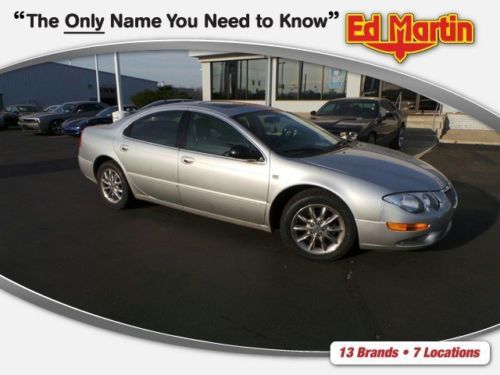

Base 3.5l Cd Front Wheel Drive Leather Moonroof Automatic Power Windows Locks on 2040-cars

Indianapolis, Indiana, United States

Chrysler 200 Series for Sale

2006 chrysler touring 300 series black stretch limo(US $40,000.00)

2006 chrysler touring 300 series black stretch limo(US $40,000.00) 1957 chrysler windsor 2-door hardtop, low miles, wire wheeels!!!(US $39,900.00)

1957 chrysler windsor 2-door hardtop, low miles, wire wheeels!!!(US $39,900.00) 2012 chrysler convertible 200 3.6 touring(US $15,500.00)

2012 chrysler convertible 200 3.6 touring(US $15,500.00) We finance! 3389 miles 2013 chrysler 300 5.7l v8 16v premium

We finance! 3389 miles 2013 chrysler 300 5.7l v8 16v premium We finance! 44914 miles 2011 chrysler 300c 300c 5.7l v8 16v

We finance! 44914 miles 2011 chrysler 300c 300c 5.7l v8 16v Rare 2002 chrysler prowler inca gold only 6,692 miles! one of 583 produced!(US $35,995.00)

Rare 2002 chrysler prowler inca gold only 6,692 miles! one of 583 produced!(US $35,995.00)

Auto Services in Indiana

West Side Auto Collision ★★★★★

V R Auto Repairs ★★★★★

Tri State Battery Supply ★★★★★

Tony Kinser Body Shop ★★★★★

Stanfa Tire & Auto ★★★★★

Speed Shop Motorsports ★★★★★

Auto blog

Chrysler 100 hatchback caught cruising around Santa Monica

Thu, 21 Feb 2013A coming hatchback said to be called the Chrysler 100 has been caught on video traipsing around Santa Monica by Autoblog reader Zach Dillman. Still wearing the scrapyard assemblage of Alfa Romeo Giulietta body panels as it was when spy photographers began capturing it last summer, its arrival date is still a question mark: some outlets have reported that it will go on sale this year, others have said it won't be in showrooms until 2016.

In fact, quite a few questions remain. Based on Fiat's Compact US Wide (CUSW) platform that supports the Dodge Dart and expected to be about the same size, the 100 is thought to be a small premium hatchback that will be priced above the Dart and below the Chrysler 200, with the idea that it can challenge the Ford Focus and Hyunda Elantra at the value end and the Buick Verano and Acura ILX at the premium end. Word is that there will be no sedan version.

It looks like there'll be plenty of gewgaws inside, with buttons for Adaptive Cruise Control, Lane Departure Warning, Forward Collision Warning and a button to toggle the traction control.

The USPS needs 180,000 new delivery vehicles, automakers gearing up to bid

Wed, Feb 18 2015Winning the New York City Taxi of Tomorrow tender was a huge prize for Nissan, even though the company is still working through the process of claiming its prize. The United States Postal Service has begun the process to take bids for a new delivery vehicle to replace the all-too-familiar Grumman Long Life Vehicle, and that will be a much larger plum for the automaker who wins it, perhaps worth more than six billion dollars. The Grumman LLV is an aluminum body covering a Chevrolet S-10 pickup chassis and General Motors' Iron Duke four-cylinder engine. The USPS bought them from 1987 to 1994, and the 163,000 of them still in service are a monumental drain on postal resources: they get roughly ten miles to the gallon instead of the quoted 16 mpg, drink up more than $530 million in fuel each year, and their constant repair needs like the balky sliding door and leaky windshields have led the service to increase the annual maintenance budget from $100 million to $500 million. A seat belt is about as modern as it gets for safety technology, and the USPS says that assuming things stay the same, it can't afford to run them beyond 2017. Last year it put out two triage requests for proposals seeking 10,000 new chassis and drivetrains for the Grumman and 10,000 new vehicles. The LLV is also too small for the modern mail system in which package delivery is growing and letter delivery is declining. The service says it doesn't have a fixed idea of the ideal "next-generation delivery vehicles," but it listed a number of requirements in its initial request and is open to any proposal. Carriers have some suggestions, though, saying they want better cupholders, sun visors that they can stuff letters behind, a driver's compartment free of slits that can swallow mail, and a backup camera. The request for information sent to automakers pegs the tender at 180,000 vehicles that would cost between $25,000 and $35,000 apiece, and it will hold a conference on February 18 to answer questions about the contract. GM is the only domestic maker to avow an interest, while Ford and Fiat-Chrysler have remained cagey. Yet with a possible $6.3 billion up for grabs and some new vans for sale that would be advertised on every block in the country, we have a feeling everyone will be listening closely come February 18. We also have a feeling the LeMons series is going to be flooded with Grummans come 2017. News Source: Wall Street Journal, Automotive News - sub.

Auto bailout cost the US goverment $9.26B

Tue, Dec 30 2014Depending on your outlook, the US Treasury's bailout of General Motors, Chrysler (now FCA) and their financing divisions under the Troubled Asset Relief Program was either a complete boondoggle or a savvy move to secure the future of some major employers. Regardless of where you fall, the auto industry bailout has officially ended, and the numbers have been tallied. Of the $79.69 billion that the Feds invested to keep the automakers afloat, it recouped $70.43 billion – a net loss of $9.26 billion. The final nail in the coffin for the auto bailout came in December 2014 when the Feds sold its shares in Ally Financial, formerly GMAC. The deal turned out pretty good for the government too because the investment turned a 2.4 billion profit. The actual automakers have long been out of the Treasury's hands, though. The current FCA paid back its loans six years early in 2011, the Treasury sold of the last shares of GM in late 2013. According to The Detroit News, the government's books actually show an official loss on the auto bailouts of $16.56 billion. The difference is because the larger figure does not include the interest or dividends paid by the borrowers on the amount lent. While it's easy to see fault in any red ink on the Feds' massive investment, the number is less than some earlier estimates. At one time, deficits around $44 billion were thought possible, and another put things at a $20.3 billion loss. Outside of just the government losing money, the bailouts might have helped the overall economy. A study from the Center for Automotive Research last year estimated that the program saved 2.6 million jobs and about $284.4 billion in personal wealth. It also indicated that the Feds' reduction in income tax revenue alone from Chrysler and GM going under could have been around $100 billion for just 2009 and 2010, significantly more than any loss in the bailout.