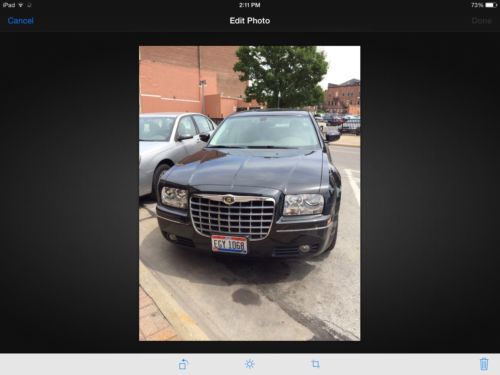

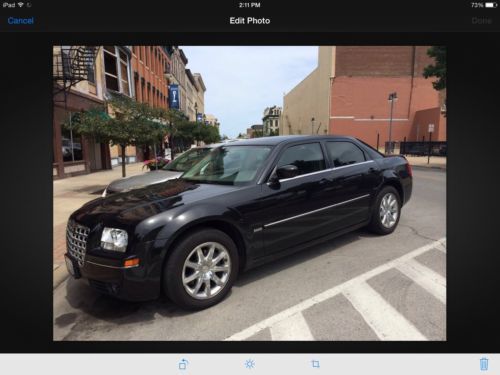

Chrysler 300c Touring Signature Series on 2040-cars

Sandusky, Ohio, United States

|

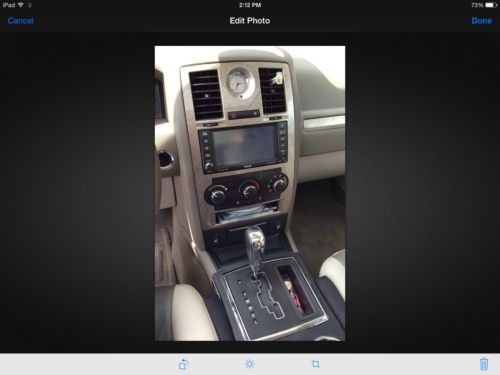

Great condition. Always garage kept. Touring signature series with all the options: leather, navigation, sun roof, alloy wheels, power everything, heated seats and LOW MILES!!! Beautiful car. Everything works and runs GREAT!!!

|

Chrysler 300 Series for Sale

Black auto v6 navigation rear view camera panorama roof 20" wheels loaded

Black auto v6 navigation rear view camera panorama roof 20" wheels loaded 2009 chrystler 300(US $11,500.00)

2009 chrystler 300(US $11,500.00) 2005 chrysler 300 c sedan 4-door 5.7l

2005 chrysler 300 c sedan 4-door 5.7l 5.7l awd oversized alloy wheels leather navigation remote start dual climate

5.7l awd oversized alloy wheels leather navigation remote start dual climate 07 300c-5.7l hemi-46k-gps-xm radio-sonroof-heated seats-finance price only(US $13,995.00)

07 300c-5.7l hemi-46k-gps-xm radio-sonroof-heated seats-finance price only(US $13,995.00) Mopar ltd edition hemi nav heated leather

Mopar ltd edition hemi nav heated leather

Auto Services in Ohio

Xenia Radiator & Auto Service ★★★★★

West Main Auto Repair ★★★★★

Top Knotch Automotive ★★★★★

Tom Hatem Automotive ★★★★★

Stanford Allen Chevrolet Cadillac ★★★★★

Soft Touch Car Wash Systems ★★★★★

Auto blog

Junkyard Gem: 1950 Chrysler Windsor Club Coupe

Tue, May 8 2018In 1950, shoppers in Chrysler showrooms had a choice between the low-end Royal, the midgrade Windsor, and the top-of-the-line New Yorker. This 1950 Windsor coupe managed to outlast nearly all of its contemporaries, finally coming to a halt in a wrecking yard just outside of Chicago. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. I stopped by this yard, Ashley's U-Pick-A-Part in Joliet, while I was working at the 24 Hours of Lemons Chicago race. When it comes to junkyard ambience, this one is nearly impossible to top (though Martin's Salvage in northeastern Colorado comes close), especially given its location: right across the street from the now-closed Joliet prison, best-known for its role in the opening sequence of " The Blues Brothers." Set on the grounds of an ancient, decaying factory, a large part of Ashley's inventory lives indoors in Rust Belt splendor. The star of the Chrysler section, this '50 Windsor has a place of honor and sits separate from your humdrum Avengers and Grand Cherokees. Because this is the Upper Midwest, the floors are more air than metal and big bites out of the rest of the car have been inflicted by the Rust Monster. Note the airbags inside the coil springs. The interior has long since been gutted, probably to live on in other, less rusty early-1950s Chrysler cars. The Windsor— and the body number makes it clear that this car did start life as a Windsor— came with a 251-cubic-inch Chrysler flathead six-cylinder engine. The New Yorker had a straight-eight flathead. V8s weren't available in Chryslers until the advent of the Hemi V8 the following year. This car may have had many engine swaps during its lifetime, but we have no way of knowing the details. Atop the rust and body filler, some lovingly applied stenciled-on flames. Someone felt proud of this car, even at the very end. Related Video: Featured Gallery Junked 1950 Chrysler Windsor in Illinois wrecking yard View 20 Photos Auto News Chrysler Automotive History Coupe 1950s

Stellantis lays off salaried workers, cites uncertainty in EV transition

Sat, Mar 23 2024DETROIT — Jeep maker Stellantis is laying off about 400 white-collar workers in the U.S. as it deals with the transition from combustion engines to electric vehicles. The company formed in the 2021 merger between PSA Peugeot and Fiat Chrysler said the workers are mainly in engineering, technology and software at the headquarters and technical center in Auburn Hills, Michigan, north of Detroit. Affected workers were notified starting Friday morning. “As the auto industry continues to face unprecedented uncertainties and heightened competitive pressures around the world, Stellantis continues to make the appropriate structural decisions across the enterprise to improve efficiency and optimize our cost structure,” the company said in a prepared statement Friday. The cuts, effective March 31, amount to about 2% of Stellantis' U.S. workforce in engineering, technology and software, the statement said. Workers will get a separation package and transition help, the company said. “While we understand this is difficult news, these actions will better align resources while preserving the critical skills needed to protect our competitive advantage as we remain laser focused on implementing our EV product offensive,” the statement said. CEO Carlos Tavares repeatedly has said that electric vehicles cost 40% more to make than those that run on gasoline, and that the company will have to cut costs to make EVs affordable for the middle class. He has said the company is continually looking for ways to be more efficient. U.S. electric vehicle sales grew 47% last year to a record 1.19 million as EV market share rose from 5.8% in 2022 to 7.6%. But sales growth slowed toward the end of the year. In December, they rose 34%. Stellantis plans to launch 18 new electric vehicles this year, eight of those in North America, increasing its global EV offerings by 60%. But Tavares told reporters during earnings calls last month that “the job is not done” until prices on electric vehicles come down to the level of combustion engines — something that Chinese manufacturers are already able to achieve through lower labor costs. “The Chinese offensive is possibly the biggest risk that companies like Tesla and ourselves are facing right now,Â’Â’ Tavares told reporters. “We have to work very, very hard to make sure that we bring out consumers better offerings than the Chinese.

FCA recalls over 200k Jeep Cherokees for windshield wiper static

Tue, Sep 1 2015Fiat Chrysler Automobiles is issuing a recall for over 200,000 versions of the 2014 Jeep Cherokee due to a problem with static buildup disabling the windshield wipers. FCA has identified 158,671 units in the United States. Another 18,366 vehicles are estimated to be affected in Canada, a further 3,582 in Mexico, and 26,049 outside of North America. The problem, according to the first statement below, results from static building up if the wipers are operated in dry conditions. The static could mess with the wipers' control module, rendering them disabled. To fix the problem, dealers will be instructed to install a ground strap to the module. In parallel, FCA is also offering incentives to the owners of certain trucks that were subject to recall but for which remedies were not immediately available. To encourage those owners to bring their older vehicles in for the required service, the automaker will disperse $100 prepaid cards for use at their discretion. The program is offered to owners of certain model year Jeep Grand Cherokee, Jeep Liberty, Chrysler Aspen, and Dodge Durango sport-utility vehicles, as well as certain Dodge Dakota and Ram trucks. Owners of the affected Grand Cherokees will have the option instead to take a $1,000 consideration toward the purchase of a new vehicle or for parts and service. The offers are only being extended under certain specific criteria, though. So if you think that could be you, you'll want to read through the conditions in the second announcement below. STATEMENT: CONTROL MODULE August 31, 2015 , Auburn Hills, Mich. - FCA US LLC is recalling an estimated 158,671 SUVs in the U.S. to help protect their control modules from static buildup that may potentially disable the vehicles' windshield wipers. An investigation by FCA US discovered static buildup may occur if the vehicles' windshield wipers are activated during dry conditions. Significant static buildup may affect a control module that powers the wipers. The Company is unaware of any related injuries or accidents. Affected are model-year 2014 Jeep Cherokee SUVs. An estimated 18,366 vehicles will be recalled in Canada, as will an estimated 3,582 in Mexico and 26,049 outside the NAFTA region. Dealers will install a ground strap to the control module to eliminate the potential for static buildup. Customers will be advised when they may schedule service, which will be performed at no cost.