat

What's the right car for the 'Planes, Trains, and Automobiles' remake?

Sat, Nov 7 2020As the Thanksgiving holiday approaches so, too, does the season in which many Americans will rewatch that holiday classic, "Planes, Trains, and Automobiles." The Steve Martin and John Candy movie is a staple of holiday-season viewing. Soon, however, it will be joined by a new version. Paramount Pictures is doing a remake of "Planes, Trains, and Automobiles," starring Will Smith and Kevin Hart. In the 1987 original, Martin and Candy rent a pea-soup green Chrysler LeBaron Town&Country convertible (well, sort of), which suffers a series of mishaps including catching fire yet still chugs along. It was a star turn for the wood-sided K-car droptop (though not the last), and that got us thinking: What should the Smith and Hart duo get stuck with at Marathon Rent-A-Car? Of course, it needs to be a convertible. Among the widely used rental-car convertibles, a Ford Mustang or a Chevy Camaro would be too sporty and cool. This trip is supposed to be miserable. A Buick Cascada or a Beetle convertible would be more appropriate. Of the two, a Beetle is probably better from a comedy standpoint. But there is another car that stands out as the clear winner: the Chrysler PT Cruiser convertible. Granted, the PT convertible went out of production in 2008, making it a bit old for a current rental lot — but not too old. And the PT Cruiser was even offered with a Woodie package, providing even greater alignment with the LeBaron of old. However, the Woodie package was only offered from 2002–2004, so it predated the convertible by one model year. We think that in this case, the filmmakers should put aside strict historical accuracy and apply the faux-wood appliques to the PT convertible for maximum continuity with the original movie. Besides, the original car wasn't technically a Chrysler LeBaron: it had a different name and badging, plus a non-factory color. It wasn't too different from the Wagon Queen Family Truckster from "Vacation" in that regard. So, what do you think? Is it time for the PT Cruiser to join the great pantheon of movie road-trip cars? Or would something else make for a better movie motors classic?