1970 El Camino Ss Pro Touring on 2040-cars

Huntsville, Ontario, Canada

Engine:427ci, 600HP

Body Type:Pickup Truck

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Exterior Color: Black

Make: Chevrolet

Interior Color: Black

Model: El Camino

Number of Cylinders: 8

Trim: SS

Drive Type: Rear wheel

Mileage: 37,765

Sub Model: Pro Touring

Chevrolet El Camino for Sale

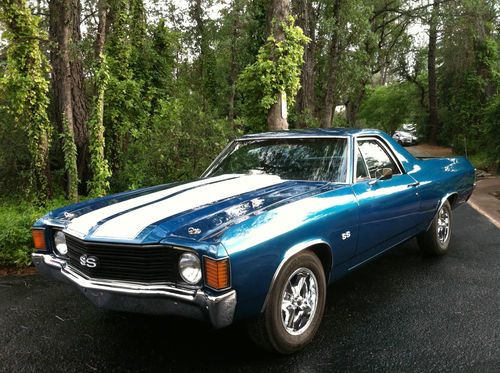

1972 el camino completly restored rare color ,teal with white strips

1972 el camino completly restored rare color ,teal with white strips 1973 chevy el camino rebuilt 350,. very clean runs great! bid with confidence

1973 chevy el camino rebuilt 350,. very clean runs great! bid with confidence 1970 chevrolet el camino custom

1970 chevrolet el camino custom Incredible 1972 ss 396 el camino, all original true ss 396 cranberry red car

Incredible 1972 ss 396 el camino, all original true ss 396 cranberry red car 1969 chevy el camino ss big block(US $11,700.00)

1969 chevy el camino ss big block(US $11,700.00) 1959 el camino 350 4 speed automatic 700r4 hotrod hot rat rod 55 pictures

1959 el camino 350 4 speed automatic 700r4 hotrod hot rat rod 55 pictures

Auto blog

Chevy Camaro is a good sport, wishes Ford Mustang Happy 50th

Tue, 15 Apr 2014It was 1966 when Chevrolet launched its challenger to the wildly successful Ford Mustang, the Camaro. While the competition between the two brands was already healthy, the arrival of the Camaro set off one of the most intense, model-to-model rivalries in the industry.

That competitive spirit hasn't stopped Chevy and the Camaro from wishing Ford's iconic muscle car a Happy 50th Birthday as the Ford's April 17 anniversary rolls around. These two cars have been linked over the years, and while the rivalry took a break for a few years in the 2000s, today's competition between the Camaro and Mustang is as fierce as it's ever been.

You might recall that this friendliness when it comes to major milestones isn't too rare. Ford put on quite a display for General Motors' hundredth anniversary back in 2008. As the Camaro's fiftieth birthday approaches in 2016, we wouldn't be surprised to see the Mustang sending its best wishes to its Bowtie rival.

Why Cadillac thinks it needs to succeed in Europe to sell cars elsewhere

Tue, 26 Feb 2013Ward's Auto has taken an interesting look at the renewed focus General Motors is showing towards Cadillac in Europe. Susan Docherty, president and managing director of Chevrolet and Cadillac in Europe (pictured), says in order for the luxury brand to thrive in China, it first needs to succeed in the old country. The reason? Chinese buyers look to Europe for cues as to what's deemed worthy of the term "luxury." There are hurdles to the plan, however. In addition to the fact that the EU is flooded with high-end nameplates, GM doesn't necessarily have the distribution network in place to put buyers behind the wheel.

Combine that with persistent economic woes and Cadillac's checkered past marred by a lack of diesel engine options and a bankrupt distributor, and the road ahead for the brand looks like less of an uphill climb and more like a straight-up cliff face. But Docherty is optimistic and says she has a plan for the brand. We recommend heading over to Ward's for a closer look at the full read.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.