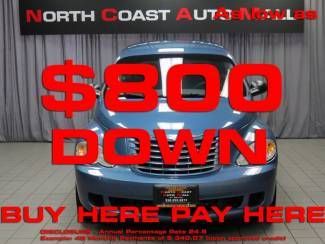

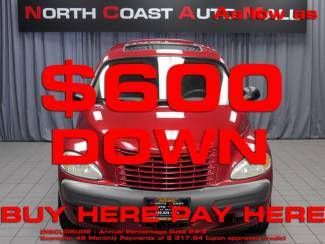

2002(02)pt Cruiser We Finance Bad Credit! Buy Here Pay Here Low Down $399 on 2040-cars

Bedford, Ohio, United States

Vehicle Title:Salvage

Engine:2.4L 2429CC 148Cu. In. l4 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Wagon

Fuel Type:GAS

Make: Chrysler

Warranty: Vehicle has an existing warranty

Model: PT Cruiser

Trim: Limited Wagon 4-Door

Power Options: Air Conditioning, Cruise Control, Power Windows

Drive Type: FWD

Doors: 4

Mileage: 116,737

Engine Description: 2.4L L4 SFI DOHC 16V

Sub Model: 4dr Wgn Limited

Exterior Color: Blue

Number of Cylinders: 4

Interior Color: Gray

Chrysler PT Cruiser for Sale

We finance 2001 chrysler pt cruiser auto clean carfax 2 owners pwrwndws kylssent(US $3,500.00)

We finance 2001 chrysler pt cruiser auto clean carfax 2 owners pwrwndws kylssent(US $3,500.00) 2005 chrysler pt cruiser convertible, ultra low 40k miles, 2nd california owner(US $8,750.00)

2005 chrysler pt cruiser convertible, ultra low 40k miles, 2nd california owner(US $8,750.00) 2007(07) chrysler pt cruiser we finance! clean! save big! drive now!(US $9,995.00)

2007(07) chrysler pt cruiser we finance! clean! save big! drive now!(US $9,995.00) 2001(01) chrysler pt cruiser clean! we finane! buy here pay here! save big now!!(US $8,995.00)

2001(01) chrysler pt cruiser clean! we finane! buy here pay here! save big now!!(US $8,995.00) Touring, alloy wheels, auto, nice starter car financing options are available!

Touring, alloy wheels, auto, nice starter car financing options are available! 2006 pt cruiser 4-door (c14612125)

2006 pt cruiser 4-door (c14612125)

Auto Services in Ohio

World Auto Parts ★★★★★

West Park Shell Auto Care ★★★★★

Waterloo Transmission ★★★★★

Walt`s Auto Inc ★★★★★

Transmission Engine Pros ★★★★★

Total Auto Glass ★★★★★

Auto blog

Bonhams to auction Carroll Shelby's prototypes and personal cars

Fri, Apr 6 2018Fans of Carroll Shelby will want to make their way to Greenwich, Conn., this June, because Bonhams will be selling a great many cars from the man's personal collection. And many of them are the first of their kind, marking important milestones in Shelby's career. One of those important cars is a 1982 Dodge Charger prototype, which might not look as impressive as a Cobra, but it was important in that it was the first car on which Shelby collaborated with Chrysler. That car led to the first Shelby Charger, as well as other special small Chryslers including the GLH Omnis and Chargers (GLH standing for "Goes Like Hell"). In fact, the first Charger GLH-S (Goes Like Hell S'more) is also part of this collection. There are even some prototypes up for auction that never resulted in a production car, such as a Shelby modified Dodge Ram. That one is probably our favorite: the gold ram hood ornament, the huge pentastar in the grille, the double-barrel truck horn on the roof. It's wonderful nonsense. Of course it isn't just Chryslers going up for sale. There are a couple of GT500 and GT350 Mustangs in the mix from a variety of years. Perhaps most interesting is the very first Shelby Series I, Shelby's ill-fated roadster designed from the ground-up by the Texan's company. Unlike the other early Series I models, Shelby's had a supercharger, which led to a supercharger option being offered later. You can check out the full list of cars below, and pictures of each one in the gallery at the top. The auction will happen on June 3, and every vehicle offered has no reserve, so they'll all be sold for whatever price is shown at the drop of the gavel. 1927 Ford Model T 1931 Ford Model A 1935 Chrysler Airflow Sedan 1955 DeSoto Hard Top 1966 Shelby GT350 Convertible 1967 Lincoln Continental Convertible 1968 Shelby GT350 1969 Shelby GT 500 previously owned by Jackie Cooper Jr. 1969 Shelby GT 500 1982 Shelby Charger Prototype 1983 De Tomaso Pantera 1983 Dodge/Shelby Pickup Concept 1987 DeTomaso GT5-S 1987 Dodge CSX Serial #1 1987 Shelby Charger GLH-S Serial #1 1987 Dodge Shelby Lancer Serial #1 1988 Dodge Shelby Dakota Prototype 1989 Dodge CSX VNT Serial #1 1965 Shelby Cobra 427 Continuation 1999 Shelby Series 1 Serial #1 2008 Shelby GT 500 KR 2011 Shelby GT 500 Super Snake Aurora Race Car Related Video: Featured Gallery Shelby Collection View 72 Photos Image Credit: Bonhams Chrysler Dodge Ford Auctions Performance Classics shelby

2018 Chrysler Pacifica Hybrid Long-Term Update | Nokian winter tires in a winter wonderland

Wed, Mar 27 2019Winter is technically over now, but the cold and snow are maintaining their grip here in Michigan. While much of the country is bouncing right along into a warm spring, we're happy to still be wearing our Nokian Hakkapeliitta winter tires on our long-term Chrysler Pacifica Hybrid. You can't count out another massive blizzard even into late April here. That said, we're hoping the worst is over, so it's time to take stock of how the winter tires performed on the front-wheel-drive minivan. Nokian produced the first winter tire ever in 1934, so one could say that they've had awhile to figure this out. The tire model we were provided for our van is the Hakkapeliitta R3 SUV. The Pacifica is obviously no SUV, but at almost 5,000 pounds it's perfect for this flavor of tire. Nokian says they're designed for high performance SUVs and are made with Aramid sidewalls to resist punctures or cuts. Chrysler fits the Pacifica Hybrid with all-season tires from the factory, but we were determined to make it a proper seven passenger sleigh. We got a fair amount of snow this year in Michigan, but I encountered the worst conditions on a road trip to Buffalo, N.Y. I was actually sort of hoping a lake-effect blizzard might present itself as a challenge, and my snow prayers were answered with authority. Inches of snow don't usually pile up on highways here easily with the amount of plows and salt typically employed, but it did in this storm. The Pacifica hardly flinched from the deep tracks of powder on the road. Near-whiteout conditions forced slow driving, but the Pacifica never felt like it was going to slip and slide out of its lane as I tracked around highway bends with increasing speed. Braking was impressive, as the tires managed to find grip in the snow that all-season tires just can't match. Thankfully, I never needed 100 percent lock in any emergency situations, but I tried it out in some empty parking lots to see how well it does at hauling everything to a stop. The Nokians performed admirably here, too. With ABS firing away, the winter rubber finds grip in places all-seasons would just slide on by. Starting wasn't much of an issue, either. We tested the tires in anything from dustings to snow that was about six inches deep and largely untouched by other vehicles. The front tires would scrabble for grip initially with greater throttle inputs in the deep stuff, but they'd hook and pull the van forward with authority after a quick second.

2017 Chrysler Pacifica scores near top on minivan mpg

Tue, Mar 8 2016The 2017 Chrysler Pacifica gets 28 miles per gallon fuel economy on the highway, 18 mpg city, and 22 mpg combined, according to the government's newly announced estimates. Those figures compare well to the 2016 Town & Country's EPA rating of 25 mpg highway, 17 mpg city, and 20 mpg combined. They also make the new minivan among the most efficient models in its class, although not quite the king. These fuel economy figures only apply to the 2017 Pacifica with the 3.6-liter V6, which makes 287 horsepower and 262 pound-feet of torque, and the nine-speed automatic. We will have to wait until the second half of the year to find out how the plug-in hybrid performs, but the brand believes at least 80 MPGe is possible. Chrysler also plans to make stop-start available later, which will increase real-world fuel numbers. Compared to the currently on-sale competitors, the 2017 Pacifica is among the top, but there are two clear rivals. The 2016 Honda Odyssey has EPA ratings of 28/19/22. Those figures match the Chrysler on the highway and combined, but beat it by one mpg in the city. The other challenger is the 2016 Nissan Quest at 27/20/23. The Nissan wins by two mpg in the city and one mpg combined, but the Pacifica wins by one on the highway. According to Fueleconomy.gov, the front-wheel drive Toyota Sienna and Kia Sedona match the Pacifica's 18 mpg city rating, but they can't beat its combined or highway numbers. Related Video: All-new Gasoline-powered 2017 Chrysler Pacifica Offers Unsurpassed Fuel Economy, Greener Ownership Experience 28-mpg highway unsurpassed in minivan segment; 12 percent better than model it replaces Combined-cycle rating of 22 mpg is 10 percent better Improved fuel efficiency contributes to nine-percent reduction in Global Warming Potential (GWP) All-new Pacifica's superior performance attributable to engineering enhancements, such as: Upgraded version of award-winning Pentastar V-6 TorqueFlite transmission; world's first minivan application of nine-speed automatic gearbox Best-in-class aerodynamics Aggressive weight-reduction strategies March 8, 2016 , Auburn Hills, Mich. - The all-new 2017 Chrysler Pacifica minivan has earned a highway-cycle fuel-economy rating of 28 miles per gallon (mpg) from the U.S. Environmental Protection Agency (EPA) – a benchmark unsurpassed by any minivan on the market. It is also 12 percent better than the vehicle Pacifica replaces.