Chevrolet Corvette 3lt on 2040-cars

Miami, Florida, United States

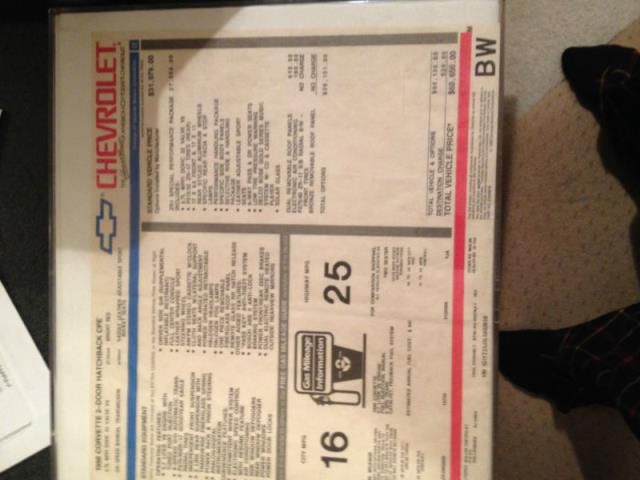

This 2014 Chevrolet Corvette 3LT is practically brand new. Only 4,241 miles on this garage kept beauty.Majority of those mile being highway mileage

Chevrolet Corvette for Sale

Chevrolet corvette zr1(US $14,000.00)

Chevrolet corvette zr1(US $14,000.00) Chevrolet corvette 2lz(US $23,000.00)

Chevrolet corvette 2lz(US $23,000.00) Chevrolet corvette(US $12,000.00)

Chevrolet corvette(US $12,000.00) Chevrolet corvette 2- door coupe(US $2,000.00)

Chevrolet corvette 2- door coupe(US $2,000.00) Chevrolet corvette z51/3lt(US $19,000.00)

Chevrolet corvette z51/3lt(US $19,000.00) Chevrolet corvette convertible(US $2,000.00)

Chevrolet corvette convertible(US $2,000.00)

Auto Services in Florida

Xtreme Car Installation ★★★★★

White Ford Company Inc ★★★★★

Wheel Innovations & Wheel Repair ★★★★★

West Orange Automotive ★★★★★

Wally`s Garage ★★★★★

VIP Car Wash ★★★★★

Auto blog

Ford Bronco, Bronco Sport, sub-Ranger pickup and GM EVs | Autoblog Podcast #618

Thu, Mar 12 2020In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Green, John Beltz Snyder and Road Test Editor Zac Palmer. Top of the list this week are the leaked photos of the 2021 Ford Bronco and Bronco Sport. Then they talk about the possibility of a small Ford pickup based on the Focus, as well as all the electric vehicles Snyder saw in person at GM's "EV Day." The editors have been driving the Ram Power Wagon and Hyundai Sonata, and Palmer took Autoblog's long-term Subaru Forester to New Orleans. Finally, they help a listener choose a small luxury crossover in this week's "Spend My Money" segment. then, just as they're about to wrap up the show, they learn that the 2020 New York Auto Show has been postponed due to the coronavirus outbreak. Good times. Autoblog Podcast #618 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown 2021 Ford Bronco and Bronco Sport leaked photos (and, just as we predicted, more photos) Ford shows its dealers the sub-Ranger pickup More details about everything we saw at GM's "EV Day" Driving the 2020 Ram 2500 Power Wagon Driving the 2020 Hyundai Sonata Driving our long-term 2019 Subaru Outback to New Orleans Spend My Money: Audi Q3, Volvo XC40 or Range Rover Evoque? 2020 New York International Auto Show postponed Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video:

Best midsize trucks for 2024

Mon, Jun 17 2024Pickup trucks are hugely popular in the United States, but most of them carry huge dimensions and huge price tags to match. That's where the rapidly expanding midsize truck market comes into play. With options from nearly every major manufacturer in America, there are plenty of midsize trucks to consider, but the best midsize pickup trucks are more comfortable, more capable off-road or more luxurious than the rest of the crowd. Put simply, there's an excellent midsize truck for every buyer, whether they want to save money with a low starting price and strong efficiency, tackle technical trails, surround themselves with leather and wood or even hit the road with the wind in their hair on their way to the beach. We've tested all of the midsize trucks in America available for 2024 and picked out the best choices for any type of buyer. Read on to find out which option is the best midsize truck for you for 2024 or 2025 (expect more versions of the Toyota Tacoma and Jeep Gladiator in 2025, too). If you're needs don't require a midsize truck, you may want to consider a compact. There are only two for sale in 2024, and we break down our rankings here.  Best midsize trucks for 2024 2024 Chevrolet Colorado Why it stands out: Good ride, handling; powerful engines; strong towing; refined interior; Google infotainment Could be better: Only one cab/bed combination (four door, short bed) Starting Price: $31,095 Read our most recent Chevrolet Colorado review Suffice it to say, we're big fans of the latest Chevy Colorado. In fact, we think the Colorado is the best midsize pickup truck in America overall. Thanks to the base WT offering, the starting price is reasonable, but the Colorado is really at its best in one of its more specialized forms. The Trail Boss expands its off-road capabilities with a suspension lift and chunky tires, the ZR2 adds an even larger suspension lift and a gaggle of off-road special bits and the ZR2 Bison tops the range with sensational Multimatic DSSV spool-valve dampers, special bumpers and underbody cladding for rock-crawling prowess. In between those specialist packages lie the LT and Z71 trims, which is what will make up the majority of sales. A low-power turbocharged 2.7-liter four-cylinder making 237 horsepower and 259 pound-feet of torque is standard, while the more common engine is a more powerful version with 310 HP and 390 lb-ft. A High-Output engine option keeps the same 310 HP but boosts torque to 430 lb-ft.

GM under fire from safety advocates over braking problem caused by recall fix

Thu, Feb 6 2020Safety experts are lambasting General Motors over what they say is the automaker’s slow notification of owners of certain 2019 sedans and trucks that a recall fix could cause power braking to fail and increase the risk of a crash, the Detroit Free Press reports. GMÂ’s original recall in December targeted about 550,000 Cadillac CT6 sedans and Chevrolet Silverado 1500 and GMC Sierra 1500 pickups, all from the 2019 model year, over potentially defective electronic stability control and antilock brakes. In that case, GM said the errors would not show up as a diagnostic warning on the instrument cluster. But after GM had done recall work on 162,000 vehicles, about 1,700 owner have complained that their power brakes didnÂ’t work after they had the recall done and then used the OnStar app to start their vehicle. GM then issued a supplemental fix for customers whoÂ’d already had their vehicles serviced. In this case, a diagnostic warning should illuminate saying either “Service Brake Assist” or “Service ECS,” which GM says is a signal that a customer should not drive the vehicle and instead call their dealer, which will tow the vehicle and have it repaired. Safety advocates say the automaker hasnÂ’t gone far enough to protect customers. “The fact that you could potentially start a vehicle and not have brakes is a pretty risky proposition,” Sean Kane, president of the Safety Research and Strategies, which works on auto issues for plaintiffs and governmental organizations, told the Freep. “The fact that they wouldnÂ’t notify owners (sooner) is pretty stunning.” GM told the Freep it was required to notify the National Highway Traffic Safety Administration and file paperwork before it notified customers about the original recall, which was made Dec. 12. It then had to investigate and resolve the problem created by its original recall fix before alerting customers. GMÂ’s call center and dealers are contacting the remaining 900 customers who havenÂ’t yet had the update made to the original recall repair. GM also hired a vendor to send recall letters to the 550,000 customers affected by the original recall notifying them about the update. There are no known injuries or deaths related to the problem. Read the Freep story here.