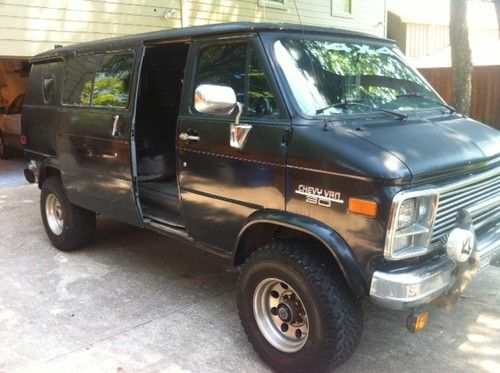

1990 Chevy Van Mark Iii (46000 Miles) on 2040-cars

Lansing, Michigan, United States

Engine:5.7 LITER

For Sale By:Private Seller

Vehicle Title:Clear

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows

Model: G20 Van

Mileage: 46,469

Year: 1990

Trim: burgundy

Options: Cassette Player

Drive Type: rear wheel drive

This Chevy van is our baby! It is a 8 cylinder chevy 5.7 liter Mark III. My father purchased this brand new in 1990 and has treated it like his baby. The Chevy Van has 46000 miles on it and it is all highway miles. We only drove this van for vacations. I have replaced the ac condenser, muffler, air filter, and serpentine belt. It drives fantastic. The tires are nailguard tires and very brand new. The only damage is a slightly bent wheel well when a tire blew out 15 years ago. The bottom of the van has a Ziebart rust prevention coat my father put on years ago and that has kept it in great shape. This is a great find and will make a family or tailgater, or lover of chevy's very happy. In two years it will be a classic!! It has a cooler built in and the backseat becomes a bed.

Chevrolet G20 Van for Sale

Professionally modified extended roof van w/wheelchair lift and hand brakes

Professionally modified extended roof van w/wheelchair lift and hand brakes 1971 chevy beauville sportvan g20 v8 low mileage classic excellent condition

1971 chevy beauville sportvan g20 v8 low mileage classic excellent condition 1995 chevrolet g20 chruch van 15 passenger only 40k right miles no reserve!!!!

1995 chevrolet g20 chruch van 15 passenger only 40k right miles no reserve!!!! 1979 chevy chevrolet 4x4 g20 van

1979 chevy chevrolet 4x4 g20 van 1991 chevy g20 conversion van 350 v8 5.7 l low miles $1900 obo(US $1,900.00)

1991 chevy g20 conversion van 350 v8 5.7 l low miles $1900 obo(US $1,900.00) 1994 sherrod conversion van g20

1994 sherrod conversion van g20

Auto Services in Michigan

Welch Auto Parts Inc ★★★★★

Wear Master ★★★★★

Walsh`s Service ★★★★★

Vehicle Accessories ★★★★★

Tuffy Auto Service Centers ★★★★★

Town And Country Auto Service Center LLC ★★★★★

Auto blog

Is Buick's surprise Detroit concept a Camaro-sized coupe?

Sun, Jan 10 2016Tomorrow night marks the unofficial start of the 2016 Detroit Auto Show. Keep your eyes peeled for a number of reveals, including a surprise debut from Buick. Yes, Buick. And we think it's going to be something really hot. According to a report from Bloomberg, the Tri-Shield's secret car could be a Camaro-sized sport coupe concept. As Bloomberg explains, it'd certainly gel with the impression the company is trying to put out – that it's no longer a brand for those with one foot in the grave. Introducing a sports coupe, even as a concept, could certainly reinforce that message. And if it happens to make production – which is not a certainty, Bloomberg's secret source says – it could certainly help Buick drive its average buyer age down from 59. Bloomberg doesn't offer any speculation on Buick's new coupe, but we have no problem making educated guesses. Our most reliable conjecture is this: it will ride on General Motors' Alpha platform, which underpins both the Camaro and the Cadillac ATS. And with a certain twin-turbocharged V6 in the GM stable, we've got an idea of what kind of engine could be shown. That speculation will have to suffice for now. But don't worry, we'll have official details, live images, and video tomorrow when Buick unveils its new concept in Detroit's Eastern Market.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

Weekly Recap: The implications of strong new car sales

Sat, Jun 6 2015New car sales are on a roll in the United States this year, and analysts are optimistic the industry will maintain its torrid pace. Sales increased 1.6 percent in May and reached an eye-popping seasonally-adjusted selling rate of 17.8 million, the strongest pace since July 2005, according TrueCar research. That positions the industry for one of its strongest years ever, as consumer confidence, low interest rates, low fuel costs, and an influx of new products propel gains. In addition to the positive economic factors, May also featured warmer weather across much of the US, an extra weekend, and it came on the heels of relatively weak April sales. Analysts suggest income tax refunds and the promise of summer driving and vacations also traditionally help May sales. "While 2015 will be one of the best years in the history of the US industry, in some ways it may be the very best ever," IHS Automotive analyst Tom Libby wrote in a commentary. "Not only are new vehicle registration volumes approaching the record levels of the early 2000s, but now registrations and production capacity are much more closely aligned so the industry is much more healthy." Capacity, an indicator of the auto sector's health, is also expected to grow. Morgan Stanley predicts it will eventually hit at least 20 million units per year, as many companies, including General Motors, Ford, Tesla, and Volvo are investing in new or upgraded factories. "The best predictor of US auto sales is the growth in capacity, and frankly, we're losing count of all of the additions – there's literally something new and big every week," Morgan Stanley said in a research note. Transaction prices, another telling indicator, also continue to show strength. They rose four percent in May to $32,452 per vehicle, and incentives dropped $10 per vehicle to $2,661, TrueCar said. "New vehicle sector and segment preference indicates consumers are confident about the economy and their finances," TrueCar president John Krafcik said in a statement. Still, Morgan Stanley noted the robust sales did little to immediately impact automaker stock prices and suggested it might be a prime time to sell if sales reach the 18-million pace. "Perhaps the biggest reason may be that investors have seen this movie before," the firm wrote.