2004 Chrysler Crossfire Base Coupe 2-door 3.2l on 2040-cars

Northridge, California, United States

|

For Sale By Private Party is a 2004 Chrysler Crossfire Coupe Limited edition. contact Mickey before bid 818-439-7023 |

Chrysler Crossfire for Sale

2005 limited florida car 39k miles non smoker warranty

2005 limited florida car 39k miles non smoker warranty 2005 chrysler crossfire limited coupe 2-door black 3.2l v6 automatic(US $10,000.00)

2005 chrysler crossfire limited coupe 2-door black 3.2l v6 automatic(US $10,000.00) 2006 chrysler crossfire base coupe 2-door 3.2l(US $12,500.00)

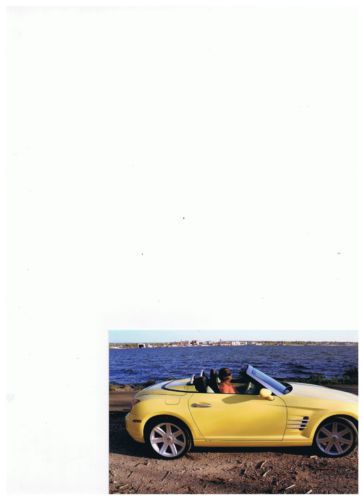

2006 chrysler crossfire base coupe 2-door 3.2l(US $12,500.00) 06 yellow convertable chrysler crossfire(US $23,000.00)

06 yellow convertable chrysler crossfire(US $23,000.00) One owner! lo miles! 2005 chrysler crossfire ltd hard to find! pristine!(US $14,900.00)

One owner! lo miles! 2005 chrysler crossfire ltd hard to find! pristine!(US $14,900.00) 2004 crysler crossfire 30k miles, 2 owner.(US $8,800.00)

2004 crysler crossfire 30k miles, 2 owner.(US $8,800.00)

Auto Services in California

Windshield Repair Pro ★★★★★

Willow Springs Co. ★★★★★

Williams Glass ★★★★★

Wild Rose Motors Ltd. ★★★★★

Wheatland Smog & Repair ★★★★★

West Valley Smog ★★★★★

Auto blog

Sell your own: 1969 Plymouth Barracuda

Mon, May 22 2017Looking to sell your car? We make it easy and free. Quickly create listings with up to six photos and reach millions of buyers. Log in and create your free listings. Always the "third" element in Detroit's Big Three, Chrysler and its Dodge, Plymouth and Chrysler divisions, usually played catchup to GM and Ford. However, Plymouth actually arrived to the ponycar segment on time, with its launch of the Valiant-based Barracuda almost on top of Ford's Mustang. That said, the segment became named for ponies, not an aggressive fish. By 1969, the Ford Mustang and Chevy Camaro were becoming bigger and more sophisticated. The Barracuda, by contrast, held on to its essential simplicity. We'd prefer the fastback and a small-block V8, but in the context of 2017 collectible-car values for Mopar, even a Slant Six coupe with unknown mileage might be worth checking out. From the supplied pics, this '69 Cuda looks to be in good condition; if it weren't, the asking price would likely be south of $10,000 – not north. Scarcity's not an issue, so this Barracuda would seem well-suited for the resto-mod treatment (above and beyond the aftermarket hood scoops), while keeping the post-purchase investment as minimal as the original outlay. Chrysler Used Car Buying Buying Guide Ownership Coupe Performance

Junkyard Gem of the Week: 1979 Plymouth Horizon (with the Woodgrain Package!)

Thu, Apr 20 2023While Ford and GM proved to have sufficiently deep pockets to design their own US-market subcompacts for the fuel-starved 1970s, Chrysler had to look to its overseas outposts to create such a car. Turning to Simca, which had become part of Chrysler Europe after Chrysler's absorption of the Rootes Group, a promising hatchback concept was developed into both a European-market version and a significantly different American-market version. Today's Junkyard Gem is an example of the latter type, found in a Denver-area self-service boneyard last summer. The first of these cars came off the Belvidere Assembly line in Illinois as 1978 models (sadly, Stellantis just shuttered Belvidere in February). The Dodge-badged version was the Omni, while the Plymouth version was the Horizon; the generic term for this car is thus Omnirizon. The Omnirizon was a great success for Chrysler, and many other vehicles were based on its platform. To name a few members of the extended Omnirizon family: the 1982-1987 Dodge Charger, the Dodge Rampage/Plymouth Scamp minitrucks, and even the Plymouth Turismo of Cocaine Factory fame. Astoundingly, production continued all the way through 1990, which meant that these thoroughly 1970s cars stuck around long enough to get airbags as standard equipment. Just as was the case with the Mitsubishi-built Dodge and Plymouth Colts, there never were any significant differences—pricing or otherwise—between the Dodge Omni and Plymouth Horizon. The Omnirizon got a fascinating assortment of engines during its first half-decade or so. For 1978 through 1980, it received the same 1.7-liter Volkswagen straight-four that went into US-market Rabbits, Sciroccos, Jettas and Audi 4000s. This one was rated at 77 horsepower and 90 pound-feet. Chrysler began bolting in its homegrown 2.2-liter four-banger starting with the 1981 Omnirizons, with the hilariously quick Omni GLH and GLHS getting turbocharged versions a few years later. From the 1983 through 1986 model years, penny-pinching Americans could buy their base-model Omnirizons with 1.6-liter Peugeot-built Simca engines delivering 62 French horses to the front wheels. This Horizon is absolutely loaded by the standards of late-1970s economy cars. The MSRP was just $4,278 (about $18,843 in 2023 dollars), but this automatic transmission would have added another $319 to the cost ($1,405 today). The base transmission for 1979 was a four-on-the-floor manual.

Next Chrysler Town & Country will have foot-operated rear doors

Mon, Aug 31 2015Families are still months away from actually seeing the next-gen Chrysler Town & Country debut at the 2016 Detroit Auto Show, but details are continuing to trickle out about the upcoming minivan. Among several features rumored in the latest leak, the sliding doors and rear hatch are reportedly optional with foot activation, according to Automotive News. It should make loading the van easier for owners with their hands full. The T&C's powertrain sees some efficiency improvements, too. Under the hood, expect an upgraded version of the 3.6-liter Pentastar V6 and the already rumored nine-speed automatic, according to Automotive News. For the all-wheel-drive version of the minivan, an electric motor would provide the propulsion at the rear axle. Inside, all of the passengers can arrive with their devices fully charged thanks to USB ports for each of the three rows. Plus, for owners who need to make room to haul, the Stow 'N Go seating is now easier to use, too. Like the latest Honda Odyssey, fastidious buyers might even spec an optional vacuum. Earlier spy shots of the van indicate the switch to a rotary gearshift and upgraded infotainment, as well. Following the Detroit debut, the T&C goes into production in Windsor, Ontario, in late February 2016, Automotive News reports. The plug-in hybrid version would come towards the end of the year possibly capable of 75 mpge.