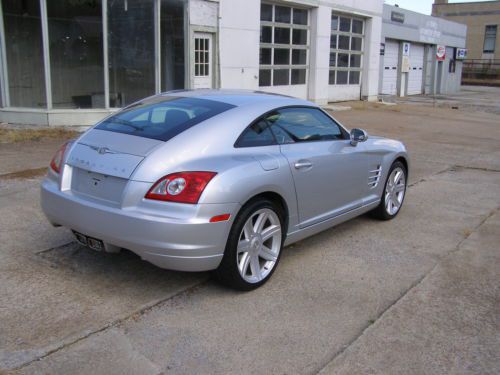

2007 Chrysler Crossfire Limited Coupe 2-door 3.2l on 2040-cars

Dickson, Tennessee, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:3.2L 3200CC 195Cu. In. V6 GAS SOHC Naturally Aspirated

Fuel Type:GAS

For Sale By:Dealer

Used

Year: 2007

Make: Chrysler

Model: Crossfire

Trim: Limited Coupe 2-Door

Options: Cassette Player, CD Player

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Drive Type: RWD

Power Options: Air Conditioning, Cruise Control, Power Locks

Mileage: 72,482

Exterior Color: Silver

Interior Color: Red

Warranty: Vehicle does NOT have an existing warranty

Number of Cylinders: 6

|

This is one of nicest examples of a true collectable vehicles of todays production. This vehicle was built by Chrysler Cooperation when it was owned by Mercedes Benz. It is a Mercedes through and through. Every part on it has the Mercedes Star. Complete drive train is Mercedes. Just a Mercedes with a Chrysler appearance. One day in the future, this will become very collectable as on of the only cars produced by Mercedes for Chrysler . This is a Texas car!! Never seen SALT. Very clean chassis and absolutely no oxidation on the aluminum parts. Clean carfax. Never painted on. Always garaged. This is the type vehicle to buy if you are going to keep it for an investment. Transportation from Nashville Tennessee to where you live will be app. fifty cents per mile. |

Chrysler Crossfire for Sale

2005 chrysler crossfire limited convertible 2-door 3.2l

2005 chrysler crossfire limited convertible 2-door 3.2l 2004 chrysler crossfire 3.2l manual, stick, black, mercedes, bmw, audi, coupe

2004 chrysler crossfire 3.2l manual, stick, black, mercedes, bmw, audi, coupe 2005 chrysler crossfire limited convertible 2-door 3.2l

2005 chrysler crossfire limited convertible 2-door 3.2l No reserve hi bid wins 2owner convertible roadster leather serviced rust free fl

No reserve hi bid wins 2owner convertible roadster leather serviced rust free fl 2005 chrysler crossfire for sale

2005 chrysler crossfire for sale 2004 chrysler low miles non smoker 1 owner fl niada certified(US $12,900.00)

2004 chrysler low miles non smoker 1 owner fl niada certified(US $12,900.00)

Auto Services in Tennessee

Sunset Towing ★★★★★

Solar Pros Window Tinting ★★★★★

Rod`s Tire Company ★★★★★

Rocky Top Chrysler Jeep Dodge Ram ★★★★★

RCS Automotive ★★★★★

Raleigh Tire Service Inc ★★★★★

Auto blog

Fiat Chrysler, Waymo expand partnership for Level 4 self-driving

Wed, Jul 22 2020Fiat Chrysler and Waymo, the self-driving unit of Google parent Alphabet Co., are expanding their partnership in an ambitious plan to develop fully autonomous commercial delivery vehicles and integrate Level 4 autonomous technology across the FCA fleet, the two companies said Wednesday. The agreement makes FCA (soon to be dubbed Stellantis when the PSA merger is complete) the exclusive partner for Waymo to develop and test self-driving Class 1-3 light commercial delivery vehicles. Initial efforts will focus on integrating the Waymo Driver system into the Ram ProMaster cargo van for commercial fleets, including Waymo Via, which have seen demand for home delivery services mushroom during the coronavirus pandemic. Conversely, FCA has tapped Waymo as its exclusive supplier for Level 4 self-driving technology across its vehicle fleet, opening up possibilities for ride-hailing and personal-use vehicles. An FCA spokesman would not commit to any timelines for integrating Waymo’s self-driving technology into the ProMaster or other brands or models. The Society of Automotive Engineers defines Level 4 systems as fully automated driving, though a human driver can manually override and take control of the wheel. There are currently no Level 4 autonomous vehicles offered to customers, and most experts believe the technology still faces many obstacles to broad adoption and regulatory clearance. Fiat Chrysler first partnered with Waymo in 2016. The two companies have worked to test WaymoÂ’s Level 4 technology using retrofitted Chrysler Pacifica Hybrid minivans. “Our now four-year partnership with Waymo continues to break new ground,” Mike Manley, Fiat ChryslerÂ’s CEO, said in a statement. “Incorporating the Waymo Driver, the worldÂ’s leading self-driving technology, into our Pacifica minivans, we became the only partnership actually deploying fully autonomous technology in the real world, on public roads.” Waymo recently introduced its fifth generation of the Waymo Driver system, which it completely redesigned to be able to handle more environments and situations. It combines 360-degree lidar sensors positioned atop the vehicle and at four points around the sides, plus cameras and radars. Waymo said it had already manufactured the new sensors and integrated them onto Jaguar I-Pace test vehicles.

Chrysler will debut a fully electric Pacifica at CES

Sun, Dec 11 2016Fiat Chrysler Automotive will debut a fully electric version of its Pacifica minivan at CES, according to a report from Bloomberg citing "people familiar with the plans." There's already a plug-in hybrid Pacifica model with a battery large enough to allow for an all-electric range of 30 miles. It's unclear if it's this electric version of FCA's minivan that will be the basis of the self-driving vehicle the automaker will provide to Google. Bloomberg's report also suggests that FCA has an electric vehicle in the works for the Maserati brand. This Tesla-fighting vehicle has been rumored for some time, with previous reports pointing for a debut in 2020. In other words, we don't expect to see an electric Maserati at CES, but we'd love to be surprised. And we'll know soon enough – CES starts in less than month. Stay tuned. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Stellantis teases mystery electric Chrysler concept

Thu, Jul 8 2021Today's Stellantis "EV Day" information dump was littered with hints and teasers, but one of the most mysterious is this Chrysler EV that was rolled out during the company's discussion of its new vehicle architecture strategy. We know virtually nothing about the concept apart from the fact that it's clearly electrified (duh, EV Day) and appears to have a fairly production-friendly interior; there are even visible panel gaps on the dash and center console, which would be indicative of more than just a simple rendering based on a hypothetical future product. The screens on the dash and seatbacks would be generous for a mainstream product in today's market, but for a future premium EV? Looks the part. Sitting somewhere between a four-door sedan and the "c" word, the silhouette gives us some Polestar 2 vibes. If it's to be built, we expect it will be marketed as more SUV than sedan, which would mean an all-wheel drive option is pretty much guaranteed. Stellantis hinted that it is based on its new STLA Large EV platform, which will offer battery capacities between 101 and 118 kWh and up to 500 miles of range. We've reached out to Chrysler for more information, but we expect they won't have much for us until they're ready to make a formal announcement. Stay tuned. Stellantis EV Day coverage: Dodge will launch the 'world's first electric muscle car' in 2024 Fully electric Ram 1500 will begin production in 2024 Jeep will have 4xe plug-in hybrid models across the lineup by 2025 Stellantis teases mystery electric Chrysler concept Stellantis previews 4 electric platforms: Here's how they'll be used Fiat says all Abarth models to be electric from 2024 Opel Manta E will be the electric revival of the classic German coupe Stellantis says its 2021 performance has been better than expected  Â

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.047 s, 7972 u