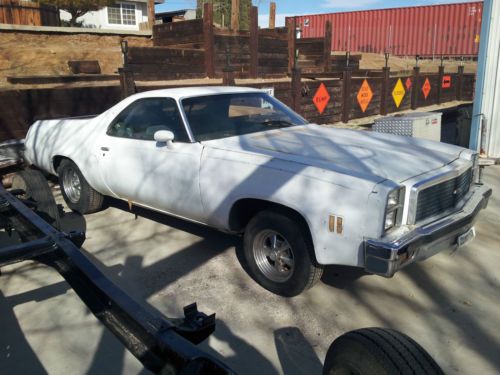

1985 Chevrolet El Camino Conquista Standard Cab Pickup 2-door 5.0l on 2040-cars

Bluffton, South Carolina, United States

Transmission:Automatic

Engine:5.0L 305Cu. In. V8 GAS OHV Naturally Aspirated

Vehicle Title:Clear

For Sale By:Private Seller

Body Type:Standard Cab Pickup

Year: 1985

Make: Chevrolet

Mileage: 125,000

Model: El Camino

Interior Color: Black

Trim: Conquista Standard Cab Pickup 2-Door

Warranty: Vehicle does NOT have an existing warranty

Drive Type: RWD

Number of Cylinders: 8

|

Chevrolet El Camino for Sale

1959 elcamino pro street extremely well build old school street rod muscle(US $25,900.00)

1959 elcamino pro street extremely well build old school street rod muscle(US $25,900.00) 1964 chevrolet custom pro street el camino(US $29,900.00)

1964 chevrolet custom pro street el camino(US $29,900.00) 1977 chevy el camino for parts(US $500.00)

1977 chevy el camino for parts(US $500.00) 1971 original california truck with over $14k spent in restoration costs in 2009(US $16,500.00)

1971 original california truck with over $14k spent in restoration costs in 2009(US $16,500.00) 1969 chevrolet chevelle ss el camino ss396 numbers matching 396(US $13,000.00)

1969 chevrolet chevelle ss el camino ss396 numbers matching 396(US $13,000.00) 1972 chevrolet el camino chevy 350 crate engine hotchkiss suspension '72

1972 chevrolet el camino chevy 350 crate engine hotchkiss suspension '72

Auto Services in South Carolina

X-Treme Audio Inc ★★★★★

Wingard Towing Service ★★★★★

Threlkeld Inc ★★★★★

TCB Automotive & Towing ★★★★★

Rothrock`s Garage ★★★★★

Reynolds Service Center ★★★★★

Auto blog

GM profit dips on truck changeover, but beats estimates

Thu, Apr 26 2018DETROIT — General Motors on Thursday reported a higher-than-expected quarterly profit despite a drop in production of high-margin pickup trucks, as it gears up for new models that are expected to boost profits next year. Like rivals Ford and Fiat Chrysler Automobiles, GM is banking on highly-profitable Chevy Silverado and GMC Sierra pickup trucks to lift profits, as consumers shift away from traditional passenger cars in favor of these larger, more comfortable trucks, SUVs and crossovers. During the first quarter, the process of changing over to GM's new pickups resulted in a drop in production of 47,000 units. GM Chief Financial Officer Chuck Stevens said the production drop had resulted in a drop in pre-tax profit of up to $800 million. Earlier this year, GM said its 2018 profits would be flat compared with 2017, but expected its all-new pickup trucks would boost margins starting in 2019. On Thursday, GM reiterated its full-year 2018 forecast for adjusted earnings in a range from $6.30 to $6.60 per share. The automaker said capital expenditures were more than $500 million higher in the quarter because of investments its new pickup trucks and a family of low-cost vehicles under development with Chinese partner SAIC Motor Corp. On Wednesday, rival Ford said it would stop investing in most traditional passenger sedans in North America. CFO Stevens told reporters on Thursday that GM has "already indicated that we will make significantly lower investments on a go-forward basis" in sedans. 2019 GMC Sierra View 21 Photos GM benefited from a lower effective tax rate in the quarter, but adjusted pre-tax margin fell to 7.2 percent from 9.5 percent a year earlier. Stevens said the company's profit margin should hit 10 percent or higher in the second quarter and for the full year. GM said material costs were $700 million higher in the first quarter, and it expects those costs to continue rising. The automaker said it would counter those increases with cost cutting measures. "It is a more difficult environment than it was three or four months ago," Stevens said when asked about rising commodity prices from potential steel and aluminum tariffs announced by the Trump administration. "But we are confident we can continue to offset that." The company reported quarterly net income of $1.05 billion or $1.43 per share, a drop of nearly 60 percent from $2.61 billion or $1.75 per share a year earlier. Analysts had on average expected earnings per share of $1.24.

GM raises 2023 guidance on strong sales, higher profits

Tue, Apr 25 2023General Motors beat first-quarter profit estimates and raised its full-year earnings and cash-flow guidance after vehicle demand at the start of the year surpassed expectations. Its shares rose in premarket trading. GM made $2.21 a share in adjusted profit in the first quarter, compared to a consensus forecast of $1.72 a share. Revenue rose 11% to $39.99 billion, it said Tuesday, which was more than the $39.24 billion analysts expected. The stronger results stem from rising sales in the US, even in the face of higher interest rates and inflation. GM executives said demand was strong enough to revise 2023 guidance upward, boosting profit estimates for the year by $500 million to between $11 billion and $13 billion. “We did it with strong production and inventory discipline and consistent pricing,” GM Chief Financial Officer Paul Jacobson said on a call with journalists. “All in all, weÂ’re feeling confident about 2023.” The Detroit automaker raised per-share full-year guidance to between $6.35 and $7.35, up from $6 to $7 a share, and said free cash flow would also increase by $500 million to a range of $5.5 billion to $7.5 billion. GMÂ’s shares pared a gain of as much as 4.4% before the start of regular trading Tuesday, rising 3.5% to $35.50 as of 6:55 a.m. in New York. The stock was up 1.9% for the year as of the close on Monday. North American Strength The automakerÂ’s sales were particularly strong in North America, where first-quarter earnings rose before interest and taxes rose to $3.6 billion. Vehicle sales rose 18% to 707,000 in the region. Jacobson said the company originally expected to sell 15 million vehicles in the US this year, slightly less than the 15.5 million annualized rate automakers foresaw in the first quarter. North American demand was enough to offset a weak performance in China, GMÂ’s second-largest market. The automaker continues to struggle in the country, where its vehicle sales fell 25% to 462,000 vehicles in the quarter. Profits from its joint ventures in the market slumped 65% to $83 million. The market has struggled overall in the wake of Covid-19 restrictions and foreign automakers have had to overcome a growing preference for Chinese brands by competing on price, squeezing profit margins. The situation in China probably wonÂ’t significantly improve until the second half of the year, according to Jacobson. GM remains on target to sell 150,000 electric vehicles this year, the CFO said.

GM says safety is a reason it's dropping Apple CarPlay, Android Auto

Tue, Dec 12 2023Update: GM sent us a statement as a follow-up to its original comments seen in this post: "We wanted to reach out to clarify that comments about GM's position on phone projection were misrepresented in previous articles and to reinforce our valued partnerships with Apple and Google and each company’s commitment to driver safety. GM's embedded infotainment strategy is driven by the benefits of having a system that allows for greater integration with the larger GM ecosystem and vehicles." The original story can be read in its entirety below.  General Motors announced its intention to remove Apple CarPlay and Android Auto functionality from its upcoming EVs earlier this year, and internet comments sections haven't been kind since. As the first of many EVs to follow – the 2024 Chevrolet Blazer EV – hits the market, GM is expanding on its initial explanations for dropping the tech. Motor Trend spoke with Tim Babbit, GMÂ’s head of product for infotainment, to learn more. Attributed to Babbit, from the story: “They have stability issues that manifest themselves as bad connections, poor rendering, slow responses, and dropped connections. And when CarPlay and Android Auto have issues, drivers pick up their phones again, taking their eyes off the road and totally defeating the purpose of these phone-mirroring programs. Solving those issues can sometimes be beyond the control of the automaker.” Babbit suggests that a world without Apple CarPlay or Android Auto will be a safer one, as folks wonÂ’t be looking to control their infotainment systems via their phones. However, Babbit also tells MT that this theory hasnÂ’t been tested in either the lab or the real world yet. Instead of using a navigation or music-playing app powered through your phone, upcoming GM EVs will use a Google-based infotainment system called “Ultifi” that runs a ton of integrated Google apps. Google Maps will be the native navigation app in the system; youÂ’ll be able to log in to Spotify or other apps to load your music up, and so on. The idea here is that youÂ’ll have all the same apps that were on your phone available but integrated within the infotainment system instead, and you'll be able to use voice controls to control every last bit of it with no need to reach for a phone. That sounds amenable in theory, but how consumers react to the removal of a feature that they know and love now is a risky gamble.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.032 s, 7923 u