Ltz, Only 7,700miles, Heated Leather, Sunroof, Bose Audio, Remote Start 12916 on 2040-cars

Painted Post, New York, United States

For Sale By:Dealer

Engine:3.6L 217Cu. In. V6 FLEX DOHC Naturally Aspirated

Body Type:Sedan

Fuel Type:FLEX

Transmission:Automatic

Warranty: Vehicle has an existing warranty

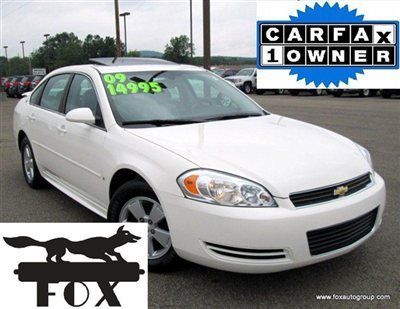

Make: Chevrolet

Model: Impala

Options: Leather

Trim: LTZ Sedan 4-Door

Doors: 4

Drive Type: FWD

Engine Description: 3.6L DOHC 16V

Mileage: 7,700

Number of Doors: 4

Sub Model: 4dr Sdn LTZ

Exterior Color: White

Number of Cylinders: 6

Interior Color: Tan

Chevrolet Impala for Sale

1965 chevy impala super sport convertible

1965 chevy impala super sport convertible Heated leather, sunroof, bose audio, xm radio, bluetooth, remote start 12895(US $20,995.00)

Heated leather, sunroof, bose audio, xm radio, bluetooth, remote start 12895(US $20,995.00) Heated leather, sunroof, bose, remote start, alloys, nonsmoker 1-owner 12973(US $13,995.00)

Heated leather, sunroof, bose, remote start, alloys, nonsmoker 1-owner 12973(US $13,995.00) 1996 impala ss

1996 impala ss 2011 chevrolet impala lt fleet / 1-owner / alloy wheels / factory warranty(US $15,677.00)

2011 chevrolet impala lt fleet / 1-owner / alloy wheels / factory warranty(US $15,677.00) 2001 chevrolet impala base sedan 4-door 3.4l no reserve!(US $1,995.00)

2001 chevrolet impala base sedan 4-door 3.4l no reserve!(US $1,995.00)

Auto Services in New York

Zoni Customs ★★★★★

Williams Toyota Scion ★★★★★

Watertown Auto Repair Svc ★★★★★

VOS Motorsports ★★★★★

Village Automotive Center ★★★★★

V J`s Car Care ★★★★★

Auto blog

2015 SEMA Show Recap | Autoblog Minute

Fri, Nov 6 2015We take a trip to Las Vegas for a preview of the 2015 SEMA Show, the trade show for automotive aftermarket professionals and enthusiasts. Autoblog's Eddie Sabatini reports on this edition of Autoblog Minute, with commentary from Senior editor, Greg Migliore. Chevrolet Ford Honda Mazda Autoblog Minute Videos Original Video galpin

Weekly Recap: The implications of strong new car sales

Sat, Jun 6 2015New car sales are on a roll in the United States this year, and analysts are optimistic the industry will maintain its torrid pace. Sales increased 1.6 percent in May and reached an eye-popping seasonally-adjusted selling rate of 17.8 million, the strongest pace since July 2005, according TrueCar research. That positions the industry for one of its strongest years ever, as consumer confidence, low interest rates, low fuel costs, and an influx of new products propel gains. In addition to the positive economic factors, May also featured warmer weather across much of the US, an extra weekend, and it came on the heels of relatively weak April sales. Analysts suggest income tax refunds and the promise of summer driving and vacations also traditionally help May sales. "While 2015 will be one of the best years in the history of the US industry, in some ways it may be the very best ever," IHS Automotive analyst Tom Libby wrote in a commentary. "Not only are new vehicle registration volumes approaching the record levels of the early 2000s, but now registrations and production capacity are much more closely aligned so the industry is much more healthy." Capacity, an indicator of the auto sector's health, is also expected to grow. Morgan Stanley predicts it will eventually hit at least 20 million units per year, as many companies, including General Motors, Ford, Tesla, and Volvo are investing in new or upgraded factories. "The best predictor of US auto sales is the growth in capacity, and frankly, we're losing count of all of the additions – there's literally something new and big every week," Morgan Stanley said in a research note. Transaction prices, another telling indicator, also continue to show strength. They rose four percent in May to $32,452 per vehicle, and incentives dropped $10 per vehicle to $2,661, TrueCar said. "New vehicle sector and segment preference indicates consumers are confident about the economy and their finances," TrueCar president John Krafcik said in a statement. Still, Morgan Stanley noted the robust sales did little to immediately impact automaker stock prices and suggested it might be a prime time to sell if sales reach the 18-million pace. "Perhaps the biggest reason may be that investors have seen this movie before," the firm wrote.

Recharge Wrap-up: Tesla P85D upgrades coming soon, lease a Chevy Volt for $149 a month

Wed, Dec 31 2014CarCharging has raised $6 million from shareholders and has restructured to save cash. The EV charging company plans to expand further in 2015 - with an eye toward achieving profitability - in part by investing in technology and "unlocking the value of our significant equipment inventory," says CarCharging CEO Michael D. Farkas. The group expects to reduce administrative costs by 40 percent, and has hired an interim Chief Financial Officer to help carry out its plans for growth. CarCharging raised the cash through offering convertible preferred stock to its shareholders, whom Farkas thanked "for their passion and patience." Read more in the press release below. Rydell Chevrolet in Los Angeles is offering Chevrolet Volt leases for $149 per month. In a video ad, Rydell offers the Volt for $169 a month with $3,390 due at signing, but another ad shows the offer at $149 a month with $3,550 down or $248 per month with $0 down. Rydell Chevrolet will ship the car anywhere in the lower 48 states. It also appears they offer cupcakes. See Rydell's video below, or read more at Inside EVs. Tesla will upgrade the Model S P85D with higher performance and top speed. The free update, which is due "in the next few months" according to a statement from Tesla, will raise the electronically limited top speed from 130 to 155 miles per hour. "Additionally, an over-the-air firmware upgrade to the power electronics will improve P85D performance at high speed above what anyone outside Tesla has experienced to date," Tesla says. The update will be available for the lifetime of the car, which includes subsequent owners. Read more at Green Car Reports. Car Charging Group Completes $6 Million Capital Raise Concurrently Enacts Restructuring Actions to Reduce Cash Burn MIAMI BEACH, Fla., Dec. 29, 2014 /PRNewswire/ -- Car Charging Group, Inc. (OTCQB: CCGI) ("CarCharging" or the "Company"), the largest owner, operator, and provider of electric vehicle (EV) charging services, today announced that it has closed an offering (the "Offering") and raised net proceeds of up to $6 million with current institutional shareholders. The Offering consisted of convertible preferred securities with a conversion price of $0.70 and warrants exercisable at $1.00. Proceeds will be used to: - Strengthen CarCharging's balance sheet; - Build on the past year's progress; and - Provide growth capital for expanding the Company's network.