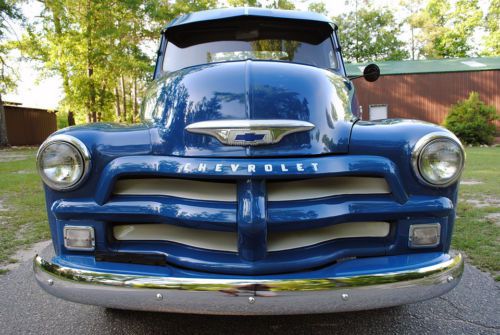

1955 Chevrolet Pickup 1st Series * Nice Older Restore * Dependable 235 3-speed on 2040-cars

Appling, Georgia, United States

Chevrolet Other Pickups for Sale

Auto Services in Georgia

ZBest Cars ★★★★★

Woods Automotive ★★★★★

Wellington Auto Sales ★★★★★

Volvotista ★★★★★

US Auto Sales - Covington ★★★★★

US Auto Sales ★★★★★

Auto blog

With only 246 Volts sold in Australia, Holden not getting next-gen model

Tue, Apr 28 2015The Chevrolet Volt has not been the resounding success General Motors hoped for here in the United States. But it's fortunes in Chevy's home country are nothing compared to how poorly it's done down under. Only 246 Volts have been sold in Australia, where the car is branded as a Holden, since its debut in 2012. That's not just a bad showing – it's an absolute disaster. According to Motoring.com.au, it was the Volt's astonishing $60,000 price tag, combined with a lack of interest from Aussie drivers, that killed the car's chances. What's fascinating about this development, though, is that it doesn't necessarily seem to be Holden that's pulling the plug. Instead, it's the Volt's Hamtramck, MI factory, which is preparing to shift into production of the second-generation model that seems to be taking the blame. According to Motoring, the plant confirmed that it will only build the Gen 2 plug-in in left-hand-drive form, basically ruling out a model for Australia. "Electric and hybrid vehicles haven't taken off in Australia," Holden's director of communications, Sean Poppitt, told Motoring. "Considering the lack of infrastructure, the lack of government incentives, the large distances between cities, it's a tough sell." The death of the right-hand drive Volt won't be the only loss of business in Hamtramck. Opel has already confirmed that it will drop the plug-in's European fraternal twin, the Ampera, while the next-gen Chevy won't make the trip across the pond either. Related Video:

2019 Chicago Auto Show photo gallery: All of the grilles

Fri, Feb 8 2019Do you like trucks? How about grilles? Like really big, shiny, chromey, in-your-face, could-be-made-by-Broil-King grilles? Well, the Chicago Auto Show is the place to be. Traditionally known as the truck show of the annual auto show circuit (at least those covered by national media), Chicago has what seems like a small national park's worth of acreage devoted to both consumer and commercial trucks. From humble extended cab Ford Rangers to a mammoth F-650 with cherry picker sprouting from its aft quarters, there's bound to be a truck for everything. And they all have grilles. So above is our gallery devoted to them, because hell, why not? Should you want to know about the trucks attached to those grilles, check out our coverage below. Heavy Duty Trucks 2020 Chevrolet Silverado HD revealed, tows 35,500 pounds 2020 GMC Sierra HD revealed, has more subtle looks than Chevy sibling 2019 Ram Heavy Duty trucks get new face, 1,000 pound-feet of torque 2020 Ford F-Series Super Duty revealed, adds massive gas engine Full-Size Trucks Read how all of the full-size trucks compare to each other 2019 Chevrolet Silverado First Drive 2019 Chevrolet Silverado 2.7L Turbo First Drive 2019 GMC Sierra First Drive 2019 GMC Sierra AT4 First Drive 2019 Ram 1500 Laramie Quick Spin Review 2019 Ram 1500 eTorque Drivers' Notes Review 2019 Ford F-150 2.7L EcoBoost Quick Spin Review 2018 Ford F-150 King Ranch Power Stroke Diesel Review Related Video: Featured Gallery 2019 Chicago Auto Show: All of the grilles View 40 Photos Chicago Auto Show Chevrolet Ford GMC RAM Truck chevrolet silverado

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

1947 chevrolet 3/4 ton school bus, suburban, carryall

1947 chevrolet 3/4 ton school bus, suburban, carryall 1972 chevy chevrolet c 10 pick up stepside truck

1972 chevy chevrolet c 10 pick up stepside truck 1950 chevrolet pickup deluxe cab

1950 chevrolet pickup deluxe cab 1955 chevy cameo

1955 chevy cameo 1970 chevrolet c20 camper special with ac cab. daily driver beautiful truck

1970 chevrolet c20 camper special with ac cab. daily driver beautiful truck 1954 chevrolet pick-up truck

1954 chevrolet pick-up truck