2013 Chrysler 300 Base on 2040-cars

1320 State Road 46 East, Batesville, Indiana, United States

Engine:3.6L V6 24V MPFI DOHC

Transmission:8-Speed Automatic

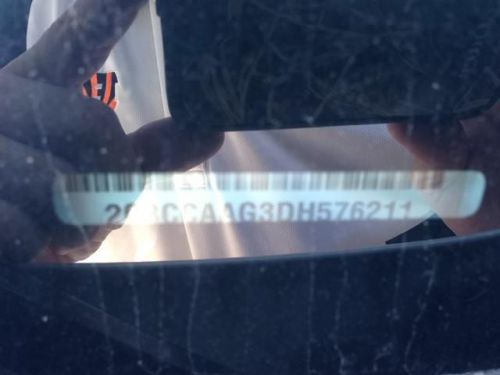

VIN (Vehicle Identification Number): 2C3CCAAG3DH576211

Stock Num: D303

Make: Chrysler

Model: 300 Base

Year: 2013

Exterior Color: Ivory Tri Coat Pearl

Interior Color: Light Frost

Options: Drive Type: RWD

Number of Doors: 4 Doors

SPEND LESS. GET MORE.

Chrysler 300 Series for Sale

2013 chrysler 300c varvatos collection(US $37,987.00)

2013 chrysler 300c varvatos collection(US $37,987.00) 2006 chrysler 300c srt-8(US $17,787.00)

2006 chrysler 300c srt-8(US $17,787.00) 2010 chrysler 300 touring(US $14,987.00)

2010 chrysler 300 touring(US $14,987.00) 2013 chrysler 300c varvatos collection(US $38,999.00)

2013 chrysler 300c varvatos collection(US $38,999.00) 2013 chrysler 300c varvatos collection(US $41,999.00)

2013 chrysler 300c varvatos collection(US $41,999.00) 2010 chrysler 300 touring(US $11,987.00)

2010 chrysler 300 touring(US $11,987.00)

Auto Services in Indiana

World Wide Automotive Service ★★★★★

World Hyundai of Matteson ★★★★★

William`s Service Center ★★★★★

Twin City Collision Repair Inc ★★★★★

Trevino`s Auto Sales ★★★★★

Tom Cherry Muffler ★★★★★

Auto blog

Auto News Recap For 5.13.16 | Autoblog Minute

Fri, May 13 2016Senior Editor Greg Migliore recaps the week in automotive news, including a look at Hyperloop One's desert propulsion test, Chrysler 300 rumors, and Nissan's purchase of Mitsubishi. Chrysler Mitsubishi Nissan Autoblog Minute Videos Original Video hyperloop

U.S. auto sales in April expected to drop despite big discounts

Thu, Apr 26 2018DETROIT — U.S. auto sales in April likely fell nearly 8 percent from the same month in 2017 despite big discounts for consumers, industry consultants J.D. Power and LMC Automotive said on Thursday. For much of the past two years, the discounts offered by automakers have remained at levels that industry analysts say are unsustainable and unhealthy in the long term. April U.S. new vehicle sales will likely be about 1.31 million units, down from 1.42 million units a year earlier, the consultancies said. The forecast was based on the first 17 selling days of April. Automakers, including Ford and Fiat Chrysler Automobiles, will release April U.S. sales results on May 1. Earlier this month, No. 1 U.S. automaker General Motors said it will stop reporting monthly U.S. sales because the 30-day snapshot does not accurately reflect the market. GM will instead issue quarterly sales reports. U.S. new vehicle sales fell 2 percent in 2017 to 17.23 million units after hitting a record high in 2016. Sales are expected to drop further in 2018 as interest rates rise and more late-model used cars return to dealer lots to compete with new ones. LMC expects full-year 2018 U.S. new vehicle sales to come in at around 17 million units. "Uncertainty and unfavorable factors appear to be mounting for autos, including a volatile stock market, rising interest rates, rising oil prices and potential trade roadblocks," Jeff Schuster, LMC's head of global vehicle forecasts, said in a statement. The seasonally adjusted annualized rate of sales for April will be 16.6 million vehicles, down more than 2 percent from 17 million units in April 2017, the consultancies said. Retail sales to consumers, excluding lower-margin fleet sales to rental agencies, businesses and government, were set to decline about 9 percent in April. The level of consumer discounts, which can erode profit margins and undercut resale values, "remains the larger concern," the consultancies said. The average discount was $3,698, up $187 from April 2017. Discounts on trucks and SUVs were up $426, but down $226 on passenger cars. Reporting by Nick CareyRelated Video: Image Credit: Reuters Earnings/Financials Chrysler Ford GM JD Power

SpeedKore's 'Baba Yaga' Chrylser Pacifica will eat kids, not shuttle them

Tue, May 23 2023In American movies, the Baba Yaga wears a tailored tactical suit, carries an HK P30L as his primary, drives a 1969 Mustang Mach1, and answers to the name of John Wick. In Slavic folklore, the original Baba Yaga wears less exclusive garb, carries a mortar and pestle, and lives in a cottage that stands on and walks around the forest on chicken legs. The latter version would probably trade in her cottage for SpeedKore's conceptual creation named in her honor, a Chrysler Pacifica with a Demon engine. Working with virtual artist Abimelec Arellano at Abimelec Design, the Wisconsin-based tuners drew up a minivan that could put fear into any children unfortunate enough to anger the mother behind the wheel. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. This isn't just about a witch, either. It's a witch with a side of demon plus an extra side of demon. The Hellcat powertrain reaches 1,025 horsepower in the limited-edition Dodge Challenger SRT Demon 170. That wasn't enough. The caption notes, "The 6.2L V-8 has been treated to what we're calling the 'Lilith Package.' Named for the primordial mother of demons, the Lilith Package brings the supercharged Hemi to a proper 1,514 horsepower and channels it through an 8-speed ZF transmission before the Michelin wrapped SRT wheels deliver power to the pavement." Visual treats include a hood scoop, remade grille, and larger intakes for better breathing, fender flares, tinted taillights, central-exit dual exhaust, and the appropriate badging. A sleeper this is not. A regular Chrysler Pacifica weighs about 4,530 pounds and makes, at most, 296 horsepower when given hybrid help. SpeedKore's version not only multiplies that figure by more than five, the aerospace-grade carbon fiber body panels that are a shop specialty are claimed to drop 1,000 pounds. They'll do a fine execution of the mission statement, which we're told is "setting lap records, roasting tires, and putting a pep in your step." Anyone who hasn't been too scrambled to step out of the van at its destination, at least. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.