Black 2006 Chrysler Pt Cruiser - Limited Edition/2.4l Turbo/leather Interior on 2040-cars

Simi Valley, California, United States

|

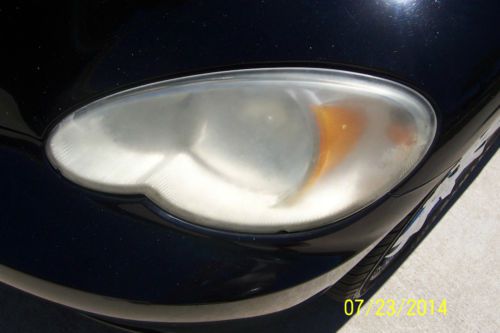

Available here for purchase is a 2006 Chrysler PT Cruiser in good condition! This is the Limited Edition 4-door, 2.4L Turbo, leather interior, automatic version of the vehicle...in black. Original owner! Purchased back in '06 with 25 dealer miles. There are now just under 113,000 miles. Car needs new brakes as they are squeaking currently. Tires are in good condition and have some miles left on them. Air conditioning unit needs to be fixed...I was told by PepBoys that it needs a new compressor (quoted a price of around $800 to fix). Body has only minor damage. Front bumper has some scuffing/scraps and missing a piece of the grill. Small nick/crack/ding to the front windshield on the passenger side. Brand new automatic transmission was installed back in 2012...right around the 90,000 mile mark. Car comes from a non-smoking home! Still a decent car and has plenty of miles left on it. Please be local to Los Angeles if interested in seeing/test-driving vehicle. Clean and clear title...so purchase with confidence!

|

Chrysler PT Cruiser for Sale

2001 chrysler pt cruiser limited wagon 4-door 2.4l(US $2,299.99)

2001 chrysler pt cruiser limited wagon 4-door 2.4l(US $2,299.99) 02 pt cruiser limited 1 owner clean carfax heated leather seats no reserve

02 pt cruiser limited 1 owner clean carfax heated leather seats no reserve 2009 pt cruiser, excellent condition, 57500 miles, new tires and brakes(US $7,000.00)

2009 pt cruiser, excellent condition, 57500 miles, new tires and brakes(US $7,000.00) 2003 chrysler pt cruiser touring wagon 4-door 2.4l

2003 chrysler pt cruiser touring wagon 4-door 2.4l 2006 chrysler pt cruiser limited wagon 4-door 2.4l(US $3,500.00)

2006 chrysler pt cruiser limited wagon 4-door 2.4l(US $3,500.00) 2001 chrysler pt cruiser base / limited edition gas 2.4 mt

2001 chrysler pt cruiser base / limited edition gas 2.4 mt

Auto Services in California

Z & H Autobody And Paint ★★★★★

Yanez RV ★★★★★

Yamaha Golf Cars Of Palm Spring ★★★★★

Wilma`s Collision Repair ★★★★★

Will`s Automotive ★★★★★

Will`s Auto Body Shop ★★★★★

Auto blog

Stellantis reports record margins, $7B profits despite chip shortage

Tue, Aug 3 2021MILAN — Automaker Stellantis on Tuesday said it achieved faster-than-expected progress on synergies and record margins in its first six months as a combined company, despite suffering 700,000 units in lower production due to interruptions in the semiconductor supply chain. The company — formed from French carmaker Peugeot PSAÂ’s takeover of the Italian-American company Fiat Chrysler — reported net profit of 5.9 billion euros ($7 billion) in the first half of 2021, compared with a loss 813 million euros during the same period a year earlier, which was impacted by the coronavirus restrictions around the globe. Shipments rose 44% to 3.2 million units, while revenues rose 46% to 75 billion euros. “We are very pleased with the speed with which the new team has begun to execute as one company, as Stellantis,Â’Â’ Chief Financial Officer Richard Palmer told reporters. Semiconductor shortages accounted for 200,000 units of production losses in the first quarter and 500,000 in the second quarter. Semiconductors are used more than ever before in new vehicles with electronic features such as Bluetooth connectivity and driver assist, navigation and hybrid electric systems. Stellantis achieved 1.3 billion euros in cost savings in the first half, mostly by sharing investments in new technologies and platforms, which Palmer said was a faster rate than initially forecast. It aims to achieve 80% of the targeted 5 billion in cost savings by 2024. “These synergies allow us to continue to invest in the electrification strategy, which we talk about every day,” Palmer said. Stellantis, which lags competitors in rolling out electric vehicles, plans to launch 21 fully electric or plug-in gas electric hybrid vehicles over the next two years. North American posted record profitability on global sales of Ram trucks and the strong launch of the Jeep Wrangler 4xe, which was the best-selling plug-in gas electric vehicle in the United States in the second quarter. Stellantis was the market leader in South America and second in Europe. The results were presented on a pro-forma basis, taking into account the performance of each of the carmakers as separate entities during 2020. Related video: 2021 Jeep Wrangler Rubicon 392 Inside and Out

Hellcat no help to Fiat-Chrysler's bottom-of-the-pile mpg average

Wed, Oct 15 2014What, you expected the "fastest muscle car ever" to help fleetwide fuel economy? Nope, don't think that's going to happen. That means Fiat Chrysler will likely to continue to languish at the bottom of the heap when it comes to fleetwide fuel economy among the largest automakers serving the US, especially as the automaker starts to sell its Dodge Challenger SRT Hellcat. A few hundred Fiat 500E electric vehicles aren't going to turn the trend around. See, Chrysler has once again finished at the bottom of the list when it came to fleetwide fuel economy among automakers for 2014 model-year vehicles, according to a preliminary study by the US Environmental Protection Agency. Chrysler and Fiat had an average of 21.1 miles per gallon. That substantially lagged the overall 24.2 mpg average, but it was an increase from the company's 20.9 mpg average last year and the 20.1 mpg average two years prior. For 2014, General Motors had the second-worst fleetwide fuel economy at an even 22 mpg. Fiat Chrysler does say it's working on improving its fuel economy, according to Automotive News. The company plans on making its inline-four-cylinder and V6 engines smaller, and will sell more vehicles with eight- and nine-speed transmissions. Heck, there's even a plug-in hybrid version of the Chrysler Town & Country minivan in the works for late 2015, and the company can tout fuel-efficiency gains with the Chrysler 200 and Jeep Cherokee. We would be remiss if we didn't note that, compared to its muscle-car forefathers, the Hellcat actually performs pretty well at the pump. Last month, word got out that the 2015 Challenger Hellcat, equipped either with a six-speed manual or an eight-speed automatic transmission, got a combined fuel economy of 16 mpg. Heck, the automatic-tranny version got 22 mpg on the highway. And that's for a car with 707 horsepower and a 10-second quarter-mile time. Still, with the pedal floored, the car can burn a gallon and a half of fuel per minute. Ouch.

More Ram trucks recalled over tailgate issue

Wed, May 29 2019Almost a year ago Fiat Chrysler recalled roughly 1.6 million Ram trucks over an issue with the locking power tailgate. The actuator limiter tab for the power locking mechanism could fracture, which would permit the actuator's lock-rod control to move beyond its limits. That would pull the locking rods open, thereby allowing the tailgate to open at any time. The 2018 recall covered Ram 1500, 2500, and 3500 pickups from the 2015 to 2017 model years, with the five-foot-seven and six-foot-four beds and the power locking tailgate option. Trucks with eight-foot beds, and those with manual-locking tailgates, were excluded. The trucks with eight-foot beds have been added to the recall as of earlier this month, putting 410,351 more trucks in the pool. According to Consumer Reports, Ram redesigned the locking assembly on the other two shorter bed sizes for trucks built after August 2, 2017, which was the end of the 2017 model year. But the eight-foot long-bed trucks didn't get the redesigned part until April 2, 2018 for some reason, making all eight-foot-bed pickups from the 2015 model year to April 1, 2018 part of the recall equation. FCA says it's not aware of any accidents or injuries because of the issue. The company plans to notify owners on June 28. The paperwork filed with the National Highway Traffic Safety Administration doesn't advise owners to stop driving the trucks, but nor does it instruct owners on how to address the problem in the meantime. Sounds like bungee cords might be the go. The fix is estimated to take 30 minutes at the dealer and entails removing the tailgate cover and installing a stop block to prevent the locking actuator's pivot arm from traveling too far. FCA says it will reimburse owners for any other repairs made to address the problem. Meanwhile, owners can contact Fiat Chrysler Automobiles customer service at 800-853-1403, and refer to FCA's number for this recall, V44. The NHTSA campaign number is 19V-347. Last year's recall comes under FCA number U74, and NHTSA campaign number 18V-486. Ram's not alone on this field. The NHTSA continues to investigate the 2017 Ford Super Duty pickups for a similar issue.