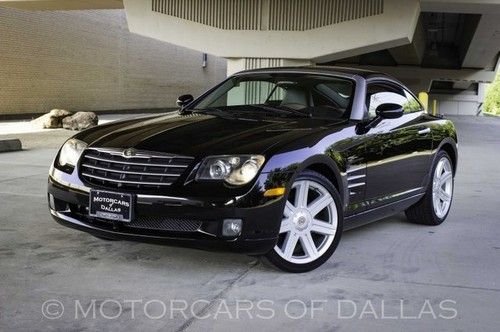

2006 Chrysler Crossfire 5~speed Cd Player Low Miles 2~owners Cali Car on 2040-cars

Mundelein, Illinois, United States

For Sale By:Dealer

Engine:3.2L 3200CC 195Cu. In. V6 GAS SOHC Naturally Aspirated

Body Type:Coupe

Transmission:Manual

Fuel Type:GAS

Make: Chrysler

Model: Crossfire

Disability Equipped: No

Trim: Base Coupe 2-Door

Doors: 2

Cab Type: Other

Drive Type: RWD

Drivetrain: Rear Wheel Drive

Mileage: 51,292

Number of Doors: 2

Exterior Color: Black

Interior Color: Gray

Number of Cylinders: 6

Chrysler Crossfire for Sale

2005 chrysler crossfire limited convertible

2005 chrysler crossfire limited convertible 06 limited heated leather low miles excellent condition rare find 07 08

06 limited heated leather low miles excellent condition rare find 07 08 2005 chrysler crossfire 6-speed cruise control only 58k texas direct auto(US $10,980.00)

2005 chrysler crossfire 6-speed cruise control only 58k texas direct auto(US $10,980.00) 2004 chrysler crossfire limited coupe 2-door 3.2l sapphire blue 6 spd low miles!(US $7,850.00)

2004 chrysler crossfire limited coupe 2-door 3.2l sapphire blue 6 spd low miles!(US $7,850.00) 2007 chrysler crossfire limited manual heated seats homelink active spoiler

2007 chrysler crossfire limited manual heated seats homelink active spoiler 2004 chrysler crossfire base coupe 2-door 3.2l(US $15,000.00)

2004 chrysler crossfire base coupe 2-door 3.2l(US $15,000.00)

Auto Services in Illinois

Yukikaze Auto Inc ★★★★★

Woodworth Automotive ★★★★★

Vogler Ford Collision Center ★★★★★

Ultimate Exhaust ★★★★★

Twin Automotive & Transmission ★★★★★

Trac Automotive ★★★★★

Auto blog

Fiat Chrysler, Peugeot announce merger as world's No. 4 carmaker

Thu, Oct 31 2019MILAN — Fiat Chrysler and France's PSA Peugeot said Thursday they have agreed to merge to create the world's fourth-largest automaker with enough scale to confront big shifts in the industry, including a race to develop electric cars and driverless technologies. Italian-American Fiat Chrysler brings with it a strong footprint in North America, where it makes at least two-thirds of its profits, while Peugeot is the No. 2 automaker in Europe. Both lag in China, however, despite the participation of Peugeot's Chinese shareholder, Dongfeng, and are playing catching up in developing electric vehicles. Fiat Chrysler shares were trading up 9% at 14 euros in Milan, while PSA Peugeot shares were down 3.2% to 22.84 euros. The 50-50 merger is expected to offer savings of 3.7 billion euros ($4 billion), which the automakers expect to achieve without any factory closures — a concern of unions in both France and Italy where the carmakers have more overlap. Fiat Chrysler's strongest brands are Jeep SUVs and Ram trucks and it is focusing on relaunching its premium and luxury brands, Alfa Romeo and Maserati, with a focus on hybrid engines. It still makes smaller cars under the Fiat marquee, mostly for the European and Latin American markets. PSA Peugeot makes mostly small, city-friendly cars, family sedans and SUVs under the nameplates of Peugeot, Citroen and Germany-based Opel, which it bought in 2017. That is where the companies can expect to have the most overlap. The new company would be worth $50 billion, with revenue of 170 billion euros ($189 billion). It would produce 8.7 million cars a year — still behind Toyota, Volkswagen and the Renault-Nissan alliance, which make over 10 million each. Once a merger is finalized, PSA Peugeot CEO Carlos Tavares will be chief executive of the new company, with Fiat Chrysler Chairman John Elkann becoming chairman. Fiat Chrysler CEO Mike Manley will have a senior executive role. "This convergence brings significant value to all the stakeholders and opens a bright future for the combined entity," Tavares said in a statement. Manley called it "an industry-changing combination," and noted the long history of cooperation with Peugeot in industrial vehicles in Europe. The 11-member board will be made up of five members from each company plus Tavares, who is locked in as CEO for five years.

Rising aluminum costs cut into Ford's profit

Wed, Jan 24 2018When Ford reports fourth-quarter results on Wednesday afternoon, it is expected to fret that rising metals costs have cut into profits, even as rivals say they have the problem under control. Aluminum prices have risen 20 percent in the last year and nearly 11 percent since Dec. 11. Steel prices have risen just over 9 percent in the last year. Ford uses more aluminum in its vehicles than its rivals. Aluminum is lighter but far more expensive than steel, closing at $2,229 per tonne on Tuesday. U.S. steel futures closed at $677 per ton (0.91 metric tonnes). Republican U.S. President Donald Trump's administration is weighing whether to impose tariffs on imported steel and aluminum, which could push prices even higher. Ford gave a disappointing earnings estimate for 2017 and 2018 last week, saying the higher costs for steel, aluminum and other metals, as well as currency volatility, could cost the company $1.6 billion in 2018. Ford shares took a dive after the announcement. Ford Chief Financial Officer Bob Shanks told analysts at a conference in Detroit last week that while the company benefited from low commodity prices in 2016, rising steel prices were now the main cause of higher costs, followed by aluminum. Shanks said the automaker at times relies on foreign currencies as a "natural hedge" for some commodities but those are now going in the opposite direction, so they are not working. A Ford spokesman added that the automaker also uses a mix of contracts, hedges and indexed buying. Industry analysts point to the spike in aluminum versus steel prices as a plausible reason for Ford's problems, especially since it uses far more of the expensive metal than other major automakers. "When you look at Ford in the context of the other automakers, aluminum drives a lot of their volume and I think that is the cause" of their rising costs, said Jeff Schuster, senior vice president of forecasting at auto consultancy LMC Automotive. Other major automakers say rising commodity costs are not much of a problem. At last week's Detroit auto show, Fiat Chrysler Automobiles NV's Chief Executive Officer Sergio Marchionne reiterated its earnings guidance for 2018 and held forth on a number of topics, but did not mention metals prices. General Motors Co gave a well-received profit outlook last week and did not mention the subject. "We view changes in raw material costs as something that is manageable," a GM spokesman said in an email.

Fiat-Chrysler CEO: Please Don't Buy The Fiat 500e

Wed, May 21 2014Fiat-Chrysler's CEO had a strange request for electric vehicle shoppers on Wednesday: don't buy the all-electric Fiat 500e. While CEO Sergio Marchionne was speaking at a conference in Washington, he told the crowd he's tired of Chrysler-Fiat losing money, The Detroit News reported. "I hope you don't buy it [the 500e] because every time I sell one it costs me $14,000," he said to the audience at the Brookings Institution. "I'm honest enough to tell you that." Marchionne said federal and state fuel efficiency mandates are forcing the automaker to build unprofitable cars, according to Reuters. A normal Fiat 500 starts at $16,195, and the 500e starts at $32,650, before federal and state tax credits. There are no sales data to indicate how the 500e is performing. Related Gallery The Best Hybrids For The Money View 12 Photos Green Chrysler Fiat Car Buying Electric fiat 500e