2004 Chrysler 300m Base on 2040-cars

1875 E Edwardsville Rd, Wood River, Illinois, United States

Engine:3.5L V6 24V MPFI SOHC

Transmission:4-Speed Automatic

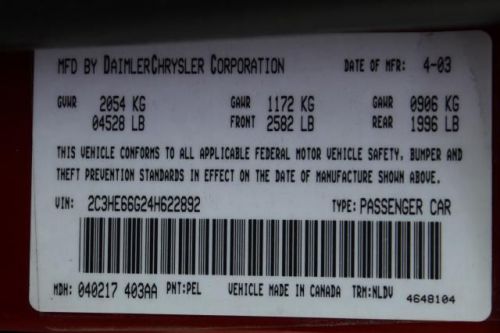

VIN (Vehicle Identification Number): 2C3HE66G24H622892

Stock Num: 6353-2

Make: Chrysler

Model: 300M Base

Year: 2004

Exterior Color: Deep Lava Red Metallic

Interior Color: Dark Slate Gray

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 80990

Your lucky day! Don't wait another minute! Confused about which vehicle to buy for you and your loved ones? Well look no further than this gorgeous 2004 Chrysler 300M. J.D. Power and Associates gave the 2004 300M 4 out of 5 Power Circles for Overall Initial Quality Design. Lots of get-up-and-go for an outstanding price in this so-much-fun to drive 300M. CALL DAVID SANDERS FOR MORE DETAILS AND AVAILABILITY AT 855-518-5647!

Chrysler 300 Series for Sale

2014 chrysler 300 base(US $26,735.00)

2014 chrysler 300 base(US $26,735.00) 2008 chrysler 300c hemi(US $15,943.00)

2008 chrysler 300c hemi(US $15,943.00) 2013 chrysler 300c base(US $26,986.00)

2013 chrysler 300c base(US $26,986.00) 2008 chrysler 300 lx(US $12,934.00)

2008 chrysler 300 lx(US $12,934.00) 2014 chrysler 300 base(US $26,735.00)

2014 chrysler 300 base(US $26,735.00) 2014 chrysler 300c base(US $29,910.00)

2014 chrysler 300c base(US $29,910.00)

Auto Services in Illinois

Universal Transmission ★★★★★

Todd`s & Mark`s Auto Repair ★★★★★

Tesla Motors ★★★★★

Team Automotive Service Inc ★★★★★

Sterling Autobody Centers ★★★★★

Security Muffler & Brake Service ★★★★★

Auto blog

Lee Iacocca's very first Dodge Viper RT/10 nets $285,500 at auction

Fri, Jan 17 2020The first 1992 Dodge Viper RT/10 to roll down the assembly line, which was snapped up by Chrysler chief Lee Iacocca, yesterday hammered at the Bonhams auction in Arizona for $285,500, more than double the pre-sale estimate. According to a history of the car published by the auction house, Iacocca, in his introduction of the Viper to the press, pointed to the car on stage and said, "This one right here is mine." That historic Viper, with serial number 001, has never been available on the open market, as Iacocca kept the car from new until he passed away last year. The car has been driven just 6,200 miles and was being sold by his estate. Other Lee Iacocca cars offered at the same sale fared less well. A 1986 Chrysler LeBaron Town & Country convertible — the ultimate expression of Iacocca's company-saving K-cars — with 20,500 miles on it sold for $19,040. That's less than the $20,000 to $25,000 the auction house had estimated the car would bring. A third car from the former auto executive's estate was a customized 2009 Ford Mustang. The pony car was one of a limited run of 45 Iacocca-branded custom Mustangs, which were reworked by Metalcrafters and sold by Galpin Ford in Los Angeles. The Iacocca Mustang, never titled and with 220 miles on it, hammered for $49,280. Related Video:   Featured Gallery Lee Iacocca's 1992 Dodge Viper RT/10 View 13 Photos Celebrities Chrysler Dodge Auctions Automotive History

Stellantis to idle Chrysler Pacifica production in wake of chip shortage

Fri, Mar 26 2021Stellantis will idle production of the Chrysler Pacifica at its Windsor, Ontario, facility for several weeks due to the ongoing global chip shortage. The facility will be idled starting Monday. "Stellantis continues to work closely with our suppliers to mitigate the manufacturing impacts caused by the various supply chain issues facing our industry," a Stellantis spokesperson told Autoblog. "Due to the unprecedented global microchip shortage, production at the Windsor Assembly Plant will be down beginning next week through mid April." Automotive production shutdowns continue to mount amid a global microchip shortage brought on by spiking consumer demand across countless industries, production slowdowns due to pandemic restrictions, and untimely natural and man-made disasters. The shortage has put a great deal of pressure on chip producers, especially in Asia. Taiwan’s central role in producing chips has shot into focus during the COVID-19 pandemic, with soaring demand for laptops, tablets and other equipment to power the work-from-home trend benefiting firms like Taiwan Semiconductor Manufacturing Co Ltd (TSMC), the worldÂ’s largest contract chipmaker. Washington has increasingly viewed tech-powerhouse democracy as a key part of its strategy to shift global supply chains away from China, especially when it comes to technology and chip companies. Foreign governments and companies have also beseeched Taiwan to help resolve a shortage of auto chips which have idled factories around the world. U.S. companies are not standing still either. This week, processor giant Intel announced a $20 billion plan to expand its advanced chip manufacturing capacity in Arizona. This article includes reporting by Reuters.

Chrysler recalling 49K Chargers for headlight components

Fri, 14 Mar 2014Chrysler has issued a recall for about 49,375 2011 and 2012 Dodge Chargers with halogen headlamps due to a problem with the lights. The automaker says that there could be an issue with the jumper harness and other related components.

The automaker says that 43,450 cars are affected in the US, 2,850 in Canada, 375 in Mexico and 2,700 outside of North America. The vehicles will have their headlight assemblies, including the jumper harnesses and bulbs, inspected and potentially replaced. Dodge says that its engineers investigated reports of that were similar to what was found when it recalled about 10,000 police Chargers in 2012 for overheating light components. There have been no injuries or accidents related to fault, according to Chrysler.

The automaker will be in contact with affected owners, and schedule the service. Naturally, any repairs will be free of charge. Scroll down for the company's full announcement.