2004 Chrysler Crossfire on 2040-cars

Portsmouth, Ohio, United States

For Sale By:Dealer

Engine:3.2L 3200CC 195Cu. In. V6 GAS SOHC Naturally Aspirated

Body Type:Coupe

Transmission:Automatic

Fuel Type:GAS

Make: Chrysler

Model: Crossfire

BodyStyle: Coupe

Trim: Base Coupe 2-Door

FuelType: Gasoline

Drive Type: RWD

Mileage: 142,425

Number of Doors: 2

Exterior Color: White

Interior Color: Unspecified

Number of Cylinders: 6

Chrysler Crossfire for Sale

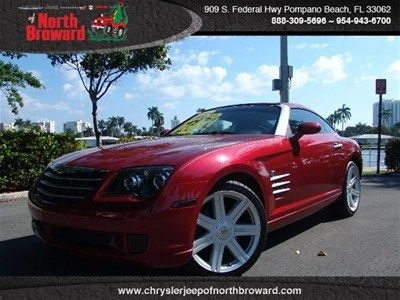

2006 limited 3.2l red

2006 limited 3.2l red 2005 chrysler crossfire limited convertible 2-door 3.2l(US $8,500.00)

2005 chrysler crossfire limited convertible 2-door 3.2l(US $8,500.00) 2006 chrysler crossfire ltd(US $17,500.00)

2006 chrysler crossfire ltd(US $17,500.00) Chrysler crossfire limited coupe slk mercedes 3.2l v6 great mpg(US $9,999.00)

Chrysler crossfire limited coupe slk mercedes 3.2l v6 great mpg(US $9,999.00) 2005 chrysler crossfire single cd heated seats rear spoiler power top

2005 chrysler crossfire single cd heated seats rear spoiler power top Convertible 3.2l cd 4 wheel disc brakes abs brakes am/fm radio air conditioning

Convertible 3.2l cd 4 wheel disc brakes abs brakes am/fm radio air conditioning

Auto Services in Ohio

West Chester Autobody Inc ★★★★★

West Chester Autobody ★★★★★

USA Tire & Auto Service Center ★★★★★

Trans-Master Transmissions ★★★★★

Tom & Jerry Auto Service ★★★★★

Tint Works, LLC ★★★★★

Auto blog

Fiat Chrysler will pay $70M to settle safety disclosure suit

Thu, Dec 10 2015FCA US will pay a $70 million civil penalty to the National Highway Traffic Safety Administration for failing to submit Early Warning Report data going back to 2003. The automaker will also provide any missing data since that time, and an auditor will monitor future compliance. NHTSA says the failures to report this information "stem from problems in FCA's electronic system for monitoring and reporting safety data, including improper coding and failure to account for changes in brand names." There are no allegations of any intentional deception by the automaker. NHTSA will wrap up the latest fine with the previous consent order against FCA US earlier this year for the automaker's handling of 23 recalls. The company will know owe the safety regulator a total of $140 million in cash, and there will be possibility of $35 million more in deferred penalties if FCA doesn't comply with the agency's requests. In a statement about the fine to Autoblog, FCA US said the automaker "accepts these penalties and is revising its processes to ensure regulatory compliance." The company strongly believes that it didn't miss any safety problems over the time with this problem. Early Warning Reports include information on deaths, injuries, crashes, and other potential safety concerns, and NHTSA often uses the data in investigations for possible recalls. In September, the safety agency first announced the automaker failed to submit these documents. At the time, the regulator's administrator Mark Rosekind promised to "take appropriate action after gathering additional information on the scope and causes of this failure." FCA US also released a statement then about the lapse and said the company notified NHTSA immediately after discovering the problem. FCA US is not the first company to run afoul of NHTSA's reporting requirement. The agency fined Triumph Motorcycles and Honda this year for similar lapses. It also punished Ferrari in 2014. U.S. DOT Fines Fiat Chrysler $70 million for Failure to Provide Early Warning Report Data to NHTSA WASHINGTON – The U.S. Department of Transportation's National Highway Traffic Safety Administration has imposed a $70 million civil penalty on Fiat Chrysler Automobiles (FCA) for the auto manufacturer's failure to report legally required safety data. The penalty follows FCA's admission in September that it had failed, over several years, to provide Early Warning Report data to NHTSA as required by the TREAD Act of 2000.

Fiat Chrysler begins Magneti Marelli spinoff

Thu, Jul 19 2018MILAN — Fiat Chrysler has kicked off its planned spinoff of parts maker Magneti Marelli, which will be registered in the Netherlands and listed on the Milan stock exchange, a document outlining initial plans and seen by Reuters showed. The spinoff is part of a plan by FCA Chief Executive Sergio Marchionne to "purify" the Italian-American carmaker's portfolio and to unlock value at Magneti Marelli similar to his earlier spinoff of Ferrari. Analysts say Magneti Marelli could be worth between 3.6 billion and 5 billion euros ($4.2 billion to $5.8 billion). It sits within FCA's components unit alongside robotics specialist Comau and castings firm Teksid. FCA has created a separate entity called MM Srl, the document showed, into which it will fold Magneti Marelli's electronics and electro-mechanical operations related to racing motorbikes and racing cars, as well as 14 other holdings in various companies around the world, including Germany, Slovakia, Mexico and South Africa. MM will be incorporated into a Dutch holding company via a cross-border merger, it added. FCA declined to comment. The move follows a similar procedure adopted by FCA for the spinoff and listing of Ferrari as well as of trucks and tractor maker CNH Industrial, both registered in the Netherlands and listed in Milan. The Dutch holding company would allow Marchionne, known for his success in extracting shareholder value through this strategy, to introduce a loyalty share scheme to reward long-term investors through multiple voting rights, as was the case with CNH and Ferrari. That would tighten the grip of FCA's controlling shareholder Exor, the Agnelli family's investment holding company, on the parts maker. Magneti Marelli, which employs around 43,000 people and operates in 19 countries, is a diversified components supplier specialized in lighting, powertrain and electronics. The Magneti Marelli separation is expected to be completed by the end of this year or early 2019, FCA has said. FCA's advisers initially looked at a possible initial public offering for the business to raise cash to cut FCA's debt, but the Agnelli family — FCA's main shareholder — was put off by low industry valuations and did not want its stake in Magneti Marelli to be diluted, three sources close to the matter told Reuters in March. Magneti Marelli has often been touted as a takeover target, and FCA has fielded interest from various rivals and private equity firms over the years.

Former Treasury boss unaware auto task force fired GM's Wagoner

Wed, 14 May 2014We dig a good political tell-all every once in a while (how else will we get our political fix while waiting for House of Cards' third season?). Today, we get just that from former Treasury Secretary Timothy Geithner's new book, "Stress Test," which details, among other parts of the 2009 financial catastrophe, the structured bankruptcy that allowed Chrysler and General Motors to emerge as competitive players in the auto industry.

In the book, which is nicely recapped by The Detroit News, Geithner discusses the firing of GM CEO Rick Wagoner while explaining how much trust he had in the auto industry task force that executed the move without his knowledge.

Auto Czar Steve Rattner "didn't even consult me before he fired General Motors CEO Rick Wagoner; if anything, that move increased my confidence in Team Auto," Geithner wrote.