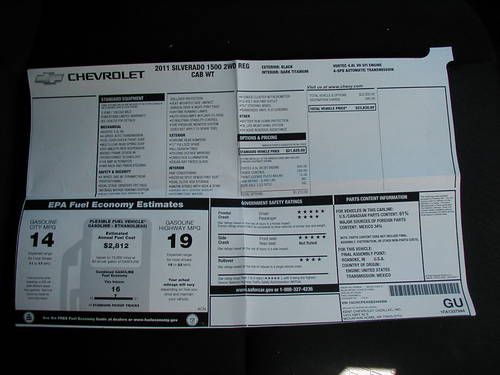

2011 Chevrolet Silverado 1500 Lt Standard Cab Pickup 2-door 4.8l on 2040-cars

Derby, Kansas, United States

Body Type:Standard Cab Pickup

Engine:4.8L 294Cu. In. V8 FLEX OHV Naturally Aspirated

Vehicle Title:Clear

Fuel Type:FLEX

Interior Color: Black

Make: Chevrolet

Number of Cylinders: 8

Model: Silverado 1500

Trim: LT Standard Cab Pickup 2-Door

Warranty: Vehicle has an existing warranty

Drive Type: RWD

Mileage: 4,424

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Sub Model: Silverado

Power Options: Air Conditioning, Cruise Control

Exterior Color: Black

Chevrolet Silverado 1500 for Sale

Custom lifted chevy silverado 1500hd 4x4 fabtech steel bumper changer 20 wheels(US $14,995.00)

Custom lifted chevy silverado 1500hd 4x4 fabtech steel bumper changer 20 wheels(US $14,995.00)

2005 chevrolet silverado c1500(US $2,900.00)

2005 chevrolet silverado c1500(US $2,900.00) 2010 ltz 4x4 used 5.3l v8 16v automatic 4wd onstar bose(US $28,750.00)

2010 ltz 4x4 used 5.3l v8 16v automatic 4wd onstar bose(US $28,750.00) 2013 chevrolet silverado 1500 ltz 4x4 6-speed crew cab truck loaded immaculate!!

2013 chevrolet silverado 1500 ltz 4x4 6-speed crew cab truck loaded immaculate!! 2010 crew cab, short box, 4x4, tow hitch, spray liner, chrome tube steps, cd

2010 crew cab, short box, 4x4, tow hitch, spray liner, chrome tube steps, cd

Auto Services in Kansas

Topeka Battery Co ★★★★★

Tim Worthy`s Transmission Repair ★★★★★

Susquehanna Auto Clinic ★★★★★

O`Reilly Auto Parts ★★★★★

Outlaw Auto Sports ★★★★★

Olathe Auto Paints & Supplies Inc ★★★★★

Auto blog

GM extends production at Detroit factory until early 2020

Fri, Feb 22 2019General Motors Co said on Friday it had extended the production at its Detroit Hamtramck plant until January 2020, against an earlier plan to discontinue production in June this year. The No.1 U.S. automaker is revamping its operations, which include plant closures and thousands of job cuts, as it looks to boost profitability in the wake of declining U.S. auto sales. The Hamtramck plant will continue to produce the Chevrolet Impala and Cadillac CT6 sedans until early next year, the company said. "We are balancing production timing while continuing the availability of Cadillac advanced technology features currently included in the CT6-V — the Blackwing Twin-Turbo V-8 (engine) and Super Cruise (driver assistance system)," GM said. The plant has already discontinued production of the Buick LaCrosse sedan and Chevrolet Volt electric hybrid car. Detroit-based union United Auto Workers' President Gary Jones said GM's decision to continue production at the plant was a relief for the workers as well as their families. "We commend GM for today's decision and we reiterate the importance of a collective bargaining process in times like these," Jones said. Reporting by Ankit Ajmera. Related Video:

The Tesla Model S was the best-selling EV of 2015

Thu, Jan 14 2016According to numbers crunched over at Hybrid Cars, the Tesla Model S was the best selling pure electric vehicle last year with 50,366 deliveries. These numbers might not tell the whole story, since Tesla reports deliveries made in 2015 that might have been sold in a different calendar year, while other makers are tallying sales. However, it's inarguable that the Model S ended up in more worldwide driveways than the second-place Nissan Leaf, which did about 43,000 sales. In the US alone, Leaf sales were down 42.8 percent year-on-year, from 30,200 in 2014 to 17,269 last year, and that decline also increased throughout the year. That marks a great finish to a great start to 2015, when Tesla took the lead in EV sales in the US for the first quarter. On top of that, as of last year the Model S becomes the second-best selling EV ever, with 107,148 deliveries since the middle of 2012. It trails the Nissan Leaf, with well over 200,000 worldwide sales. The Chevrolet Volt/Opel Ampera combo takes a close third, with about 106,000 sales. The Nissan and Chevy rivals both launched at the end of 2010, a 16-month head start on the Tesla. Down the charts, the Mitsubishi Outlander PHEV which continues to be forbidden fruit for our market notched 39,000 sales. The BYD Qin PHEV sold 31,898 examples in China, and BYD would take the overall victory from Tesla with 58,728 deliveries if you counted all of its EV and PHEV production, such as its electric buses. The BMW i3 nabbed fourth place with 24,057 global sales. In 2011 the Munich automaker said it wanted to sell 30,000 i3s annually by 2014, but by the time the car launched the company considered 15,000 annual sales 'great for now,' so the 2015 number seems a fine place to wind up. Related Video: News Source: Hybrid Cars Green BMW Chevrolet Mitsubishi Nissan Tesla

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.