2dr Converti Convertible, 2.4l Cd 4 Cylinder Engine 5-speed M/t A/c Am/fm Stereo on 2040-cars

Huntsville, Alabama, United States

Engine:2.4L 2429CC 148Cu. In. l4 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Convertible

Fuel Type:GAS

Transmission:Automatic

Warranty: Unspecified

Make: Chrysler

Model: PT Cruiser

Options: CD Player

Trim: Base Convertible 2-Door

Power Options: Power Windows

Drive Type: FWD

Vehicle Inspection: Inspected (include details in your description)

Mileage: 11,722

Number of Doors: 2

Sub Model: 2dr Converti

Exterior Color: Silver

Number of Cylinders: 4

Interior Color: Gray

Chrysler PT Cruiser for Sale

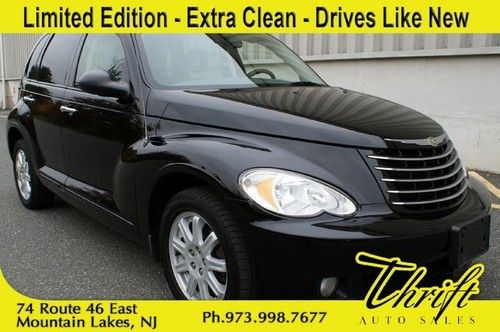

2006 chrysler pt cruiser 4-door 2.4 liter 4 cylinder automatic ((no reserve)) nr

2006 chrysler pt cruiser 4-door 2.4 liter 4 cylinder automatic ((no reserve)) nr 07 chrysler pt cruiser-loaded-extra clean-must see!-w/ warranty(US $6,995.00)

07 chrysler pt cruiser-loaded-extra clean-must see!-w/ warranty(US $6,995.00) 08 pt cruiser convertible, 2.4l 4 cylinder, auto, cloth, pwr equip, cruise,clean

08 pt cruiser convertible, 2.4l 4 cylinder, auto, cloth, pwr equip, cruise,clean Starts and runs automatic transmission repairable rebuildable damaged salvage

Starts and runs automatic transmission repairable rebuildable damaged salvage 2006 chrysler pt cruiser street series touring edition car~yellow sport~clean!!

2006 chrysler pt cruiser street series touring edition car~yellow sport~clean!! 2006 pt cruiser turbo convertable

2006 pt cruiser turbo convertable

Auto Services in Alabama

Tire City & Automotive Service ★★★★★

Tint Spectrum ★★★★★

Southern Armature Works Inc ★★★★★

Shorty`s Car Care ★★★★★

Pruitt Radiator & Auto Repair ★★★★★

Premier Truck Centers ★★★★★

Auto blog

Fiat Chrysler and Renault pursue $35-billion merger to combat car industry upheaval

Mon, May 27 2019MILAN/PARIS — Fiat Chrysler pitched a finely balanced merger of equals to Renault on Monday to tackle the costs of far-reaching technological and regulatory changes by creating the world's third-biggest automaker. If it goes ahead, the $35 billion-plus tie-up would alter the landscape for rivals including General Motors and Peugeot maker PSA Group, which recently held inconclusive talks with Fiat Chrysler (FCA), and could spur more deals. Renault said it was studying the proposal from Italian-American FCA with interest, and considered it friendly. Shares in both companies jumped more than 10 percent as investors welcomed the prospect of an enlarged business capable of producing more than 8.7 million vehicles a year and aiming for 5 billion euros ($5.6 billion) in annual savings. It would rank third in the global auto industry behind Japan's Toyota and Germany's Volkswagen. But analysts also warned of big complications, including Renault's existing alliance with Nissan, the French state's role as Renault's largest shareholder and potential opposition from politicians and workers to any cutbacks. "The market will be careful with these synergy numbers as much has been promised before and there isn't a single merger of equals that has ever succeeded in autos," Evercore ISI analyst Arndt Ellinghorst said. With these sensitivities in mind, FCA proposed an all-share merger under a listed Dutch holding company. After a 2.5 billion euro dividend for existing FCA shareholders - giving a big upfront boost to the Agnelli family that controls 29% of FCA - investors in each firm would hold half of the new entity. The merged group would be chaired by Agnelli family scion John Elkann, sources familiar with the talks told Reuters, while Renault chairman Jean-Dominique Senard would likely become CEO. Italian Deputy Prime Minister Matteo Salvini said the proposed merger could be good news for Italy if it helped FCA to grow, but it was crucial to preserve jobs. He did not comment on the French government's 15% stake in Renault, but an influential lawmaker from the ruling League party said Rome may seek a stake in the combined group to balance France's holding. A deal could also have profound repercussions for Renault's 20-year-old alliance with Nissan, already weakened by the crisis surrounding the arrest and ouster of former chairman Carlos Ghosn late last year. The Japanese carmaker has yet to comment on FCA's proposal.

Tier 1 suppliers call GM the worst OEM to work with

Mon, 12 May 2014Among automakers with a big US presence, General Motors is the worst to work for, according to a new survey from Tier 1 automotive suppliers, conducted by Planning Perspectives, Inc.

The Detroit-based manufacturer, which has been under fire following the ignition switch recall and its accompanying scandal, finished behind six other automakers with big US manufacturing operations. Suppliers had issues with trust and communications, as well as intellectual property protection. GM was also the least likely to allow suppliers to raise their prices in the face of unexpected increases in material cost, all of which contributed to 55 percent of suppliers saying their relationship with GM was "poor to very poor."

GM's cross-town competitors didn't fare much better. Chrysler finished in fifth place, ahead of GM and behind Dearborn-based Ford, which was passed for third place this year by Nissan. Toyota took the top marks, while Honda captured second place.

Marchionne recruiting activist investors to prompt GM merger

Tue, Jun 9 2015Sergio Marchionne may have been rebuffed in his previous advances at General Motors, but he's not about to give up that easily. According to The Wall Street Journal, the Fiat Chrysler chief is now turning to activist investors to help coax GM into joining forces. Marchionne has been a staunch and ceaseless advocate of the need for consolidation, arguing that the industry needs to amalgamate into larger groups that will share resources and reduce overhead. Under his leadership, the Fiat group consolidated its own operations, and officially merged with Chrysler last year. But he's also been pursuing additional mergers with the likes of Volkswagen, Peugeot, Ford, and Opel (to name just a few). Now he's pursuing a merger with GM, which has not shown much enthusiasm towards the idea. For one thing, GM is a much larger company, and probably doesn't need FCA as much as FCA needs it. For another, it has a troubled past with Marchionne, who in 2005 dissolved an agreed merger (of sorts) with GM, yet still managed to get the General to pay Fiat some $2 billion in the process. However, Marchionne is evidently hoping that the intervention of activist investors could compel GM CEO Mary Barra and company to proceed with a merger anyway. For precedent, he's looking at the recent negotiation between GM and some of its stakeholders that prompted the company to buy back $5 billion of its own shares, demonstrating Barra's willingness to deal with investors. The more compelling precedent, however, may have been set in 2006, when activist investor Kirk Kerkorian locked arms with Carlos Ghosn to get GM to consider joining the alliance between Renault and Nissan. GM ultimately declined, and Ghosn turned instead of Daimler (which of course has its own history of having merged with Chrysler). Only time will tell if this initiative will prove more successful, but one thing's for sure, and that's that Marchionne isn't about to relent in his pursuit of a major merger partner.