Chevrolet El Camino for Sale

Auto Services in New York

Websmart II ★★★★★

Wappingers Auto Tech ★★★★★

Wahl To Wahl Auto ★★★★★

Vic & Al`s Turnpike Auto Inc ★★★★★

USA Cash For Cars Inc ★★★★★

Tru Dimension Machining Inc ★★★★★

Auto blog

'Tomorrowland' movie will advertise Chevy Volt, E-NVs

Fri, Mar 27 2015Before the 2016 Chevrolet Volt arrives at dealerships, it's going to come to a cineplex near you. The next-generation hybrid and the EN-V electric networked vehicle concept will play bit parts in the background of the upcoming Disney movie Tomorrowland starring George Clooney and Britt Robertson. Chevrolet will run digital and television ads around the movie's opening, which is May 22 in the US. The Bowtie and Disney tie-up is another in their years-long collaboration, going back to the revamped Test Track that opened at Epcot Center in 2012, and Chevolet is also the official vehicle of Shanghai Disney. The press release below has more on the movie and the Volt, the movie trailer is above – there's no Volt in it, but there is a late-model Buick. Chevrolet and Disney See Possibilities in 'Tomorrowland' Film to help kick off marketing efforts for next-generation Chevrolet Volt DETROIT, 2015-03-26 – At their core, Disney and Chevrolet are entities of optimism, believing that with a little ingenuity, anything is possible. They will come together in the new Disney film "Tomorrowland" to imagine the possibilities. The all-new 2016 Chevrolet Volt and EN-V concepts appear in the backdrops of the present day and Tomorrowland. The film's U.S. debut is May 22. In Disney's riveting mystery adventure "Tomorrowland," a jaded scientist and an optimistic teen embark on a danger-filled mission to unearth the secrets of an enigmatic place somewhere in time and space. "Tomorrowland is a place where nothing is impossible, which is something that Chevrolet believes can exist in the here and now," said Tim Mahoney, vice president, Global Chevrolet. "The Chevrolet spirit reflects the hopes and possibilities of tomorrow in real instruments of change for today like the next-generation Chevrolet Volt." The first marketing efforts for the 2016 Chevrolet Volt will be tied to Tomorrowland. A television spot and digital advertising will debut in early May. The all-new Volt is an electric car with extended range, showcasing a sleeker, sportier design that offers 50 miles of EV range, greater efficiency and stronger acceleration. The Volt's new, efficient propulsion system will offer an estimated total driving range of more than 400 miles. With regular charging, owners can expect to average more than 1,000 miles between gas fill-ups. Chevrolet and Disney have a long history of collaboration around the globe.

Recharge Wrap-up: Chevy Volt named KBB "Best Buy," slow BMW i3 sales in Germany

Wed, Nov 19 2014The Chevrolet Volt has been awarded Kelley Blue Book's Electric/Hybrid Car Best Buy for 2015. KBB cited the car's electric commuter capabilities, extended range, acceleration, design and overall value as reasons to place it above the Nissan Leaf, BMW i3 and Toyota Prius. It works well in the real world, and doesn't leave drivers with range anxiety. Plus, it's comfortable, and a fun car to drive, according to KBB. Read more at Kelley Blue Book. The BMW i3 is seeing slow sales in Germany. BMW has sold about half the number of i3s it expected in its home country, with about 1,900 sold in the first nine months. BMW projected sales of 5,000 to 6,000 in the first year. BMW partly blames long shipping times for the slow sales, and the company is offering incentives in hopes of getting more people to adopt the electric car. In the US, BMW sold more than 1,000 units each month between August and October. Read more at Green Car Reports. Audi is pursuing new carbon-neutral synthetic fuels - or e-fuels - such as Audi e-diesel. Audi's newest project uses electrolysis of water to create hydrogen, which it then reacts with CO2 extracted from the air. The result is a liquid - called Blue Crude - full of energy from hydrocarbon compounds. The Blue Crude can then be converted into a sulfur-free synthetic diesel called e-diesel. This e-diesel can be used as a drop-in fuel, blended into fossil diesel for a more renewable fuel. Read more at Hybrid Cars. Uber is partnering with Spotify to allow passengers to choose what music they listen to during their ride. Users will be able to choose their own playlist that will be ready and playing for them when they are picked up. It offers a more personalized experience from the ride-hailing service, which, according to Uber CEO Travis Kalanick, is "nirvana" for music lovers. Paying Spotify users will be able to use the feature initially in London, Los Angeles, Mexico City, Nashville, New York, San Francisco, Singapore, Stockholm, Sydney and Toronto. Check out the video below and read more at Wired. Featured Gallery 2014 Chevrolet Volt View 11 Photos Related Gallery 2014 BMW i3: First Drive View 33 Photos News Source: Kelley Blue Book, Green Car Reports, Hybrid Cars, WiredImage Credit: Chevrolet Green Audi BMW Chevrolet Transportation Alternatives Technology Emerging Technologies Electric Videos recharge wrapup

Top 11 Lego Technic cars to buy on Amazon in 2024

Mon, Jan 22 2024Autoblog may receive a share from purchases made via links on this page. Pricing and availability are subject to change. I recently got a birthday wish list from my 11-year-old nephew, and I couldn't help but smile when I saw “Lego Technic Cars” at the top. Lego isnÂ’t a phase, itÂ’s a lifestyle. Once a Lego fan, always a Lego fan. In fact, IÂ’d be willing to bet that many of you reading this right now have some kind of Lego vehicle in a box somewhere, or better yet, on display in your home. While theyÂ’re not necessarily cheap, getting into building Lego Technic vehicles doesnÂ’t have to bankrupt you, either, unless you go for the $400 Lamborghini right off the bat. Here are 11 of our favorite Lego Technic vehicles on Amazon, right now, ranging from an affordable $35 all the way up to $450. LEGO Technic Ford Mustang Shelby GT500 Ages 9+ (544 Pieces) - $39.99 (20% off) One of my first and favorite model cars growing up was a first-gen Ford Mustang GT350, so this GT500 for under $40 is right up my alley. At 544 pieces and made for ages 9 and up, the GT500 is a considerable step up from Grave Digger but a great starter to a Technic collection nonetheless. It isnÂ’t the most accurate-looking vehicle in this list, but the AR app and the fact that it can drive make it a worthwhile purchase. $39.99 at Amazon LEGO Technic Formula E Porsche 99X Electric Ages 9+ (422 Pieces) - $49.99 Not a Ford fan? Not a problem. This Formula E Porsche 99X is the same price and better looking than the GT500. Even though there are 122 fewer pieces in this Porsche set, it has a level of detail seen in much more expensive Technic sets including numerous decals and a pull back motor. $49.99 at Amazon LEGO Technic Jeep Wrangler Ages 9+ (665 Pieces) - $54.99 This is the set I ended up going with for my nephew, not because I think it is the coolest, but because for the price, I think you get the most bang for your buck. 665 pieces is over 50% more than the comparatively priced Porsche 99X and it also scratches the nostalgia itch for me: The first-ever model vehicle I built was a yellow Jeep Wrangler Sahara. This Wrangler Rubicon has definitely had some aftermarket mods like the front winch, which makes it one of the coolest Technic sets under $60. $54.99 at Amazon LEGO Technic Monster Jam Grave Digger Ages 7+ (212 Pieces) - $34.16 If ever there was a gateway Lego Technic, this Grave Digger is it.

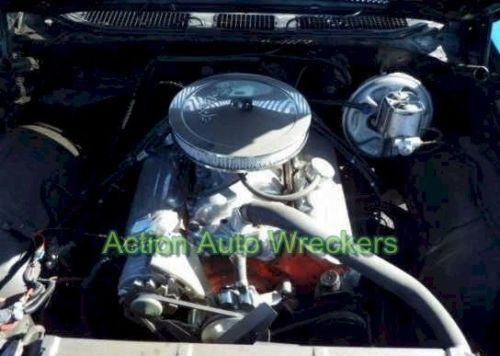

1959 chevrolet el camino restored with many nos parts one owner 427 big block 59

1959 chevrolet el camino restored with many nos parts one owner 427 big block 59 1969

1969 1970 chevrolet el camino - true ss!!!

1970 chevrolet el camino - true ss!!! 1965 chevrolet-el camino

1965 chevrolet-el camino 1969 chevy el camino fresh paint and upholstery, runs great !

1969 chevy el camino fresh paint and upholstery, runs great ! 1972 chevy chevelle elcamino ss 22,484 original documented miles !!

1972 chevy chevelle elcamino ss 22,484 original documented miles !!