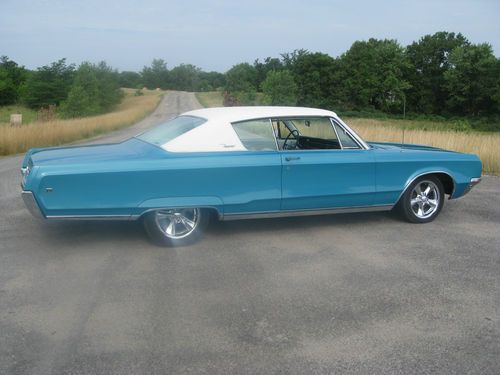

1968 Chrysler Newport Custom Hardtop 2-door Mopar Big Block on 2040-cars

Lawrence, Kansas, United States

Body Type:Hardtop

Engine:6.3L 383Cu. In. V8 GAS Naturally Aspirated

Vehicle Title:Clear

Fuel Type:GAS

For Sale By:Private Seller

Interior Color: WHITE/TURQUOISE

Make: Chrysler

Number of Cylinders: 8

Model: Newport

Trim: Custom Hardtop 2-Door

Warranty: Vehicle does NOT have an existing warranty

Drive Type: U/K

Mileage: 64,549

Exterior Color: light turquoise metallic

Chrysler Newport for Sale

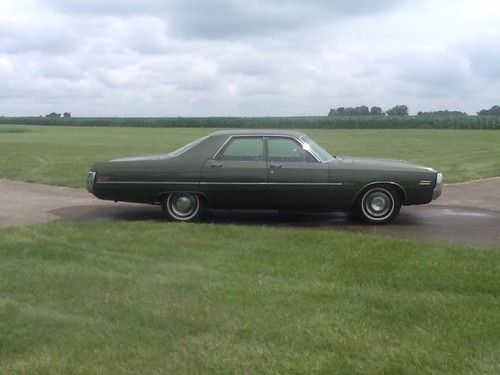

1971 chrysler newport royal 6.3l(US $5,500.00)

1971 chrysler newport royal 6.3l(US $5,500.00) 1962 chrysler newport, 4 door, all original, mopar, classic car, 383 big block

1962 chrysler newport, 4 door, all original, mopar, classic car, 383 big block 1965 chrysler newport base sedan 4-door 6.3l

1965 chrysler newport base sedan 4-door 6.3l 1978 chrysler newport has been in storage four years-private colletor-runs/drive(US $4,999.00)

1978 chrysler newport has been in storage four years-private colletor-runs/drive(US $4,999.00) 1962 chrysler newport(US $3,000.00)

1962 chrysler newport(US $3,000.00) 1977 chrysler newport with 56,100 original miles.(US $3,999.00)

1977 chrysler newport with 56,100 original miles.(US $3,999.00)

Auto Services in Kansas

X-Treme Automotive L.L.C. ★★★★★

Vilela Auto Body ★★★★★

Salazar Auto Repair ★★★★★

Roe Body Shop ★★★★★

Rich Industries Auto Parts ★★★★★

Ray`s Muffler & Auto Repair ★★★★★

Auto blog

Fiat Chrysler recalls 1.6M vehicles to fix Takata airbags

Fri, Jan 11 2019DETROIT — Fiat Chrysler is recalling more than 1.6 million vehicles worldwide to replace Takata front passenger airbag inflators that can be dangerous. Takata inflators can explode with too much force, hurling shrapnel into drivers and passengers. At least 23 people have died from the problem worldwide and hundreds injured. The recall covers the 2010 through 2016 Jeep Wrangler SUV, the 2010 Ram 3500 pickup and 4500/5500 Chassis Cab trucks, the 2010 and 2011 Dodge Dakota pickup, the 2010 through 2014 Dodge Challenger muscle car, the 2011 through 2015 Dodge Charger sedan, and the 2010 through 2015 Chrysler 300 sedan. It's part of the largest series of automotive recalls in U.S. history. About 10 million inflators are being recalled this year. Already Ford, Honda and Toyota have issued recalls in the latest round. Fiat Chrysler owners will be notified by letter and dealers will replace the inflators with safe ones. The company says it's not aware of any injuries in vehicles involved in this recall, but says it has plenty of replacement parts and is urging people to get the repairs done. "Recall service is free, we have replacement parts and dealers are ready to help," Mark Chernoby, FCA's head of safety for North America, said in a statement. The recall includes 1.4 million vehicles in the United States. Takata used the chemical ammonium nitrate to create a small explosion to inflate the airbags. But the chemical can deteriorate over time due to high humidity and cycles from hot temperatures to cold. The most dangerous inflators are in areas of the South along the Gulf of Mexico that have high humidity. The Fiat-Chrysler recall is part of a phased-in replacement of Takata inflators being managed by the National Highway Traffic Safety Administration. Owners can check to see if their vehicles have been recalled by going to airbagrecall.com and keying in license plate or vehicle identification numbers. More than three years after the U.S. National Highway Traffic Safety Administration took over management of recalls involving Takata inflators, one third of the recalled inflators have not been replaced, according to an annual report last year from the government and a court-appointed monitor. The report said 16.7 million faulty inflators out of 50 million under recall have yet to be fixed. Safety advocates say the completion rate should be far higher given the danger associated with the inflators.

Fiat to list on New York Stock Exchange?

Mon, 06 Jan 2014Citing the ever-nebulous "two sources close to Fiat," Reuters is reporting that the Italian automaker and owner of the Chrysler brand is likely to list itself on the New York Stock Exchange. The move could reportedly happen as soon as 2015, marking the end, at least in the minds of investors, of Fiat's 115-year base in Turin, Italy.

The Italian government is not likely to react favorably to Fiat's potential move from Italy to the United States, despite initially positive reactions to Fiat's landmark final purchase of Chrysler, the third-largest automaker in the US. Fiat spent $3.65 billion to buy out the 41.46-percent stake in Chrysler that had been owned by the United Auto Workers' VEBA trust fund.

With little sign of a swift European recovery, Fiat has little choice but to focus on markets outside its traditional home, and a listing in New York could potentially be a boon for investors. According to International Strategy and Investment analyst George Galliers, speaking to Reuters, "People [would be] more likely to think of the entity in the same context as they do Ford and GM" if it were listed on the NYSE.

Chrysler-Fiat quality chief out after another poor Consumer Reports showing

Tue, 28 Oct 2014Fiat Chrysler has announced a management change following the company's woeful performance in the latest Consumer Reports Annual Auto Reliability Survey. Of the 28 brands surveyed, FCA's marques occupied the five the seven lowest scores, while Dodge, Ram, Jeep and Fiat were the four lowest scorers.

Doug Betts, FCA's 51-year-old head of quality "left the company to pursue other interests," which, considering the aforementioned paragraph, means he was sacked. According to Automotive News, Betts joined Chrysler in 2007, defecting from Nissan, and, insiders report, had a somewhat tumultuous relationship with new boss Sergio Marchionne.

His replacement is the newly promoted Matthew Lidane (shown at inset), who was formerly VP of systems and components. Lidane has been at Chrysler since 1987 and was previously chief engineer of the Jeep product team as well as the vehicle line boss for the compact US wide platform which (ironically) underpins two of FCA's lowest scoring vehicles, the Dodge Dart and Jeep Cherokee.