Convertable on 2040-cars

Grandview, Missouri, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:2.4L 2429CC 148Cu. In. l4 GAS DOHC Turbocharged

Fuel Type:GAS

For Sale By:Private Seller

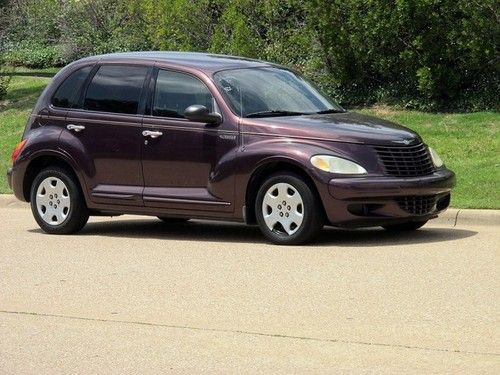

Make: Chrysler

Model: PT Cruiser

Trim: Touring Convertible 2-Door

Options: Alloy Wheels, CD Player, Convertible

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Drive Type: FWD

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows

Mileage: 109,633

Sub Model: Touring

Exterior Color: Purple

Warranty: Vehicle does NOT have an existing warranty

Interior Color: Gray

Vehicle Inspection: Passes Mo Safety Inspection

Number of Cylinders: 4

Rare Model, Rare Color. . .. Plum Crazy purple pearl with red flake

Graphite Interior, 2.4 DOHC Turbocharged engine, 4 speed Automatic

109k miles. New timing belt, new turbo. No air or water leaks around the top. Top looks new, but isn't. Everything is tight and right. Great summer ride if you're looking for a gas sipper with some style that stands out from all the silver/grey econo-boxes out there. This is just a solid fun little car that should be a blast to drive for years to come.

Chrysler PT Cruiser for Sale

2007 pt cruiser sport wagon, silver 5d 92k miles in *great* condition, $4500 obo(US $4,800.00)

2007 pt cruiser sport wagon, silver 5d 92k miles in *great* condition, $4500 obo(US $4,800.00) 2001 red chrysler pt cruiser base wagon 4-door 2.4l(US $3,000.00)

2001 red chrysler pt cruiser base wagon 4-door 2.4l(US $3,000.00) 2009 chrysler pt cruiser touring

2009 chrysler pt cruiser touring 2006 chrysler pt cruiser touring edition

2006 chrysler pt cruiser touring edition 2006 chrysler pt cruiser touring wagon 4-door 2.4l no reserve 3 days only

2006 chrysler pt cruiser touring wagon 4-door 2.4l no reserve 3 days only 2004 chrysler pt cruiser touring 5spd. power windows cold a/c!(US $3,500.00)

2004 chrysler pt cruiser touring 5spd. power windows cold a/c!(US $3,500.00)

Auto Services in Missouri

Total Tinting & Total Customs ★★★★★

The Auto Body Shop Inc. ★★★★★

Tanners Paint And Body ★★★★★

Tac Transmissions & Custom Exhaust ★★★★★

Square Deal Transmission ★★★★★

Sports Car Centre Inc ★★★★★

Auto blog

China's Great Wall confirms its interest — in Jeep, or all of FCA

Tue, Aug 22 2017HONG KONG/SHANGHAI — Chinese automaker Great Wall Motor reiterated its interest in Fiat Chrysler Automobiles NV on Tuesday, but said it had not held talks or signed a deal with executives at the Italian-American automaker. China's largest sport utility vehicle manufacturer made a direct overture to Fiat Chrysler on Monday, with an official saying the company was interested in all or part of FCA, owner of the Jeep and Ram truck brands. Automotive News first reported the news, quoting Great Wall Motor President Wang Fengying as saying she planned to contact FCA to discuss acquiring the Jeep brand specifically. Those comments sent FCA shares higher but also raised questions over the ability of China's seventh-largest automaker by sales to buy larger Western rival FCA, or even Jeep, which some analysts value at as much as one-and-a-half times FCA. Great Wall sought to dampen speculation on Tuesday. It confirmed it had studied Fiat Chrysler, but said there was "no concrete progress so far" and "substantial uncertainty" over whether it would eventually bid. "The company has not built any relationship with the directors of FCA nor has the company entered into any discussion or signed any agreements with any officer of FCA so far," the company said in an English-language stock exchange filing. It did not give further detail. Fiat Chrysler stock dipped on the statement on Tuesday. Great Wall said trading in its Shanghai-listed shares would resume on Wednesday after having been suspended. Fiat Chrysler declined to comment on Great Wall's statement. On Monday, it said it had not been approached and was fully committed to implementing its current business plan. FLUSHING OUT RIVALS? Great Wall Motor, which was early to spot China's love of SUVs, had revenue of $14.8 billion last year and sold 1.07 million vehicles - but that compares with FCA's 2016 revenue of 111 billion euros ($130.6 billion). Analysts said Great Wall would need to raise both debt and equity to complete any deal, meaning its chairman Wei Jianjun could lose majority control. One possible scenario, according to analysts at Jefferies, would see Wei keeping a roughly 30 percent stake, while Great Wall would raise $10-$14 billion in debt and $10 billion in equity - hefty for a group currently worth just $16 billion. Ultimately, politics could be the clincher.

FB Tuning debuts 400-hp carbon-bodied Chrysler Crossfire in Monaco

Wed, 30 Apr 2014The Chrysler Crossfire was, suffice it to say, a matter of taste. Based on old Mercedes-Benz mechanicals, it included retro styling accents and an armadillo roofline. Some loved it, but there was clearly room for improvement - not to mention more sales - and that's just what Italian coachbuilder FB Tuning had to showcase at the Top Marques show in Monaco this year.

Called the FB-ONE, it's based on the Crossfire, which itself was based on the same R170 chassis as the first-generation Mercedes-Benz SLK. It packs the same 3.2-liter V6 as well, which FB claims to have tuned farther than anything Daimler-Chrysler ever managed with the same engine. Whereas the SLK32 AMG packed 354 horsepower and the Crossfire SRT-6 offered 330, the FB-One packs a nice, round 400 hp, which ought to be good for a 0-60 time of little over four seconds.

As you can see, that's not all they've done with FB-One. It's also been rebodied in carbon fiber, with gold accents, deep-dish alloys that look like they came out of a casino and the headlights from an Audi A8. Whether the result is your cup of tea likely depends, as it did with the Crossfire in the first place, on your own personal tastes, so check it out for yourself in the video below.

Chrysler stays IPO until 2014

Mon, 25 Nov 2013There will not be a Chrysler IPO in 2013. Fiat, according to a report from Forbes, has announced that it will not be able to make the American brand's initial public offering before the end of the year, saying that the short, five-week window that makes up the rest of 2013 is "not practicable."

Not surprisingly, the issue with the Chrysler IPO is the same as it's always been - a disagreement between parent company Fiat, which owns 58.5 percent of the Chrysler Group and a UAW healthcare trust, which owns 41.5 percent. Fiat wants to buy out the UAW VEBA healthcare trust, which is responsible for shouldering retiree healthcare costs, but the two sides are hung up on an actual price tag for the remaining two-fifths of the company.

The original idea saw an IPO as a way of setting a fair market price for the remaining shares, although it's not entirely clear what broke down and led to a delay of the IPO plan. As Forbes points out, by waiting until 2014, Chrysler could be risking a cool-off in the IPO market, which could mean less money in its pocket when the automaker finally goes public.