2012 Chrysler 300 Limited on 2040-cars

1438 Galbraith Rd, Cincinnati, Ohio, United States

Engine:3.6L V6 24V MPFI DOHC Flexible Fuel

Transmission:8-Speed Automatic

VIN (Vehicle Identification Number): 2C3CCACG3CH236519

Stock Num: 40060

Make: Chrysler

Model: 300 Limited

Year: 2012

Exterior Color: Deep Cherry Red Crystal Pearlcoat

Interior Color: Black

Options: Drive Type: RWD

Number of Doors: 4 Doors

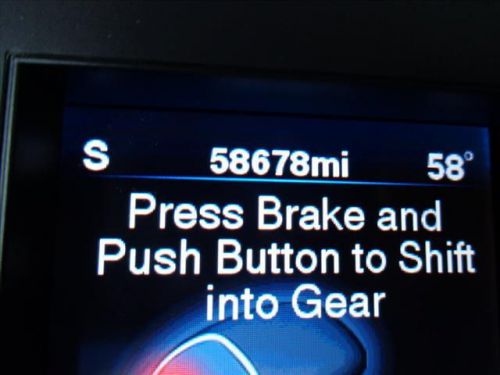

Mileage: 58666

If you are looking for a luxurious car this is the car for you. Beautiful dark red exterior. Heated seats and a beautiful dashboard computer display. This is a car you have to see in person! Luxury for a fraction of the cost of new. Passed a 60 point inspection and just detailed. Buy with confidence! This vehicles story can be verified with an Auto check Title History report.

Chrysler 300 Series for Sale

2007 chrysler 300 touring(US $13,888.00)

2007 chrysler 300 touring(US $13,888.00) 2012 chrysler 300 base(US $21,888.00)

2012 chrysler 300 base(US $21,888.00) 2013 chrysler 300 base(US $23,888.00)

2013 chrysler 300 base(US $23,888.00) 2010 chrysler 300 touring(US $14,888.00)

2010 chrysler 300 touring(US $14,888.00) 2013 chrysler 300 base(US $25,888.00)

2013 chrysler 300 base(US $25,888.00) 2014 chrysler 300 base(US $32,235.00)

2014 chrysler 300 base(US $32,235.00)

Auto Services in Ohio

Westside Auto Service ★★★★★

Van`s Tire ★★★★★

Used 2 B New ★★★★★

T D Performance ★★★★★

T & J`s Auto Body & Collision ★★★★★

Skipco Financial ★★★★★

Auto blog

7 major automakers to build open EV charging network

Wed, Jul 26 2023A new joint venture established by BMW, GM, Honda, Hyundai, Kia, Mercedes-Benz and Stellantis will build a new North American electric vehicle charging network on a scale designed to compete with Tesla's industry-benchmark Supercharger network. The 30,000-plus planned new chargers will accommodate both Tesla's almost-standard North American Charging System (NACS) and existing automakers' Combined Charging System (CCS) options, effectively guaranteeing compatibility with the vast majority of current and upcoming electric models — whether they're from one of the involved automakers or not. "With the generational investments in public charging being implemented on the Federal and State level, the joint venture will leverage public and private funds to accelerate the installation of high-powered charging for customers. The new charging stations will be accessible to all battery-powered electric vehicles from any automaker using Combined Charging System (CCS) or North American Charging Standard (NACS) and are expected to meet or exceed the spirit and requirements of the U.S. National Electric Vehicle Infrastructure (NEVI) program." Critically, the automakers involved will have a say in how the charging tech is implemented, guaranteeing that the hardware will play nicely with each automaker's in-house charging systems. Hyundai and Kia, for example, were hesitant to jump on board the Tesla NACS bandwagon earlier this year over concerns that the Supercharger network is insufficient for powering the two automakers' 800-volt charging systems; similar tech is used by Volkswagen and Porsche. In addition to providing much-needed capacity and high-output charging for America's growing fleet of electric cars and trucks, the new network will integrate seamlessly with each automaker's in-app and in-vehicle features, rather than forcing customers to use third-party tools and payment systems, as is the case with some existing public charging infrastructure. "The functions and services of the network will allow for seamless integration with participating automakersÂ’ in-vehicle and in-app experiences, including reservations, intelligent route planning and navigation, payment applications, transparent energy management and more. In addition, the network will leverage Plug & Charge technology to further enhance the customer experience," the announcement said.

Fiat Chrysler's Q3 profit boosted by strong North American earnings

Tue, Oct 24 2017MILAN, Italy — Fiat Chrysler Automobiles (FCA) reported a 17 percent jump in third-quarter adjusted operating profit on Tuesday, helped by a strong performance in its key North American market and improving operations in Europe and Latin America. The world's seventh-largest carmaker still makes the lion's share of its profits in North America, so improving, or at least maintaining, its margins there is a key focus. The carmaker reported an 8 percent adjusted operating profit margin in the region, up from 7.6 percent a year ago, despite a drop in sales and shipments. "FCA's profitability in North America remained strong in the quarter despite a weakening market there," a Milan-based analyst said. FCA's profitability compares with an 8.3 percent North America margin reached in the quarter by bigger U.S. rival GM , showing CEO Sergio Marchionne making progress towards his goal of closing the margin gap with GM and the company's other U.S. rival, Ford, by 2018. The company's confirmation of its full-year outlook also pushed shares higher, a trader added. The stock was up 2.8 percent by 1129 GMT, outperforming a 1 percent rise in the European auto index. FCA has been retooling some U.S. factories to boost output of sport-utility vehicles (SUVs) and trucks while ending production of some unprofitable sedans to strengthen profitability as the U.S. car market comes off its peak. The company said a drop in North America shipments due to lower fleet sales and discontinued models was partially offset by higher deliveries of Ram trucks and two models from the Alfa Romeo stable: the Stelvio sport utility vehicle and Giulia sedan. Profitability also improved in Europe, helped by sales of the Stelvio and the new Jeep Compass, and Latin America, while margins at Maserati remained strong at 13.8 percent due to strong demand for its first SUV, the Levante. In a later conference call, investors are looking for hints on the new strategy to 2022 which the company promised to unveil early next year. Chief Executive Sergio Marchionne said earlier this year that FCA would streamline its portfolio and that components businesses, including Magneti Marelli, would be separated from the group, possibly via a spin-off. While FCA confirmed its targets this year, doubts remain about its exposure to a weakening U.S. market, recall costs and potential fines over emissions after it was targeted by European and U.S.

FCA's profit rises ahead of Peugeot merger

Thu, Feb 6 2020MILAN — Fiat Chrysler (FCA) posted a 7% rise in fourth-quarter profit on Thursday, boosted by strong business in North America and better results in Latin America as it heads into a merger with France's PSA. The Italian-American carmaker said adjusted earnings before interest and tax (EBIT) rose to 2.12 billion euros ($2.3 billion), in line with a 2.11 billion forecast in Reuters poll of analysts. That left its adjusted operating profit for the year at 6.67 billion euros ($7.34 billion), just shy of its target of over 6.7 billion euros. Its adjusted EBITDA margin came in at 6.2%, in line with its target of more than 6.1%. A trader said Fiat Chrysler results were "a touch above" expectations and the carmaker's shares in Milan were up 3.4% at 1300 GMT following the results. Fiat Chrysler and Peugeot maker PSA agreed in December to combine forces in a $50 billion deal to create the world's No. 4 carmaker, in response to slower global demand and the mounting cost of making cleaner cars amid tighter emissions rules. Chief Executive Mike Manley said last month that talks with PSA were progressing well and that he hoped to complete the deal by early 2021. FCA reiterated its plan to boost adjusted EBIT to above 7 billion euros ($7.7 billion) this year. In slides prepared for an analyst call, FCA said it was monitoring the global impact of coronavirus in China. FCA operates in the country through a loss-making joint venture with Guangzhou Automobile Group (GAC) and has a 0.35% share of the Chinese passenger car market. Reporting by Giulio Piovaccari; Additional reporting by Danilo Masoni; Editing by Stephen Jewkes, Jason Neely and David Clarke. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.