Original 1971 Chevrolet Nova Real Ss L78 Creation Big Block 396 Super Sport on 2040-cars

Ursa, Illinois, United States

Body Type:Coupe

Engine:396 Big Block

Vehicle Title:Clear

Fuel Type:Premium

For Sale By:Private Seller

Interior Color: Black

Make: Chevrolet

Number of Cylinders: 8

Model: Nova

Trim: Super Sport with Deluxe Interior

Drive Type: Rear

Mileage: 89,000

Sub Model: Super Sport SS

Warranty: Vehicle does NOT have an existing warranty

Exterior Color: Cranberry Red

Chevrolet Nova for Sale

* 1971 nova * 396/375 hp. * automatic * 12 bolt * new paint and interior(US $21,500.00)

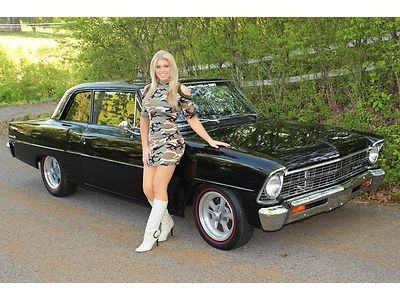

* 1971 nova * 396/375 hp. * automatic * 12 bolt * new paint and interior(US $21,500.00) 1967 chevy ii (nova) sedan

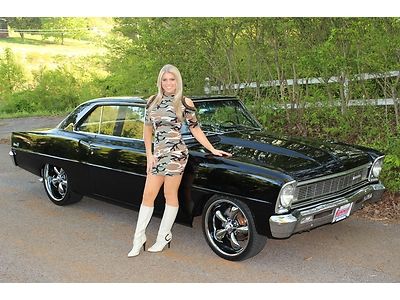

1967 chevy ii (nova) sedan 1967 chevy black beauty nova vintage air disc brakes drives a1 350/350 must see

1967 chevy black beauty nova vintage air disc brakes drives a1 350/350 must see 1966 chevy black beauty nova hardtop 383 stroker pdb slick slick slick

1966 chevy black beauty nova hardtop 383 stroker pdb slick slick slick 1972 chevrolet nova ss 350 v8 4 speed manual ps console pb check this out(US $17,999.00)

1972 chevrolet nova ss 350 v8 4 speed manual ps console pb check this out(US $17,999.00) 1973 chevrolet nova roller

1973 chevrolet nova roller

Auto Services in Illinois

Z & J Auto Sales ★★★★★

Wright Automotive Inc ★★★★★

Wheatland Automotive Inc ★★★★★

Value Services ★★★★★

V & R Auto & Truck Repair ★★★★★

United Glass Co ★★★★★

Auto blog

First privately owned Corvette Stingray blitzes 1/4 mile in 12.23 at 114.88 mph

Tue, 01 Oct 2013Chevrolet's latest road rocket, the Corvette Stingray, is a very quick car. If one needs further proof of that, we recommend they take a look at this video from Hennessey of what is claimed to be the first privately owned C7 Corvette to make a pass down the quarter mile. Not just any quarter mile, mind, this black C7 blitzed its way down the tuner's primary testing dragstrip. The Chevrolet ran the quarter in just 12.23 seconds at 114.88 miles per hour. That is a very quick time for a stock car.

Equipped with the Z51 package and a six-speed automatic transmission, not only does the C7 run a solid time, but it does so with little to no drama. That won't last though, as Hennessey will likely return it to its owner with far more power - we just hope they show a drag run of the completed product. Take a look below to watch the C7's 12.23-second run on video.

GM says over 40% of new China launches in next five years will be EVs

Wed, Aug 19 2020SHANGHAI — General Motors is planning an electric car offensive in China with more than 40% of its new launches in the country over the next five years set to be electric vehicles (EVs), the U.S. carmaker said on Wednesday. GM's electric vehicles, many of which will be all-electric battery cars, will be manufactured in China with almost all parts coming from local suppliers, the company said in a statement released at its Tech Day event in Shanghai. Reuters reported earlier on Wednesday that GM was planning to overhaul its Chinese line-up to stem a slide of sales after more than two decades of growth in a country that contributes nearly a fifth of its profit. GM's new China boss Julian Blissett told Reuters that new technologies, such as EVs and cars with near hands-free driving for highways, would play a key role in GM's China initiatives, which are part of a push to get annual sales in the country back to the 4 million peak it hit in 2017. GM did not say in its statement how many new or significantly redesigned models it was planning to launch in China over the next five years. "China will play a crucial role in making our vision a reality," GM CEO Mary Barra said in the statement, referring to its initiative to create what it describes as a future of "zero crashes, zero emissions and zero congestion" through electrification and smart-driving technologies. GM has said it plans to invest more than $20 billion in electric and automated vehicles globally by 2025. It was not clear how much of that investment will be spent in China. (Reporting by Norihiko Shirouzu in Shanghai; Editing by David Clarke) Related Video: Green Buick Cadillac Chevrolet GM Electric China

GM profit dips on truck changeover, but beats estimates

Thu, Apr 26 2018DETROIT — General Motors on Thursday reported a higher-than-expected quarterly profit despite a drop in production of high-margin pickup trucks, as it gears up for new models that are expected to boost profits next year. Like rivals Ford and Fiat Chrysler Automobiles, GM is banking on highly-profitable Chevy Silverado and GMC Sierra pickup trucks to lift profits, as consumers shift away from traditional passenger cars in favor of these larger, more comfortable trucks, SUVs and crossovers. During the first quarter, the process of changing over to GM's new pickups resulted in a drop in production of 47,000 units. GM Chief Financial Officer Chuck Stevens said the production drop had resulted in a drop in pre-tax profit of up to $800 million. Earlier this year, GM said its 2018 profits would be flat compared with 2017, but expected its all-new pickup trucks would boost margins starting in 2019. On Thursday, GM reiterated its full-year 2018 forecast for adjusted earnings in a range from $6.30 to $6.60 per share. The automaker said capital expenditures were more than $500 million higher in the quarter because of investments its new pickup trucks and a family of low-cost vehicles under development with Chinese partner SAIC Motor Corp. On Wednesday, rival Ford said it would stop investing in most traditional passenger sedans in North America. CFO Stevens told reporters on Thursday that GM has "already indicated that we will make significantly lower investments on a go-forward basis" in sedans. 2019 GMC Sierra View 21 Photos GM benefited from a lower effective tax rate in the quarter, but adjusted pre-tax margin fell to 7.2 percent from 9.5 percent a year earlier. Stevens said the company's profit margin should hit 10 percent or higher in the second quarter and for the full year. GM said material costs were $700 million higher in the first quarter, and it expects those costs to continue rising. The automaker said it would counter those increases with cost cutting measures. "It is a more difficult environment than it was three or four months ago," Stevens said when asked about rising commodity prices from potential steel and aluminum tariffs announced by the Trump administration. "But we are confident we can continue to offset that." The company reported quarterly net income of $1.05 billion or $1.43 per share, a drop of nearly 60 percent from $2.61 billion or $1.75 per share a year earlier. Analysts had on average expected earnings per share of $1.24.