Chevy 1 Ton on 2040-cars

Ramsay, Montana, United States

Engine:350

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Exterior Color: Blue

Make: Chevrolet

Interior Color: Blue

Model: Other Pickups

Number of Cylinders: 8

Trim: 2 Door Flatbed PU

Drive Type: Automatic

Mileage: 100,000

Sub Model: Chevrolet Flatbed PU

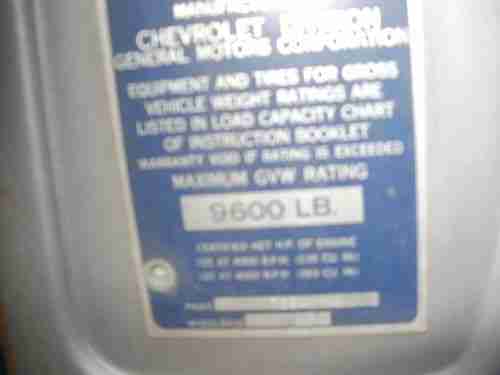

This 1958 Chevy 1 Ton Flatbed Pickup Truck is a 358 V8 Automatic. It has disc brakes, power steering and sub-frame. It runs, steers and stops good. It is located in the Butte, Montana area. I can be reached at 406-498-9696, leave a message please.

Chevrolet Other Pickups for Sale

1946 chevrolet one ton pickup

1946 chevrolet one ton pickup 1951 chevy truck...show quality..just completed frameoff restoration

1951 chevy truck...show quality..just completed frameoff restoration 1950 chevrolet pick up

1950 chevrolet pick up 1977 chevy chevrolet c20 silverado truck with 454 trailering special very rare!!

1977 chevy chevrolet c20 silverado truck with 454 trailering special very rare!! "1970 chevrolet c-20 custom camper longhorn"(US $5,500.00)

"1970 chevrolet c-20 custom camper longhorn"(US $5,500.00) +++ beuatiful matt black 1950 chevy pickup 3100, california truck +++

+++ beuatiful matt black 1950 chevy pickup 3100, california truck +++

Auto Services in Montana

Waldorf Auto Outlet ★★★★★

Tommy`s Auto Body ★★★★★

Rangitsch Brothers Tpprs ★★★★★

Loren`s Auto Repair ★★★★★

Cut Bank Tire ★★★★★

Blue Ribbon Auto SVC ★★★★★

Auto blog

GM to build outgoing Silverado and Sierra until late 2019

Tue, Nov 6 2018As it has done with previous generations, General Motors is keeping the outgoing versions of its 1500 pickups in production despite the arrival of the all-new 2019 Chevrolet Silverado and 2019 GMC Sierra. The production of the previous, K2 generation models will begin to be wound down gradually, according to Automotive News, starting with crew cabs "early next year," and double and regular cab models following during "the early second half of next year." The old model trucks will continue to be built into "late 2019" based on market demand, GM's spokesperson Kim Carpenter said. The Chevrolet will go by the name Silverado LD, with the GMC Sierra designation still to be announced. Some of the outgoing models are built by sharing the assembly work between two GM plants. Partially finished Silverado and Sierra double cab bodies are shipped from Fort Wayne, Ind., to Oshawa, Ont., where the trucks are completed, including receiving paint. This eases the workload in Fort Wayne, where production of the new T1 generation trucks started in July 2018. In January, the Silao plant in Mexico will take on the duties of building new generation regular cab and crew cab trucks. Carpenter also said that the "Oshawa shuttle," as the shared production is called, has been very successful. As a result, 60,000 more trucks will be built than what the original production forecast initially called for. GM's latest quarterly profits, disclosed last week to be $1 billion, have been far higher than expected and will result in full-year profits far higher than what had been predicted in light of steel tariffs. GM isn't the only truck maker taking a similar multi-generation approach for 2019. Both the outgoing and redesigned Ram 1500 are in production, with the previous generation being dubbed Ram 1500 Classic. Related Video:

2016 Chevrolet Corvette Stingray Beauty-Roll

Tue, Nov 10 2015For those of you paying attention, we've really ramped up the old Autoblog video game these days. Our new series Car Club USA joins Translogic and The List, and there are more Daily Drivers and Short Cuts than ever. But sometimes, all you care about is the car. The Autoblog Beauty-Roll video series has one goal: bring you glossy video images of cars, and nothing but. We're collecting moving pictures of all the cars we test, inside and out. Each episode comes with a hit of engine sound – start-up and with a few revs – to round out the package. Set your resolution to max, kick it into full-screen, turn up the sound, and enjoy today's subject, the 2016 Chevrolet Corvette Stingray. Oh, and if you'd like more Beauty-Roll, click here to see the back catalog.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.