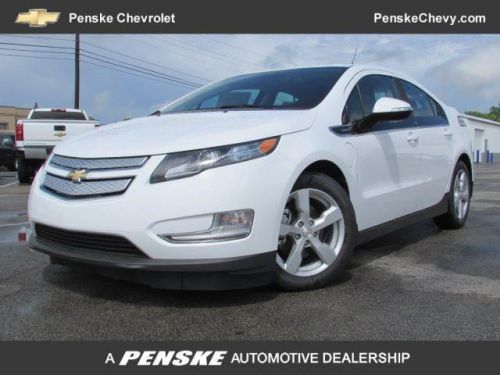

2014 Chevrolet Volt Base on 2040-cars

3210 East 96th Street, Indianapolis, Indiana, United States

Engine:Electric

Transmission:1-Speed Automatic

VIN (Vehicle Identification Number): 1G1RA6E4XEU166196

Stock Num: EU166196

Make: Chevrolet

Model: Volt Base

Year: 2014

Exterior Color: Summit White

Interior Color: Pebble Beige

Options: Drive Type: FWD

Number of Doors: 4 Doors

OUR OFFERINGS THE PENSKE PROMISE - The value added customer experience that makes a difference to you. At every turn we are providing confidence in the ownership life-cycle of your vehicle. Whether you decide to purchase, own, or part with your vehicle, you can be assured that the Penske Promise has your best interest in mind. The Penske Promise. Only at Penske Chevrolet. Confidence with every turn. The value added customer experience that makes a difference to you. At every turn we are providing confidence. Please confirm the accuracy of the included equipment by calling us prior to purchase - This 2014 Chevrolet Volt 4dr 5dr HB Hatchback features a Engine, Range Extender, 1.4L Internal Combustion E 4cyl Gasoline engine. It is equipped with a Automatic transmission. The vehicle is SUMMIT WHT with a PEB BGE/DK ACC PREM interior. It is offered with a full factory warranty. - - This vehicle is just a small representation of our inventory. We have many similar vehicles to the one you are looking for available. Please call me to discuss all your options. 99% Approval at www.penskeapproved.com. Pricing includes all applicable rebates. Rebates may vary depending on model. Express Price may not be valid with some offers. Other restrictions may apply.

Chevrolet Volt for Sale

2014 chevrolet volt base(US $33,645.00)

2014 chevrolet volt base(US $33,645.00) 2014 chevrolet volt base(US $32,140.00)

2014 chevrolet volt base(US $32,140.00) 2014 chevrolet volt base(US $33,385.00)

2014 chevrolet volt base(US $33,385.00) 2014 chevrolet volt base(US $33,400.00)

2014 chevrolet volt base(US $33,400.00) 2014 chevrolet volt base(US $33,885.00)

2014 chevrolet volt base(US $33,885.00) 2014 chevrolet volt base(US $34,715.00)

2014 chevrolet volt base(US $34,715.00)

Auto Services in Indiana

Wilson`s Transmission ★★★★★

Westside Motors ★★★★★

Tom Roush Mazda ★★★★★

Tom & Ed`s Autobody Inc ★★★★★

Seniour`s Auto Salvage ★★★★★

Ryan`s Radiator & Auto Air Service ★★★★★

Auto blog

Chevy reveals new IndyCar aero package

Tue, Feb 17 2015The IndyCar Series is not one that demands its participating teams and automakers to design their own chassis as they do in Formula One, but for this season, the organizers have opened it up to allow for custom aero packages. What you're looking at here is the new look of the chassis to be fielded by teams running under Chevy power. Based on the Dallara DW12 chassis – introduced three years ago and named after the late Dan Wheldon – Chevy's new package is designed for road courses and short ovals, with the speedway configuration to be revealed later. The kit features new wings front and rear and more sculpted side pods. It's also got new wedges at the back to envelop the otherwise open wheels that are a hallmark of Indy racing, a more streamlined engine cover and bigger rear bumper pods. The new package will debut at the Grand Prix of St. Petersburg that will kick off this year's championship in Florida on March 29, followed by the road-course grands prix in Louisiana, Long Beach, Alabama and Indianapolis before the new package needs to be ready for the Indy 500 late in May. Half of the teams on the starting grid this season will be running under Chevy power and are expected to use this new aero kit, with the remaining Honda teams slated to run a different package of their own. Chevrolet Debuts All-New 2015 IndyCar Aero Package Chevy-developed bodywork delivers improved aerodynamics 2015-02-17 INDIANAPOLIS – Chevrolet-powered racecars in the 2015 Verizon IndyCar Series will feature Chevrolet-developed aero packages. Chevrolet introduced the road course/short oval body design today at the Indianapolis Motor Speedway. It is distinguished from the previous racecar with new front wing elements, sculpted side pods and a new rear wing. A speedway configuration for the aero kit, designed for high-speed ovals, will be introduced ahead of its competitive debut at Indianapolis in May. "This is an important milestone in Chevrolet's involvement in IndyCar racing," said Jim Campbell, General Motors U.S. vice president of Performance Vehicles and Motorsports. "We focused on developing an aerodynamic package that delivers an balanced combination of downforce and drag, along with integrated engine performance. It's a total performance package." The new Chevy road course aero configuration delivers greater aerodynamic performance than the previous design.

Read This: Auto Extremist advocates for Corvette as brand with multiple models [w/poll]

Fri, 25 Jan 2013The 2014 Chevrolet Corvette really grinds Peter De Lorenzo's gears. Or, more accurately, the self-anointed Auto Extremist has an issue with what he sees as mismanagement of the legendary sports car by General Motors executives. In a new editorial on his website, De Lorenzo argues it's time to split Corvette off from Chevrolet to create an all-new brand, complete with a model range with at least three new takes on the sports car. Capable of fully leveraging the successes of the Corvette Racing program and brandishing the full might of GM's technical prowess, the Corvette brand would theoretically give Porsche something to sweat over.

Sure, that sounds like a party, but given GM's troubled track record when it comes to launching (let alone managing) brands, we say that's slippery slope that could just as easily end with the whole Corvette franchise in the scrap bin. Either way, the notion is certainly an interesting one. Head over to Auto Extremist to take in the full editorial, and then let us know what you think in Comments. Should GM split off its most storied nameplate?

View Poll

GMC Canyon, Chevy Colorado diesels finally heading to dealers

Fri, Jan 1 2016Customers who have been waiting to receive their diesel-powered Chevrolet Colorados and GMC Canyons should be relived to hear that GM will finally start to ship them out of the Wentzville Assembly Plant. "The highly anticipated 2016 GMC Canyon diesel has begun shipping to dealers," a company spokesperson confirmed to The Detroit News. The trucks originally had a fall launch date, but a final review forced a delay in deliveries. The 2.8-liter four-cylinder diesel in the midsize trucks produces 181 horsepower and 369 pound-feet of torque, and the company touts the engine's low emissions. The Environmental Protection Agency and California Air Resources Board even put the mill through extra scrutiny with a real world test in the wake of VW's diesel scandal, and the Duramax passed with no problems. At that time, a Chevy spokesperson told Autoblog that the models' launch was on track. The Duramax engine adds $3,730 to the price of a comparable V6 model, but they're the most fuel-efficient pickups on the market. The EPA estimates the twins at 31 miles per gallon highway, 22 mpg city, and 25 mpg combined in two-wheel drive form and 29/20/23 with four-wheel drive. Buyers likely can't wait to finally experience these pickups after reading a heap of positive reviews. The Colorado diesel recently earned Motor Trend's Truck of the Year award. We also came away impressed with it during our First Drive and liked the Canyon during our Quick Spin. Related Video: