2003 Chevy Monte Carlo *low Miles* 38k Gold Very Good Cond. Clean History on 2040-cars

Las Vegas, Nevada, United States

|

Hello!

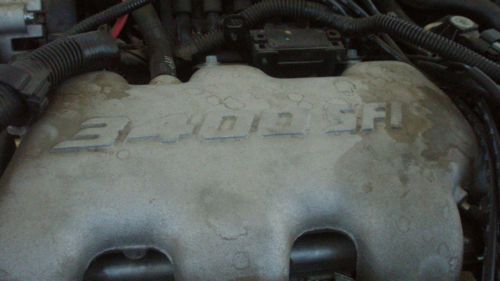

Up for bid is a 2003 Chevy Monte Carlo LS Coupe with less than 39,000 miles on it! Only two owners its entire life, me and grandma. Very well taken care of. Luxury model. Just had an oil change and passed smog in Nevada. Gets between 17 and 25 mpg in the city and between 27 and 37 on the highway! Very large trunk! Lots of room in the backseat! Automatic lights, never leave your lights on again! Very nice car. If you have any questions, please ask! |

Chevrolet Monte Carlo for Sale

1970 chevy monte carlo

1970 chevy monte carlo 1986 monte carlo cutsom hot rod muscle car donk super sweet(US $7,000.00)

1986 monte carlo cutsom hot rod muscle car donk super sweet(US $7,000.00) 1984 chevy monte carlo ss drag racing 406 sb 350 turbo

1984 chevy monte carlo ss drag racing 406 sb 350 turbo Rrred! * ss * (( mnroof...leather...alloys..loaded ))no reserve

Rrred! * ss * (( mnroof...leather...alloys..loaded ))no reserve Dale earnhardt edition(US $11,500.00)

Dale earnhardt edition(US $11,500.00) 1986 chevrolet monte carlo ss_305 ci v8_auto_23k miles_original_lots of docs

1986 chevrolet monte carlo ss_305 ci v8_auto_23k miles_original_lots of docs

Auto Services in Nevada

Zip Zap Auto ★★★★★

Vaughn Motor Sports ★★★★★

Unique Sounds ★★★★★

Trimline of Reno ★★★★★

Trimline of Reno ★★★★★

Sudden Impact Auto Body & Collision Repair Specialists ★★★★★

Auto blog

Nissan Frontier and a mid-engine Mustang | Autoblog Podcast #622

Fri, Apr 10 2020In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by News Editor Joel Stocksdale and Associate Editor Byron Hurd. They discuss news about the 2020 and 2021 Nissan Frontier, as well as a mystery Mustang and classic luxury coupes. After that, they talk about cars from the fleet including Chevy Silverados and the long-term Volvo S60 T8. Autoblog Podcast #622 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown 2020 and 2021 Nissan Frontier updates 1966 mid-engine Mustang prototype Personal luxury coupes Cars we're driving 2020 Chevy Silverado 1500 Trail Boss 2020 Chevy Silverado 2500 HD 2020 Volvo S60 T8 plug-in hybrid Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video:

Chevy Corvette Stingray picks up another award, this time from Automobile

Mon, 18 Nov 2013The new Chevrolet Corvette Stingray has picked up another buff book accolade after capturing Road and Track's Performance Car of the Year award. The seventh-generation of America's sports car (sorry Viper, Mustang, et al.) has been named Automobile Magazine's Automobile of the Year.

Automobile's award to the Corvette over competitors is the mirror image of its rival Motor Trend, which named the Cadillac CTS its car of the year over the C7. The CTS was, according to the Automobile team, the closest contender to the mighty Stingray. Great news all around for General Motors it seems.

As for what pushed the Corvette past its distant, four-door cousin, Automobile commended its excellent, 6.2-liter V8 calling the car's performance "simply awesome" while also remarking that it is easier to drive fast than ever before thanks to steering and chassis tweaks. Following a theme set by other publications, there were also plaudits for the interior, of all things, with the buff book complimenting the car's ergonomics and material quality, while also praising the standard seats.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.