1992 Chrysler Lebaron Base Convertible 2-door 3.0l on 2040-cars

Millville, New Jersey, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:3.0L 2972CC 181Cu. In. V6 GAS SOHC Naturally Aspirated

Fuel Type:GAS

For Sale By:Private Seller

Make: Chrysler

Model: LeBaron

Trim: Base Convertible 2-Door

Options: Leather Seats, CD Player, Convertible

Safety Features: Driver Airbag

Drive Type: FWD

Power Options: Air Conditioning, Cruise Control, Power Windows

Exterior Color: White

Interior Color: White&red

Number of Cylinders: 6

Mileage: 57,000

new paint i have a new top for it four wheel disc low mile must sell run great new chrysler transmission custom wheels,, fairly new tires

Chrysler LeBaron for Sale

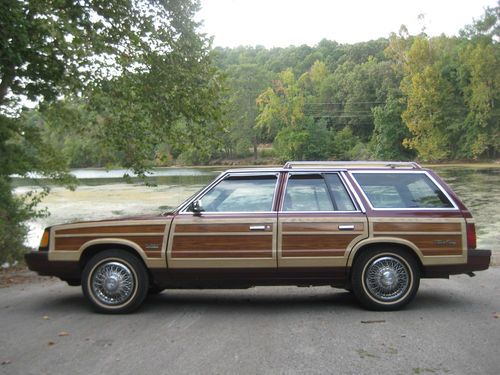

1987 chrysler lebaron town and country 2.2l turbo station wagon, 85k

1987 chrysler lebaron town and country 2.2l turbo station wagon, 85k

Classic woody 1984 chrysler lebaron turbo convertible (town and country)

Classic woody 1984 chrysler lebaron turbo convertible (town and country) 1995 chrysler lebaron gtc red convertible car, drives decent, ac, power windows

1995 chrysler lebaron gtc red convertible car, drives decent, ac, power windows 1995 chrysler lebaron gtc convertible 2-door 3.0l low miles very clean car(US $3,200.00)

1995 chrysler lebaron gtc convertible 2-door 3.0l low miles very clean car(US $3,200.00) 1980 chrysler lebaron salon coupe 2-door 5.2l(US $3,500.00)

1980 chrysler lebaron salon coupe 2-door 5.2l(US $3,500.00)

Auto Services in New Jersey

Young Volkswagen Mazda ★★★★★

Wrenchtech Auto ★★★★★

Ultimate Collision Inc ★★★★★

Tang`s Auto Parts ★★★★★

Superior Care Auto Center ★★★★★

Sunoco ★★★★★

Auto blog

4 ways FCA-PSA merger could be a plus

Thu, Oct 31 2019DETROIT — In a merger deal announced overnight, Fiat Chrysler stands to gain electric vehicle technology while PSA Peugeot Citroen could benefit from a badly needed dealership network to reach its goal of selling vehicles in the U.S. The merger would create the world's fourth-largest automaker with a combined market value of around $50 billion. Neither company would comment. Experts say the two automakers will be able to share car, SUV and commercial vehicle designs, helping each other fill weaknesses and share costs that will make them a strong global player. "We view the combination of these two companies as reasonable given global competition, high capital intensity, and industry disruption from electrified powertrain as well as autonomous technologies," Morningstar analyst Richard Hilgert wrote in a note to investors. Here are four areas that could be crucial to the two automakers' success: Technology For years, Fiat Chrysler has lagged its rivals in electric vehicle technology, with its former CEO once trying to discourage people from buying its only fully electric car in the United States, the Fiat 500E, because he lost money on each sale. The company has made progress on gas-electric hybrids and may have plans for more fully electric vehicles, but PSA has valuable technology that FCA can use, said Navigant Research analyst Sam Abuelsamid. Peugeot was relatively late to the electric vehicle game but is now working fast to catch up, notably with fellow French rival Renault. CEO Carlos Tavares has made a point of stressing the company's need to adapt to changing technology at car shows and earnings calls. Last year he announced plans to offer 40 electric models across its lineup by 2025. "Electrification hasn't been a huge part of their play up until now," Abuelsamid said. "Between the two of them, I think they could generate some scale for whatever they're doing, sharing component costs, development costs across electrical platforms," he said. More electric vehicles also would help FCA meet pollution and fuel economy regulations in Europe. As far as autonomous vehicles, neither company is among the leaders, Abuelsamid said. But that's a technology that's years into the future, giving them time to share the huge expenses and catch up together. FCA also has alliances with other companies such as Google spinoff Waymo that could bring autonomous vehicle technology to the market when ready, Abuelsamid said.

Google car boss: Deal with FCA is just 100 minivans

Fri, May 20 2016Google and FCA are working together to develop 100 self-driving minivans, but for now, that's it. So says Google car czar John Krafcik. Google is still talking to other automakers about partnerships, Reuters reports. "This is just FCA and Google building 100 cars together," Krafcik told the wire service at an energy conference in Washington. The companies won't expand the project to building an autonomous car, and Google isn't sharing proprietary technology with FCA. The co-developed vehicles won't be for sale, Reuters said. FCA CEO Sergio Marchionne has also reportedly said the deal isn't exclusive. FCA and Google announced their landmark partnership earlier this month to make 100 Chrysler Pacifica hybrid minivans with self-driving technology. The deal was hailed as a major step in advancing the technology and bridging the gap between traditional automakers and Silicon Valley. "Teaming up with Google helps put FCA in a stronger position to compete when it comes to autonomous car research and development, though significant effort remains to introduce this technology into FCA production vehicles," IHS analyst Colin Bird wrote in a research note. Related Video: Featured Gallery 2017 Chrysler Pacifica Hybrid View 56 Photos Green Chrysler Minivan/Van Autonomous Vehicles chrysler pacifica fca us chrysler pacifica hybrid

Fiat Chrysler profit up as it closes in on retiring its debt

Thu, Apr 26 2018MILAN — Fiat Chrysler Automobiles reduced its debt by more than expected in the first quarter, putting the carmaker well on course to become cash positive later this year. Chief Executive Sergio Marchionne expects to cancel all debt during 2018 — possibly by the end of June — and generate around 4 billion euros ($5 billion) in net cash by the end of the year. Marchionne has said that forecast does not include any one-off measures, nor the impact of the planned spinoff of parts maker Magneti Marelli, which he hopes to execute by early 2019. The world's seventh-largest carmaker said on Thursday net debt had fallen to 1.3 billion euros ($1.6 billion) by the end of March, well below a consensus forecast of 2.6 billion euros in a Thomson Reuters poll of analysts. FCA said capital spending fell 900 million euros in the quarter due to "program timing," which analysts said implied higher investments for the rest of the year. The Italian-American group said first-quarter operating profit rose 5 percent to 1.61 billion euros, below a consensus forecast of 1.74 billion, as a weaker performance from its North American profit center weighed. Shipments there were higher due to the new Jeep Wrangler and Compass models. But currency moves hit revenues and earnings, and costs related to new product launches added to the pressure. FCA's shift to sell more trucks and SUVs boosted margins yet again in North America to 7.4 percent from 7.3 percent in the same quarter a year ago, although they were down from the 8 percent recorded in the preceding three months. Marchionne, preparing to hand over to an internal successor next year, is close to his goal of ending a margin gap with larger U.S. rivals General Motors and Ford. The 65-year-old has said becoming debt free and being able to compete on a par with U.S. peers would mean FCA no longer needed a partner to survive and could well succeed on its own. The CEO has previously said tying up with another carmaker would help to meet the huge costs in an industry investing in electric vehicles and automated driving. FCA shares fell immediately after the results, but recovered to trade up 3 percent at 19.71 euros by 1150 GMT, outperforming a 0.4 percent rise in Europe's blue-chip stock index. ($1 = 0.8214 euros) Reporting by Agnieszka FlakRelated Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.