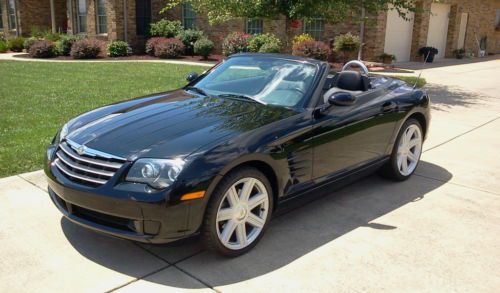

2004 Chrysler Crossfire In Excellent Condition. Only 75k Miles Private Seller on 2040-cars

Blackwood, New Jersey, United States

|

2004 Chrysler Crossfire Limited with only 75k miles

It Rear wheel drive with a V6 3.2 liter engine and MANUAL Transmission. Has every option including: Pwr everything, ABS, Telescoping Wheel, Dual & Side airbags The car is very similar to the Mercedes SLK with the same frame and engine. It is completely stock, driven by a middle aged woman, religiously maintained. There are Zero problems or issues with the car. Everything works properly Very quick little car especially fun to drive with a manual transmission. Interior and Exterior looks great. I might be interested in a trade depending on what you have. Please call if you want to come see it (856) 9O6-7448 |

Chrysler Crossfire for Sale

2005 chrysler crossfire base convertible 2-door 3.2l(US $14,500.00)

2005 chrysler crossfire base convertible 2-door 3.2l(US $14,500.00) 2005 chrysler crossfire base convertible 2-door 3.2l 30,000 miles black/black(US $13,000.00)

2005 chrysler crossfire base convertible 2-door 3.2l 30,000 miles black/black(US $13,000.00) Manual transmission financing available coupe low miles leather cd player tracti

Manual transmission financing available coupe low miles leather cd player tracti 2005 chrysler crossfire limited convertible 2-door 3.2l

2005 chrysler crossfire limited convertible 2-door 3.2l 2005 chrysler crossfire limited leather v6 coupe excellent condition

2005 chrysler crossfire limited leather v6 coupe excellent condition 2005 chrysler crossfire limited coupe(US $7,100.00)

2005 chrysler crossfire limited coupe(US $7,100.00)

Auto Services in New Jersey

West Automotive & Tire ★★★★★

Tire World ★★★★★

Tech Automotive ★★★★★

Surf Auto Brokers ★★★★★

Star Loan Auto Center ★★★★★

Somers Point Body Shop ★★★★★

Auto blog

Chrysler Voyager minivan goes fleet-only for 2022

Thu, Oct 7 2021Private motorists will not be able to buy a new Chrysler Voyager in the 2022 model year; the minivan is now a fleet-only model. The cheaper alternative to the Pacifica loses most of its trim levels, but it gains a longer list of standard features during the transition. Fleet buyers take on many shapes and forms, but in minivan-speak the term usually denotes rental car companies. Chrysler simplified buying by paring down the lineup from three to one trim. Called LX, it gains a 7.0-inch touchscreen that runs the Uconnect 5 infotainment system, second-row Stow 'n Go seats, power-operated sliding doors, heated front seats, and a heated steering wheel; that's not bad for something you're picking up at the airport to spend a weekend in. There's also a new air filtration system shared with the Pacifica.  Related: Least expensive vehicles to insure in America  The list of options now includes a package called Safety and Premium Group that bundles a blind-spot monitoring system, rear parking sensors, rear cross-path detection, full-speed forward collision warning, automatic emergency braking, and a 10.1-inch touchscreen with navigation. However, upmarket features like leather upholstery and a 19-speaker Harman-Kardon surround-sound system are not offered. Chrysler is not making mechanical changes, so power for the Voyager comes from a 3.6-liter Pentastar V6 rated at 287 horsepower and 262 pound-feet of torque. It spins the front wheels via a nine-speed automatic transmission. All-wheel drive is not available; only the Pacifica can get its power sent to four wheels. Similarly, there are no visual changes to report. The Voyager still looks like a pre-facelift Pacifica. Pricing information for the 2022 Voyager will be announced closer to its on-sale date. At launch, buyers will have five colors called Silver Mist, Brilliant Black, Bright White, Granite Crystal, and Velvet Red, respectively. The former (shown in the gallery) is new for 2022. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. How to use the Stow 'N Go seats on the 2021 Chrysler Pacifica

Marchionne on Alfa's US return, Dodge Dart's powertrain weakness and minivan plans

Fri, 18 Jan 2013As a reporter covering an auto show, the one opportunity you never want to miss is going to the Sergio Marchionne press briefing.

"This undertaking to bring Alfa back is a one-shot deal... We are not going to do this twice."

There just aren't that many real characters left in the auto industry. Marchionne, who sits atop both Chrysler and Fiat, is not only one of the smartest execs in the business, but also the most frank. Herein, a sample of the quotable always-sweatered executive:

Fiat Chrysler pressing on with Magneti Marelli spinoff amid sale rumor

Thu, Aug 23 2018MILAN — Fiat Chrysler (FCA) is pressing ahead with the spinoff of its parts maker Magneti Marelli, a spokesman confirmed in Wednesday after reports investment firm KKR was in talks to acquire the unit. "FCA is pursuing a plan to separate the Magneti Marelli business ... it will evaluate bona fide proposals for alternative transactions that may be in the best interest of the Company," the spokesman said in an emailed statement. The company would not comment on market rumors, the statement added. Earlier on Tuesday the Wall Street Journal reported that global investment house KKR was in talks to acquire the unit and that a potential sale price could exceed the 3.23 billion euros value at which some analysts valued it. In mid-July, FCA kicked off the process to register the business in the Netherlands and list it on the Milan stock exchange. Reporting by Stefano RebaudoRelated Video: Image Credit: Getty Earnings/Financials Chrysler Fiat Parts and Accessories FCA magneti marelli