*no Reserve* Nice Car* In Great Condition* on 2040-cars

Conowingo, Maryland, United States

Chrysler Crossfire for Sale

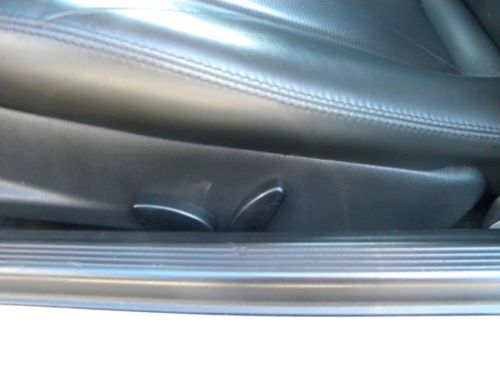

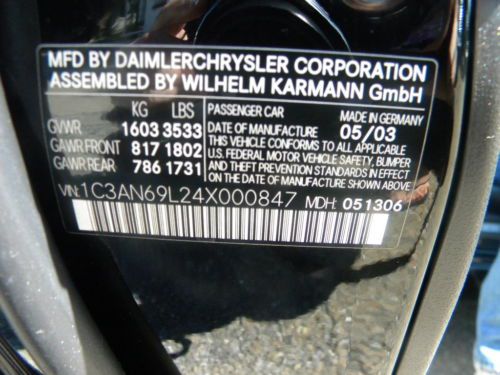

04 crossfire limited 5 speed automatic power leather heated seats 4 new tires(US $8,500.00)

04 crossfire limited 5 speed automatic power leather heated seats 4 new tires(US $8,500.00) 2005 chrysler crossfire srt-6 convertible 2-door 3.2l(US $22,000.00)

2005 chrysler crossfire srt-6 convertible 2-door 3.2l(US $22,000.00) Chrysler crossfire 2005 low mileage showroom condition(US $10,975.00)

Chrysler crossfire 2005 low mileage showroom condition(US $10,975.00) 2005 chrysler crossfire

2005 chrysler crossfire 2005 chrysler crossfire convertible

2005 chrysler crossfire convertible 2004 chrysler crossfire coupe 2-door 3.2l(US $8,600.00)

2004 chrysler crossfire coupe 2-door 3.2l(US $8,600.00)

Auto Services in Maryland

The Body Works of VA INC ★★★★★

Sarandos Automotive Technology Inc ★★★★★

Safety First Auto Repair ★★★★★

Quick Lane ★★★★★

Prestige Automotive ★★★★★

Preferred Automotive Assoc ★★★★★

Auto blog

Chrysler 300 could become an electric sedan for 2026

Fri, Jul 8 2022Australian outlet Drive says it got eyes on "insider information" that revealed Chrysler has an electric sedan in development. As has been practice for the Pentastar since long before Stellantis, this Chrysler four-door would be the platform sibling of an electric Dodge sedan, the Dodge version to arrive sometime in 2024, the Chrysler variant about two years later. Nothing in the documents identified the EV sedan as a replacement for the 300, but Drive lays out a trail of circumstantial evidence that points to this conclusion. The documents say the vehicles will run 800-volt electrical architectures, thought to mean they'll also get the most powerful versions of Stellantis' new electric motors making anywhere from 201 to 443 horsepower. And because of that, Drive expects these products to use the STLA Large platform, the platform an electric 300 would sit on. Chrysler's working up a range of new products as part of the numerous brand resets Stellantis committed to. In January, Chrysler CEO Christine Feuell told Automotive News the coming portfolio "will include a number of brand-new products that don't exist today, but also products that are still playing in segments that we're in already," calling out the fact that Chrysler only plays in the large sedan and minivan segments. Then she said, "Our intention is to redefine products for those segments, and they're certainly going to be a vast departure from what's in market today." The automaker's first EV is expected to be the Airflow, teased during the Stellantis EV day last summer before being debuted at CES in January. With Dodge already making a muscle car, turning that into a product for Chrysler seems like a no-brainer. Thing is, Drive's information and Feuell's comments could be applied to the Airflow. It's on the STLA Large platform, will pack two motors producing a combined 402 hp, and fit a battery capable of juicing a 400-mile range. As far as we can tell, Chrysler has never called it a crossover yet. Not that the nomenclature would matter anyway, since any model name with brand equity can be turned into any other kind of vehicle (see: Aspen, Blazer, Maverick, et al). The Airflow name on an EV makes a logical tie to the original Airflow produced from 1937 to 1940, that original car so named because of its aerodynamic features. But if the Airflow EV hit the market as the new 300, we couldn't say we hadn't seen that trick before.

The UAW's 'record contract' hinges on pensions, battery plants

Thu, Oct 12 2023DETROIT - After nearly four weeks of disruptive strikes and hard bargaining, the United Auto Workers and the Detroit Three automakers have edged closer to a deal that could offer record-setting wage gains for nearly 150,000 U.S. workers. General Motors, Ford Motor and Chrysler parent Stellantis have all agreed to raise base wages by between 20% and 23% over a four-year deal, according to union and company statements. Ford and Stellantis have agreed to reinstate cost-of-living adjustments, or COLA. The companies have offered to boost pay for temporary workers and give them a faster path to full-time, full-wage status. All three have proposed slashing the time it takes a new hire to get to the top UAW pay rate. The progress in contract talks follows the first-ever simultaneous strike by the UAW against Detroit's Big Three automakers. The union began the strike on Sept. 15 in hopes of forcing a better deal from each major automaker. But coming close to a deal is not the same thing as reaching a deal. Big obstacles remain on at least two major UAW demands: restoring the retirement security provided by pre-2007 defined benefit pension plans, and covering present and future joint- venture electric vehicle battery plants under the union's master contracts with the automakers. On retirement, none of the automakers has agreed to restore pre-2007 defined-benefit pension plans for workers hired after 2007. Doing so could force the automakers to again burden their balance sheets with multibillion-dollar liabilities. GM and the former Chrysler unloaded most of those liabilities in their 2009 bankruptcies. The union and automakers have explored an approach to providing more income security by offering annuities as an investment option in their company-sponsored 401(k) savings plans, people familiar with the discussions said. Stellantis referred to an annuity option as part of a more generous 401(k) proposal on Sept. 22. Annuities or similar instruments could give UAW retirees assurance of fixed, predictable payouts less dependent on stock market ups and downs, experts said. Recent changes in federal law have removed obstacles to including annuities as a feature of corporate 401(k) plans, said Olivia Mitchell, a professor at the University of Pennsylvania Wharton School and an expert on pensions and retirement. "Retirees want a way to be assured they won't run out of money," Mitchell said.

Ferrari stock sale pegged for October, or later

Sat, Jun 6 2015The Ferrari IPO is still coming, but it won't be before Columbus Day (Monday, October 12, that is), according to Fiat Chrysler Automobiles CEO Sergio Marchionne. The outspoken exec is blaming tax reasons for the fourth-quarter date, according to a report from Reuters. Marchionne said a full year needed to pass between FCA's October 13, 2014 Wall Street debut and any additional listing. This isn't the first delay in the Ferrari IPO. FCA was originally supposed to make a 10-percent offering of Ferrari during second or third quarter of 2015, before officially pushing things back to the third quarter of this year. Now, it's unclear if Ferrari will even go public before the dawn of 2016. Related Video: News Source: ReutersImage Credit: Marco Vasini / AP Earnings/Financials Government/Legal Chrysler Ferrari Fiat Sergio Marchionne FCA fiat chrysler automobiles