1970 - Chevrolet Chevelle on 2040-cars

Largo, Florida, United States

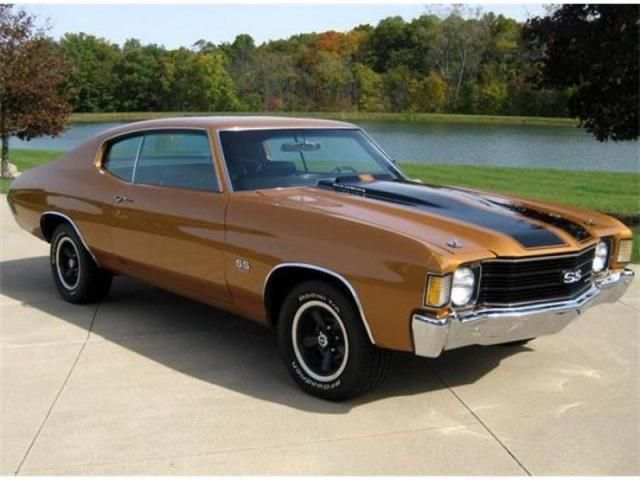

This is a clean 1970 Chevelle SS 396/4speed. Car is a perfect driver with all items working. A/C is cold. I am currently finishing the engine area to bring it back to factory. The car has a operating cowl induction, factory a/c with a Muncie Four Speed. Engine and rear are matching however the trans, is date coded. Car is garaged and covered. Paint is perfect. Any items I could leave original I did Like the window cranks,they should be clear but these are yellowed from age. If you looking for a great driving Chevelle at a great price you need to see this car. The work in the engine area will be completed end of January. I have all the parts to complete just finding the time. The car can be sold as is perfect running with the parts I have.

Chevrolet Chevelle for Sale

1968 - chevrolet chevelle(US $7,000.00)

1968 - chevrolet chevelle(US $7,000.00) 1971 - chevrolet chevelle(US $9,000.00)

1971 - chevrolet chevelle(US $9,000.00) 1969 - chevrolet chevelle(US $10,000.00)

1969 - chevrolet chevelle(US $10,000.00) 1969 - chevrolet chevelle(US $11,000.00)

1969 - chevrolet chevelle(US $11,000.00) 1972 - chevrolet chevelle(US $25,000.00)

1972 - chevrolet chevelle(US $25,000.00) 1972 - chevrolet chevelle(US $8,000.00)

1972 - chevrolet chevelle(US $8,000.00)

Auto Services in Florida

Zeigler Transmissions ★★★★★

Youngs Auto Rep Air ★★★★★

Wright Doug ★★★★★

Whitestone Auto Sales ★★★★★

Wales Garage Corp. ★★★★★

Valvoline Instant Oil Change ★★★★★

Auto blog

How real is the Chevy Bolt EV and will it really cost $30,000?

Tue, Jan 13 2015"This is us bragging that we can do this kind of car." That's how Michael Simcoe, GM's executive director for NA exteriors, described the Chevy Bolt EV concept, which made a surprise appearance at the Detroit Auto Show today. While there was talk of a 2017 production debut, this is for sure a concept vehicle. But that means the ideas behind the vehicle are perhaps more important than the details. For example, no one is talking about what size battery might appear in a production Bolt, but Simcoe would talk about how rapid progress in battery improvements made it possible for GM to make the bold Bolt declaration that promises 200 miles and a price tag of around $30,000 (after incentives). But if the Bolt makes it to market, it won't be until 2017 (as rumored) or later, is it really fair to promote the car as being available with a federal tax credit? For one thing, credits for plug-in vehicles may change in the next few years, but if the laws stay the same, each manufacturer is limited to 200,000 vehicles before the credits start to decline. GM is justifiably proud that it's sold over 70,000 Volts thus far, but with a new model coming out later this year and a few years to go until the Bolt potentially arrives, GM could be pushing right up against that 200,000 limit when the Bolt goes on sale. But Volt executive chief engineer Pam Fletcher told AutoblogGreen that, "We're just trying to take some of the confusion out." "Think about talking to the average consumer," she said. "First, going through the explanation of how the federal tax credit was set up, how it's being used and so on. [In the industry, we] have the luxury of understanding the nuances of that regulation, but right now people who aren't in the marketplace, they don't have the luxury of all that. It's already hard to communicate the details so we gave them data in a way that is what they're used to seeing." There was one question that drove the two-year Bolt gestation and design period, Simcoe said: What does a better battery offer a vehicle designer? "We've got a number of spaces we play in for powertrain technology and obviously electrification is one of them," he said. "With Volt 1 and then the Spark EV, with that development and batteries getting better for us, we started doing some practical packaging to deliver a vehicle which was not the traditional aero form which you see around electric vehicles.

GM won't pay owners of recalled cars for lost value

Thu, 12 Jun 2014Kenneth Feinberg, the man in charge of the General Motors compensation fund dealing with the its widespread ignition switch woes, has issued an informal, two-letter response to the plaintiffs in more than 70 lawsuits seeking redress for lost resale value of their Cobalts: "No." The cases were recently combined into one, but Feinberg told The Detroit News that the fund will deal "only with death and physical injury claims," and that "perceived diminished value" will get no consideration.

ALG, the firm specializing in establishing residual values, determined that Cobalt owners had lost $300 compared to the segment competition and doesn't envision any long-term effects from the recall situation. Feinberg's statement comes in advance of public details on how the compensation fund will work and adheres to GM's long-held position on the matter. The company has already asked a judge to throw out such suits using the pre-bankruptcy defense, even as it stopped using that defense in cases of injury and death.

With plenty of potential gain from the GM suit, however, don't expect the plaintiffs to give up yet. When Toyota was sued for the same reason during the unintended acceleration debacle, it eventually settled the case for between $1 billion and $1.4 billion just to get it over with. Since the 85 law firms involved in the Toyota litigation took home more than $250 million of that total, we shouldn't expect the attorneys to give up on a GM payout, either.

GM earnings rise 1% as buyers pay more for popular pickups

Thu, Aug 1 2019DETROIT — General Motors said Thursday that higher prices for popular pickup trucks and SUVs helped overcome slowing global sales and profit rose by 1% in the second quarter. The Detroit automaker said it made $2.42 billion, or $1.66 per share, from April through June. Adjusting for restructuring costs, GM made $1.64 per share, blowing by analyst estimates of $1.44. Quarterly revenue fell 2% to $36.06 billion, but still beat estimates. Analysts polled by FactSet expected $35.97 billion. Global sales fell 6% to 1.94 million vehicles led by declines in North America and Asia Pacific, Middle East and Africa. The company says sales in China were weak, and it expects that to continue through the year. In the United States, customers paid an average of $41,461 for a GM vehicle during the quarter, an increase of 2.2%, as buyers went for loaded-out pickups and SUVs, according to the Edmunds.com auto pricing site. The U.S. is GM's most profitable market. Chief Financial Officer Dhivya Suryadevara said she expects the strong pricing to continue, especially as GM rolls out a diesel pickup and new heavy-duty trucks in the second half of the year. "We think the fundamentals do remain strong, especially in the truck market," she said, adding that strength in the overall economy and aging trucks now on the road should help keep the trend going. Light trucks accounted for 83.1% of GM's sales in the quarter, and pickup truck sales rose 8.5% as GM transitioned to new models of the Chevrolet Silverado and GMC Sierra, according to Edmunds, which provides content to The Associated Press. As usual, GM made most of its money in North America, reporting $3 billion in pretax earnings. International operations including China broke even, while the company spent $300 million on its GM Cruise automated vehicle unit. Its financial arm made $500 million in pretax income. Suryadevara said GM saw $700 million in savings during the quarter from restructuring actions announced late last year that included cutting about 8,000 white-collar workers through layoffs, buyouts and early retirements. The company also announced plans to close five North American factories, shedding another 6,000 jobs. About 3,000 factory workers in the U.S. whose jobs were eliminated at four plants will be placed at other factories, but they could have to relocate. GM expects the restructuring to generate $2 billion to $2.5 billion in annual cost savings by the end of this year.