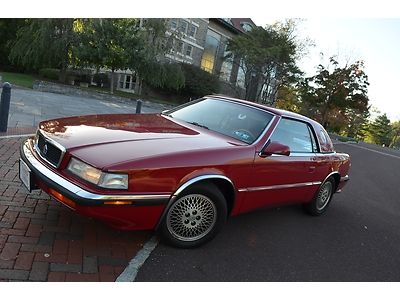

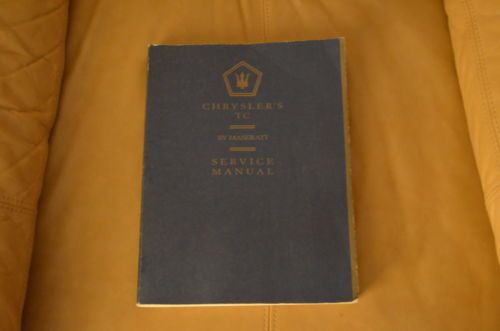

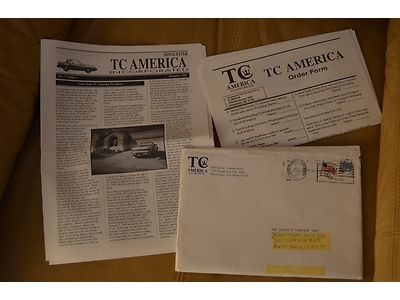

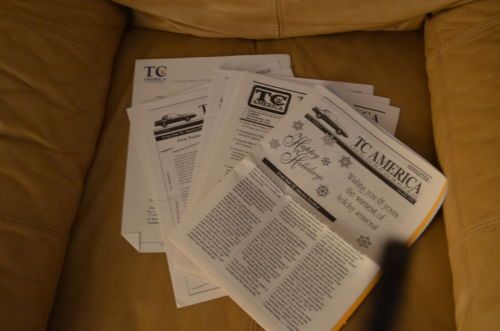

1989 Chrysler Tc Maserati Turbo 1 Owner Service Records, Top In Perfect Shape on 2040-cars

Philadelphia, Pennsylvania, United States

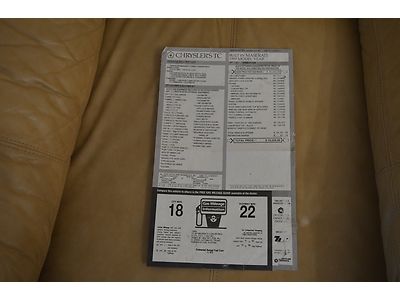

Body Type:Coupe

Engine:2.5L 2507CC 153Cu. In. l4 GAS SOHC Turbocharged

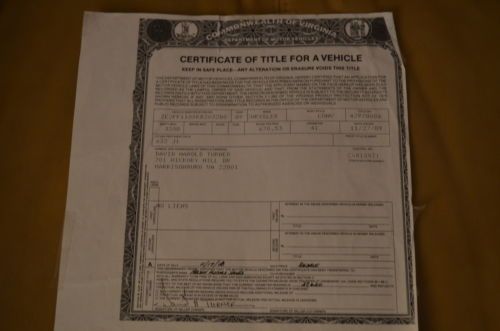

Vehicle Title:Clear

Fuel Type:GAS

For Sale By:Dealer

Number of Cylinders: 4

Make: Chrysler

Model: LeBaron

Trim: GTC Coupe 2-Door

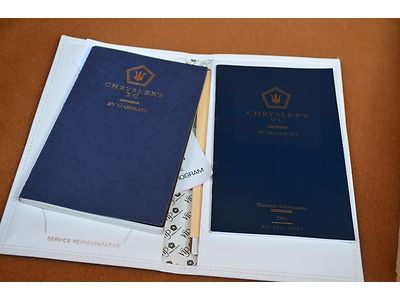

Warranty: Unspecified

Drive Type: FWD

Options: Leather Seats

Mileage: 38,725

Power Options: Power Locks

Sub Model: MASERATI TC

Exterior Color: Red

Interior Color: Tan

Chrysler LeBaron for Sale

Auto Services in Pennsylvania

Wyoming Valley Kia - New & Used Cars ★★★★★

Thomas Honda of Johnstown ★★★★★

Suder`s Automotive ★★★★★

Stehm`s Auto Repair ★★★★★

Stash Tire & Auto Service ★★★★★

Select Exhaust Inc ★★★★★

Auto blog

Treasury says auto bailout tally drops to $20.3 billion

Tue, 12 Feb 2013In December, the US Treasury announced that it was going to sell all of its shares in General Motors within 12 to 15 months. The first tranche of the 500-million total shares was purchased by GM, which took 200 million of them at $27.50 per share. That price represents an eight-percent premium over the market price at the time. The remaining 300 million shares will be sold "through various means in an orderly fashion."

Of the $418 billion disbursed through the Troubled Asset Relief Program (TARP), a report in Automotive News indicates that "about 93 percent" has been paid back, and the latest figures put Treasury's loss from the program overall at $55.58 billion. That's a $4.1 billion improvement on the last figure, when the expected red ink added up to $59.68 billion. The auto industry's portion of that loss is estimated to be $20.3 billion, a 16-percent drop from the earlier estimate of $24.3 billion.

The Treasury now owns 19 percent of GM, but if all goes well, there will be no more cause for anyone to utter "Government Motors" by the end of Q1 next year. A loss of some kind is still expected, however. Although GM's stock price is close to $29 at the time of this writing, that's still $4 below its IPO price and well below the $72 share price necessary for the government to come out even on its GM investment. On second thought, maybe the ribbing will continue.

Why the Detroit Three should merge their engine operations

Tue, Dec 22 2015GM and FCA should consider a smaller merger that could still save them billions of dollars, and maybe lure Ford into the deal. Fiat-Chrysler CEO Sergio Marchionne would love to see his company merge with General Motors. But GM's board of directors essentially told him to go pound sand. So now what? The boardroom battle started when Mr. Marchionne published a study called Confessions of a Capital Junkie. In it, Sergio detailed the amount of capital the auto industry wastes every year with duplicate investments. And he documented how other industries provide superior returns. He's right, of course. Other industries earn much better returns on their invested capital. And there's a danger that one day the investors will turn their backs on the auto industry and look to other business sectors where they can make more money. But even with powerful arguments Marchionne couldn't convince GM to take over FCA. And while that fight may now be over, GM and FCA should consider a smaller merger that could still save them billions of dollars, and maybe lure Ford into the deal. No doubt this suggestion will send purists into convulsions, but so be it. The Detroit Three should seriously consider merging their powertrain operations, even though that's a sacrilege in an industry that still considers the engine the "heart" of the car. These automakers have built up considerable brand equity in some of their engines. But the vast majority of American car buyers could not tell you what kind of engine they have under the hood. More importantly, most car buyers really don't care what kind of engine or transmission they have as long as it's reliable, durable, and efficient. Combining that production would give the Detroit Three the kind of scale that no one else could match. There are exceptions, of course. Hardcore enthusiasts care deeply about the powertrains in their cars. So do most diesel, plug-in, and hybrid owners. But all of them account for maybe 15 percent of the car-buying public. So that means about 85 percent of car buyers don't care where their engine and transmission came from, just as they don't know or care who supplied the steel, who made the headlamps, or who delivered the seats on a just-in-time basis. It's immaterial to them. And that presents the automakers with an opportunity to achieve a staggering level of manufacturing scale. In the NAFTA market alone, GM, Ford, and FCA will build nearly nine million engines and nine million transmissions this year.

Fiat Chrysler CEO says final merger talks with Peugeot going well

Thu, Jan 23 2020BRUSSELS — Fiat Chrysler's chief executive Michael Manley said on Wednesday that merger talks with Peugeot owner PSA to create the world's No. 4 carmaker are progressing well and he hopes to have a deal within 12-14 months. Speaking to Reuters on the sidelines of an industry meeting, he said he doesn't expect any major obstacles that could delay a final agreement. "Talks are progressing really well," Manley said about negotiations with the French carmaker ahead of a briefing by the European automotive association (ACEA), of which he is president. His comments come a month after the two carmakers agreed to a binding deal worth about $50 billion to combine forces in response to a slowdown in global demand and mounting costs of making cleaner vehicles amid tighter emissions regulations. Manley's timeline for completing the deal by early 2021 is in line with a forecast made by the companies in December. Fiat and Peugeot are now getting into the details of how the merger will work, including choosing which vehicle platforms — the technological underpinnings of a vehicle — will fit which products in a combined company. Because customers in different locations still prefer vastly different cars, there is room for multiple platforms in a combined group, Manley said. "That global platform is an elusive beast," he added. "This concept of a massive global platform in my mind is almost a myth, but that doesnÂ’t mean to say weÂ’re not going to recruit significant volume." Related Video:  Â

1994 chrysler lebaron lx convertable no rust runs well transmision problem

1994 chrysler lebaron lx convertable no rust runs well transmision problem 1986 chrylser lebaron lacrosse convertible

1986 chrylser lebaron lacrosse convertible 1992 cheysler lebaron, convertible, 70k original miles, clean title,clean carfax

1992 cheysler lebaron, convertible, 70k original miles, clean title,clean carfax

Collectors spectacular 1986 chysler lebaron turbo only 18k original miles mint

Collectors spectacular 1986 chysler lebaron turbo only 18k original miles mint