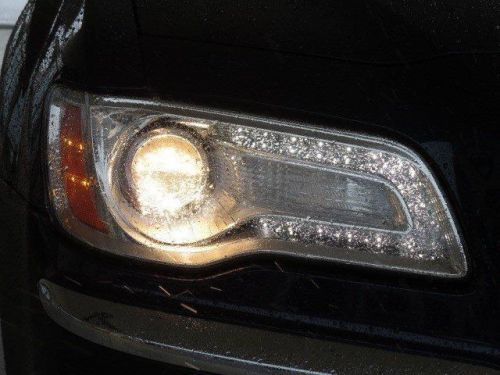

2007 Chrysler 300 Touring on 2040-cars

1017 S Main St, Wildwood, Florida, United States

Engine:3.5L V6 24V MPFI SOHC

Transmission:5-Speed Automatic

VIN (Vehicle Identification Number): 2C3KA53G37H707759

Stock Num: 707759

Make: Chrysler

Model: 300 Touring

Year: 2007

Exterior Color: Blue

Options: Drive Type: RWD

Number of Doors: 4 Doors

Mileage: 79352

Guarantee Financing Good CreditNo CreditWill find a program for you.First time Buyers Program Available.This vehicle is on our off site location, can be viewed by oppointment.Call to setup appointment. Community Auto Exchange. Wildwood,Florida 34785Office 855-892-2601 or Fax: 855-892-2601 Thank you for your recent Internet inquiry. Our staff is here to make sure that you get all the information you need to make an informed buying decision. We strive to achieve that goal, while making your purchase simple and pleasurable at the same time.

Chrysler 300 Series for Sale

2012 chrysler 300 limited(US $23,895.00)

2012 chrysler 300 limited(US $23,895.00) 2008 chrysler 300c hemi(US $15,995.00)

2008 chrysler 300c hemi(US $15,995.00) 2013 chrysler 300 base(US $25,995.00)

2013 chrysler 300 base(US $25,995.00) 2008 chrysler 300 limited(US $10,995.00)

2008 chrysler 300 limited(US $10,995.00) 2005 chrysler 300c base(US $8,900.00)

2005 chrysler 300c base(US $8,900.00) 2013 chrysler 300 s(US $30,000.00)

2013 chrysler 300 s(US $30,000.00)

Auto Services in Florida

Zych`s Certified Auto Svc ★★★★★

Yachty Rentals, Inc. ★★★★★

www.orlando.nflcarsworldwide.com ★★★★★

Westbrook Paint And Body ★★★★★

Westbrook Paint & Body ★★★★★

Ulmerton Road Automotive ★★★★★

Auto blog

VW walks away from Aurora after self-driving startup partners with FCA

Wed, Jun 12 2019BERLIN — Volkswagen has ended its partnership with self-driving car software firm Aurora, two days after the Silicon Valley start-up said it would build autonomous platforms for commercial vehicles with Fiat Chrysler Automobiles. "The activities under our partnership have been concluded," a VW spokesman said in a statement on Tuesday following an earlier Financial Times report on the move which said VW now wanted to work with Ford Motor Co on autonomous driving. Ford's majority-owned subsidiary Argo AI is building an automated "driver" that could compete with Aurora's technology. Aurora said Tuesday "Volkswagen Group has been a wonderful partner to Aurora since the early days of development of the Aurora Driver." The company's statement added that it continues to work "with a growing array of partners." The autonomous vehicle industry is still in its infancy, and alliances and strategies are fluid. Aurora has sought to remain independent and serve a number of would-be autonomous vehicle makers rather than be acquired. Aurora, which said in February it had raised $530 million in new funding, also has partnerships with Hyundai Motor Co and China's Byton to develop and test self-driving systems for automakers, fleet owners and others. After announcing its partnership with Aurora in early 2018, VW last June began discussions with Ford to develop a range of commercial vehicles, later extending the discussions to include electric vehicles and Argo's autonomous driving technology as part of an alliance designed to save billions in costs. VW and Ford have not announced partnerships involving electric or autonomous vehicle technology. Green Chrysler Fiat Ford Volkswagen Technology Emerging Technologies Autonomous Vehicles

Best and worst car brands of 2022 according to Consumer Reports

Thu, Feb 17 2022It's that time again, Consumer Reports this morning lifting the curtain on its 2022 Annual Car Brand rankings and its 10 Top Picks in the car, crossover, and truck category. Drumroll, please: This year, Subaru climbs two spots to claim the winner's circle, having come third the last two years. Last year, Mazda climbed three spots from 2020 to take the crown. This year, Mazda slipped to second, BMW taking the last spot on the podium, also a one-spot drop from 2021. Six automakers in the top 10 hailed from Japan, which is one more than last year, and five luxury makers occupied the top 10, which is two more than last year. And South Korean representation didn't crack the top this year, after Hyundai managed tenth last year. The seven makes after BMW are: Honda, Lexus, Audi, Porsche, Mini, Toyota, and Infiniti. The magazine and testing concern says its Brand Report Card "[reveals] which automakers are producing the most well-performing, safe, and reliable vehicles based on CR’s independent testing and member surveys," and that "Brands that rise to the top tend to have the most consistent performance across their model lineups." The domestics also took steps back among the 32 OEMs ranked on the 2022 card. Chrysler and Buick were the domestic carmakers who made last year's top 10 in eighth and ninth, respectively. This year, Buick dropped to eleventh, Chrysler to thirteenth. Dodge went from fourteenth to sixteenth. CR continues to ding Tesla's yoke steerer, the not-exactly-natural handhold responsible for the electric carmaker going from sixteenth last year to twenty-third this year.

FCA seeks partner to keep building Dodge Dart, Chrysler 200

Wed, Mar 9 2016Mere weeks after FCA announced it was shutting down production of the Dodge Dart and Chrysler 200, new hope emerges to give the sedans a stay of execution. Speaking at the Geneva Motor Show last week, Sergio Marchionne said that the company was looking for a partner "who is better at it than we are and who has got capacity available" in order to continue building the models on its behalf. "There are discussions going on now," said Marchionne, according to Motor Trend. "I think we will find a solution. We continue to talk. It's both a technical solution and an economic one. We need to find a solution that works economically." Contracting vehicles to be manufactured offsite is more common practice among European automakers than it is with American ones. Chrysler's former patron Mercedes, for example, has the G-Class built for it by Magna Steyr in Austria, the A-Class by Valmet in Finland, and the R-Class by AM General in Indiana (even though it's no longer sold in the US). This arrangement would, on the surface at least, appear more similar to the deal that Toyota struck with Mazda to build the Scion iA, drawing on the contractor's expertise and capacity to build the small sedan on the client company's behalf. Only rather than basing a new model on one of the partner's existing ones, this deal would ostensibly continue building FCA models on FCA platforms using FCA components. We'll have to wait to find out with whom FCA strikes up the manufacturing deal, but we wouldn't be surprised to see Marchionne turn to a partner he already knows. The company is, after all, at the center of an intricate web of joint ventures and manufacturing contracts. The Fiat 124 Spider, for example, is built by Mazda. The Fiat Sedici that preceded the 500X was built by Suzuki. Models like the Dodge Stealth and Eagle Talon were built in Illinois at the Diamond-Star Motors joint venture before Mitsubishi took it over altogether. And Dodge continued selling the Mercedes-made Sprinter long after DaimlerChrysler split. The Ram ProMaster, though built by FCA in Mexico for the North American market, stems from a partnership in France with PSA Peugeot Citroen. And the ProMaster City is built in a joint-venture plant in Turkey, from which it's also sold by GM as an Opel in Europe and a Vauxhall in the UK. With all those deals coming and going, after all, what would one more add to the complexity?