Minnesota on 2040-cars

Ramsey , Minnesota, United States

This a nice car runs well lots of fun

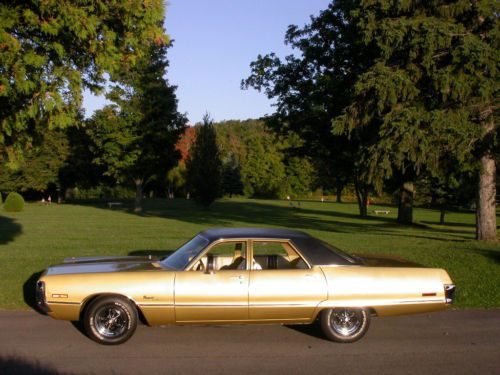

Chrysler Newport for Sale

Chrysler newport hardtop(US $2,000.00)

Chrysler newport hardtop(US $2,000.00) Chrysler newport windsor deluxe(US $2,000.00)

Chrysler newport windsor deluxe(US $2,000.00) 1974 chrysler newport. 23,000 original miles !(US $3,995.00)

1974 chrysler newport. 23,000 original miles !(US $3,995.00) 1973 chrysler newport base hardtop 2-door 6.6l

1973 chrysler newport base hardtop 2-door 6.6l Mopar muscle!

Mopar muscle! 1963 chrysler hardtop wagon(US $1,600.00)

1963 chrysler hardtop wagon(US $1,600.00)

Auto Services in Minnesota

Zimmerman Collision ★★★★★

South Central Auto Service ★★★★★

Sleepy Eye Auto Salvage ★★★★★

Sears Auto Center ★★★★★

Saigon Garage ★★★★★

Rose Car Care ★★★★★

Auto blog

Ralph Gilles responds to Dodge rumors, says brand is 'here to stay'

Fri, 12 Jul 2013This is why we love Ralph Gilles. While in Italy hanging out with a group of Viper Club members in Europe, the SRT boss took the time to respond to a question directed at him on Instagram in regards to the future of Dodge.

Recent reports have painted a bleak picture for Dodge, but Gilles defended Chrysler's full-line brand by stating that the rumors are, "all rumors, Dodge is here to stay! It may get more focused going forward but not killed!" The idea of a "more focused" Dodge brand could lend some credibility to reports that the Grand Caravan and Durango are on their way out, which would leave Dodge solely as a car, or car-based, automaker.

FCA names Mike Manley head of Ram brand

Tue, Oct 6 2015Sergio Marchionne seems to revel in shifting the numerous portfolios of the senior executives who work under him. Case in point: the latest round of hat-swapping announced by Fiat Chrysler Automobiles. Several appointments have been made at the top levels of the group, chief among them a new head of the Ram truck brand. That role will now fall to Mike Manley, who will also retain his responsibilities for the Jeep brand and as COO for the Asia-Pacific region. With his hands busy enough as it is, we'd imagine that much of the day-to-day will fall to Robert Hegbloom. He had Manley's new job until now – but will still remain head of the Ram brand for North America, where the bulk of its business is conducted. Along with the shift in leadership for the Ram brand, FCA also named Reid Bigland as head of fleet operations for North America. Bigland is also responsible for sales in the same region, and for the Alfa Romeo brand here as well. The company also named Tim Kuniskis to the Group Executive Council, charged with overseeing all the passenger-car brands in North America – including Dodge, Chrysler, and Fiat. While it was at it, FCA also named Al Gardner as head of network development for North America, and Jason Stoicevich as Bigland's deputy for US fleet and small-business sales. All these appointments take effect immediately. FCA US ANNOUNCES LEADERSHIP CHANGES October 5, 2015 , Auburn Hills, Mich. - FCA US today announced several leadership team moves in support of changes at the Fiat Chrysler Automobiles N.V. (FCA) Group Executive Council (GEC) level. The moves were made to ensure proper representation of all of FCA's major brands on the GEC, the highest management level decision making body within the FCA organization. Earlier today, the following moves were announced at the GEC level. - Mike Manley is appointed Head of Ram Brand. Manley will retain his current GEC responsibilities as APAC Chief Operating Officer and Head of Jeep Brand. - Reid Bigland is appointed Head of NAFTA Fleet. Bigland will continue his current GEC responsibility for NAFTA Sales & Alfa Romeo. - Timothy Kuniskis becomes a member of the GEC and assumes responsibility for NAFTA Passenger Car Brands, consisting of Dodge and SRT, Chrysler and FIAT. In addition, the following appointments were made to the North American leadership team. - Robert Hegbloom continues as Head of Ram Brand for North America, now reporting to Manley.

Fiat Chrysler, Peugeot announce merger as world's No. 4 carmaker

Thu, Oct 31 2019MILAN — Fiat Chrysler and France's PSA Peugeot said Thursday they have agreed to merge to create the world's fourth-largest automaker with enough scale to confront big shifts in the industry, including a race to develop electric cars and driverless technologies. Italian-American Fiat Chrysler brings with it a strong footprint in North America, where it makes at least two-thirds of its profits, while Peugeot is the No. 2 automaker in Europe. Both lag in China, however, despite the participation of Peugeot's Chinese shareholder, Dongfeng, and are playing catching up in developing electric vehicles. Fiat Chrysler shares were trading up 9% at 14 euros in Milan, while PSA Peugeot shares were down 3.2% to 22.84 euros. The 50-50 merger is expected to offer savings of 3.7 billion euros ($4 billion), which the automakers expect to achieve without any factory closures — a concern of unions in both France and Italy where the carmakers have more overlap. Fiat Chrysler's strongest brands are Jeep SUVs and Ram trucks and it is focusing on relaunching its premium and luxury brands, Alfa Romeo and Maserati, with a focus on hybrid engines. It still makes smaller cars under the Fiat marquee, mostly for the European and Latin American markets. PSA Peugeot makes mostly small, city-friendly cars, family sedans and SUVs under the nameplates of Peugeot, Citroen and Germany-based Opel, which it bought in 2017. That is where the companies can expect to have the most overlap. The new company would be worth $50 billion, with revenue of 170 billion euros ($189 billion). It would produce 8.7 million cars a year — still behind Toyota, Volkswagen and the Renault-Nissan alliance, which make over 10 million each. Once a merger is finalized, PSA Peugeot CEO Carlos Tavares will be chief executive of the new company, with Fiat Chrysler Chairman John Elkann becoming chairman. Fiat Chrysler CEO Mike Manley will have a senior executive role. "This convergence brings significant value to all the stakeholders and opens a bright future for the combined entity," Tavares said in a statement. Manley called it "an industry-changing combination," and noted the long history of cooperation with Peugeot in industrial vehicles in Europe. The 11-member board will be made up of five members from each company plus Tavares, who is locked in as CEO for five years.