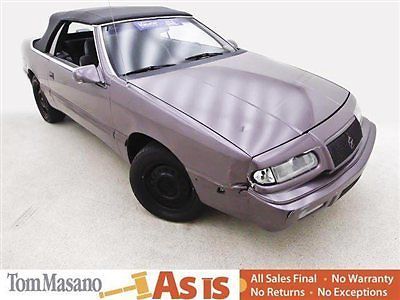

1995 Chrysler Lebaron Gtc Convertible (f9632b) ~ Absolute Sale ~ No Reserve ~ on 2040-cars

Reading, Pennsylvania, United States

Chrysler LeBaron for Sale

1989 chrsyler lebaron convertible turbo

1989 chrsyler lebaron convertible turbo 1978 lebaron 2 door coup(US $6,000.00)

1978 lebaron 2 door coup(US $6,000.00) 1988 chrysler lebaron ... low miles...convertible.. turbo

1988 chrysler lebaron ... low miles...convertible.. turbo 1995 chrysler lebaron gtc convertible 2-door 3.0l red carfax 1-owner 58203 miles(US $5,988.00)

1995 chrysler lebaron gtc convertible 2-door 3.0l red carfax 1-owner 58203 miles(US $5,988.00) 1985 chrysler lebaron(US $6,500.00)

1985 chrysler lebaron(US $6,500.00) 1988 chrysler lebaron premium convertible 2-door 2.2l

1988 chrysler lebaron premium convertible 2-door 2.2l

Auto Services in Pennsylvania

Walburn Auto Svc ★★★★★

Vans Auto Repair ★★★★★

United Automotive Service Center LLC ★★★★★

Tomsic Motor Co ★★★★★

Team One Auto Group ★★★★★

Suburban Collision Specs Inc ★★★★★

Auto blog

Analysts wary over FCA lawsuit but say emissions not as bad as VW

Wed, May 24 2017MILAN - Any potential fines Fiat Chrysler (FCA) may need to pay to settle a US civil lawsuit over diesel emissions will unlikely top $1 billion, analysts said, adding the case appeared less serious than at larger rival Volkswagen. The US government filed a civil lawsuit on Tuesday accusing FCA of illegally using software to bypass emission controls in 104,000 vehicles sold since 2014, which it said led to higher than allowable levels of nitrogen oxide (NOx) that are blamed for respiratory illnesses. FCA's shares dropped 16 percent in January when the U.S. Environmental Protection Agency (EPA) first raised the accusations, adding the carmaker could face a maximum fine of about $4.6 billion. The stock has been under pressure since. Volkswagen agreed to spend up to $25 billion in the United States to address claims from owners, environmental regulators, U.S. states and dealers. FCA, which sits on net debt of 5.1 billion euros ($5.70 billion), lacks VW's cash pile but analysts said its case looked much less severe. While VW admitted to intentionally cheating, Fiat Chrysler denies any wrongdoing. Authorities will have to prove that FCA's software constitutes a so-called "defeat device" and that it was fitted in the vehicles purposefully to bypass emission controls. Even if found guilty, the number of FCA vehicles targeted by the lawsuit is less than a fifth of those in the VW case. Applying calculations used in the German settlement, analysts estimate potential civil and criminal charges for Fiat Chrysler of around $800 million at most. Barclays has already cut its target price on the stock to take such a figure into account. Analysts also noted that FCA's vehicles are equipped with selective catalytic reduction (SCR) systems for cutting NOx emissions, so it is likely that any problem could be fixed through a software update. "Should this be the case, we estimate a total cost per vehicle of not more than around $100, i.e. around $10 million in aggregate," Evercore ISI analyst George Galliers said in a note. The estimates exclude any additional investments FCA may be asked to make in zero emissions vehicles infrastructure and awareness as was the case with VW. FCA said last week it would update the software in the vehicles in question, hoping it would alleviate the regulators' concern, but analysts said it may have been too little too late. The carmaker is also facing accusations over its diesel emissions in Europe.

Fiat and UAW back at negotiating table over Chrysler stake

Mon, 23 Dec 2013We knew there'd be no Chrysler IPO before the end of this year, but Fiat is determined to get the best run going into 2014 and is back at the poker table with the UAW. The delay was said to be Chrysler's desire to clean up a tax issue with the IRS; turns out that also bought the carmaker time to try and close a deal for the UAW's 48.5-percent stake in the company before the IPO happens.

Whereas the price Chrysler was willing to pay was once more than $1 billion under the UAW's asking price, the gap has closed to just $800 million of late. A recent valuation of the company at $10 billion - a valuation the UAW has disputed - means Fiat would be looking to pay about $4.2 billion instead of the $5 billion that the UAW seeks. But the UAW needs to hold out for the highest amount it can get because its pension obligations through the Voluntary Employee Benefit Association (VEBA) are $3.1 billion greater than the VEBA's assets, which include the Chrysler stake.

There's a clause in the agreement that Fiat can buy the VEBA shares for $6 billion, but Fiat CEO Sergio Marchionne has said that the UAW "should buy a ticket for the lottery" if they even want $5 billion. The UAW, though, has more time to wait; it's Fiat that wants access to Chrysler's $11.9-billion war chest and that would like to avoid the risk of paying the full $6 billion for the UAW share if the float really takes off. With other valuations of Chrysler as high as $19 billion, a hot IPO could make that $6 billion look like a bargain.

Pair of 1970 Plymouth Superbird barn finds hits eBay

Fri, Sep 21 2018Here are a couple noteworthy barn finds for sale right now on eBay: a pair of 1970 Plymouth Superbird muscle cars, found with their giant rear wings, retractable headlights and 440 Super Commando V8s apparently perfectly intact after being stored for decades in a garage in Maine, with their condition reportedly "very good for 40 years of dry storage." In his lengthy writeup, the seller notes the short-lived, modified Road Runner is "One of the most collectible muscle cars with one of the most incredible automotive Aerodynamic (sic) designs in automotive history." The Superbird, which saw only one production year, is approaching its 50th anniversary, with their values expected to soar, he notes. The seller explains that he learned about the Superbirds after he purchased his own blue Superbird from the Owls Head Transportation Museum auction in Maine in August for $187,000. "Just after I won the blue 1970 Super Bird with white bucket seat interior a man approached me and sat down next to me and stated he has 2 Super Birds in storage that he has owned for the last 40 years," he wrote on his listing. "He told me he purchased them from the original owners." One was B5 blue with white bucket seats, just like the one he'd just purchased. The other was Alpine White with black bucket seats. According to the back story, both cars were originally sold off the lot in 1970 at Blouin Chrysler Plymouth Dodge in Augusta, Maine, and the man who'd been keeping them in his garage said he knew both of the original owners, having purchased both cars from them around 1978. The man, who is reportedly a Mopar expert, kept them both registered until 1985 and 1987, with the registration stickers still intact on the windshields, then prepared both for storage, putting straight antifreeze in the motors and filling the cylinders with lubricating oil. Both cars are currently being stored in a garage in Massachusetts. The Alpine White Superbird has 42,497 miles on it. The highest of 84 bids as of this writing was $135,000. The blue version has just 27,416 miles on the odometer, with the highest of 93 bids at $151,100. Both were updated with Pioneer cassette decks that the seller says "are classics in themselves." The seller also notes he hasn't tried to get either car started but that both motors turn freely and that the head and taillights all work. Bidding ends Sept. 27.