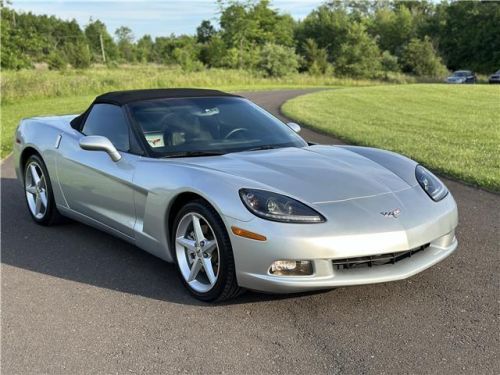

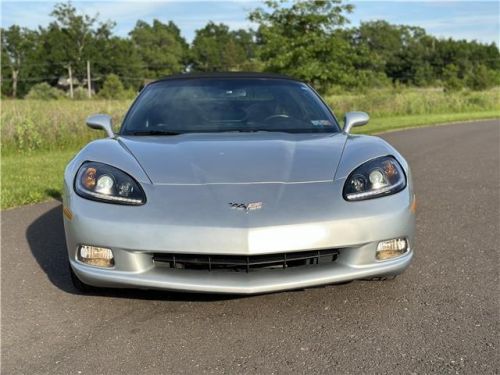

2012 Chevrolet Corvette 2dr Conv W/1lt on 2040-cars

Pipersville, Pennsylvania, United States

Engine:Engine, 6.2L (376 ci) V8 SFI (430 hp [320.6 kW] @

Fuel Type:Gasoline

Body Type:Convertible

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 1G1YE3DW8C5101078

Mileage: 62000

Make: Chevrolet

Trim: 2dr Conv w/1LT

Features: --

Power Options: --

Exterior Color: Silver

Interior Color: Black

Warranty: Unspecified

Model: Corvette

Chevrolet Corvette for Sale

1971 chevrolet corvette t-top coupe 350 auto(US $39,995.00)

1971 chevrolet corvette t-top coupe 350 auto(US $39,995.00) 2018 chevrolet corvette grand sport(US $59,000.00)

2018 chevrolet corvette grand sport(US $59,000.00) 1975 chevrolet corvette(US $9,995.00)

1975 chevrolet corvette(US $9,995.00) 1975 chevrolet corvette(US $9,400.00)

1975 chevrolet corvette(US $9,400.00) 2020 chevrolet corvette stingray 3lt z51 performance(US $115,000.00)

2020 chevrolet corvette stingray 3lt z51 performance(US $115,000.00) 1978 chevrolet corvette(US $3,150.00)

1978 chevrolet corvette(US $3,150.00)

Auto Services in Pennsylvania

X-Cel Auto & Truck Repair ★★★★★

Wynne`s Express Lube & Auto ★★★★★

Westwood Tire and Automotive Inc. ★★★★★

Waynes Truck & Auto Service ★★★★★

Triple Nickel Auto Parts ★★★★★

Top Gun Auto Painting & Bdywrk ★★★★★

Auto blog

Auto sales in March and first quarter down nearly across the board

Wed, Apr 3 2019Nearly every major automaker reported weak U.S. sales for March and the first quarter of 2019, citing a rough start to the year, but said a robust economy and strong labor market should encourage consumers to buy more vehicles as 2019 rolls on. GM, which no longer releases monthly sales figures, saw first-quarter sales fall 7 percent, with declines across all brands. Sales of Silverado pickup trucks fell nearly 16 percent and the high-margin Chevy Suburban large SUV dropped 25 percent. Ford also no longer releases monthly sales numbers, but is due to release its first-quarter sales figures on Thursday. According to industry data, Ford's sales fell 2 percent in the quarter and 5 percent in March. Ford representatives did not immediately respond to requests for comment. FCA reported a 7 percent fall in U.S. sales in March and a 3 percent drop for the first quarter. All of FCA's brands dropped in March, except for Ram, which saw a 15 percent increase in pickup truck sales. "The industry had a tough first quarter, but with spring finally starting to show its face and continued strong economic indicators ... we are confident that new vehicle sales demand will strengthen going forward," FCA's U.S. head of sales, Reid Bigland, said in a statement. Toyota reported a 3.5 percent fall in U.S. sales in March and 5 percent for the first quarter, hurt by declining demand for its Corolla sedans and Camry vehicles. "While some of our competitors are abandoning sedans, we remain optimistic about the future of the segment," Toyota said in a statement. Nissan posted a 5.3 percent drop in sales in March, and its first-quarter sales were down 11.6 percent. Honda and Hyundai bucked the trend. Honda's U.S. sales rose 4.3 percent in March and 2 percent in the quarter, while Hyundai's were up 1.7 percent and 2.1 percent, respectively. Passenger-car sales suffered throughout the January-March quarter compared with the same period in 2018 as Americans continued to abandon them in favor of larger, more comfortable pickup trucks and SUVs, which are far more profitable for automakers. The battle for market share in the particularly lucrative large-pickup truck market intensified in the quarter, as Fiat Chrysler Automobiles' Ram brand outsold the U.S.' No. 1 automaker General Motors' Chevrolet-brand trucks. The two automakers have both launched redesigned pickup trucks.

GM says EVs are the future — but trucks are going to take it there

Fri, Jan 11 2019In the PowerPoint deck for the General Motors Capital Markets Day presentation, one of the more disturbing things comes early on, during GM President Mark Reuss' initial remarks, in an area where he is discussing the company's overall strength in trucks. The point being made is that GM has a truck for all and sundry. And there it is, a phrase on a slide that should send chills up the spines of those who still pine for the old Bob Seger "Like a Rock" Silverado ads: "Little bit country. Little bit rock 'n' roll." That's right. Donny and Marie. Somehow the Denis Leary snark in the F-150 ads is all the more appealing. The Capital Markets Day presentation was chock full of observations about electrification and automation (Reuss and CEO Mary Barra both noted that the corporation's vision is one of "Zero Crashes. Zero Emissions. Zero Congestion." Dan Ammann talked about the progress being made at Cruise Automation; Reuss rolled out the plan for an array of electrified vehicles, with a luxury EV and a compact SUV being the "Centroid Entries" for the modular bases of many others). But it is worth noting that there is no getting away from the power of pickups in the U.S. market, as that was the central topic in Chief Financial Officer Dhivya Suryadevara's comments, with "Truck Franchise" being flanked by "Key Financial Priorities" and "Financial Outlook." Clearly, to gloss the old phrase, the truck segment is where the money is. Suryadevra enumerated how the truck segment is significantly different than other types of light vehicles. Among her points: GM, Ford and FCA have more than 90% of market share. The truck parc has been growing and aging over the past 10 years. Customers are fiercely loyal to the segment—as in 70% of truck buyers are truck buyers. A good number of the vehicles are for commercial use (40 percent). Trucks are "less prone to. . .mobility disruption." Trucks offer high margins. Translaton: The segment is one that they're solidly positioned in. There are lots of old trucks on the road that will need to be replaced by new ones. Perhaps buyers may switch from a Sierra to a Canyon, but it will be a truck. If your livelihood depends on that type of vehicle, even if gas prices go up or the economy begins to go south, you're going to stick with it. Most of the country isn't San Francisco, so trucks will continue to be essential. And, well, they're profitable in the extreme.

Chevy, GMC and Ram dealers are worried they'll run out of new pickups

Wed, May 6 2020One of the unexpected side effects of the ongoing coronavirus pandemic is a shortage of pickups at Chevrolet, GMC and Ram dealers. Supplies are running out, and the factories that build these trucks remain closed. Stores across the nation began increasing incentives in March, when the first stay-at-home orders were issued, in a bid to continue luring buyers into showrooms. They also launched online sales channels, or expanded their existing digital business. Sales nonetheless plummeted in April 2020, but in-demand vehicles, like the Ram 1500 and the Chevrolet Silverado, are still selling relatively well thanks in part to the aforementioned incentives. Pickups outsold sedans for the first time in April 2020, according to The Detroit News, by 17,000 units. The problem is that General Motors, Fiat Chrysler Automobiles (FCA), and Ford temporarily closed their factories in March. "The pipeline is very dry," said Mike Maroone, the CEO of a large dealership group named Maroone USA, in an interview with Automotive News. He told the publication his Chevrolet stores are sitting on a 30-day supply of the Silverado, which is one of America's best-selling vehicles. "That is a problem for us," he concluded. Coronavirus-related lockdowns and factory closures compound problems already faced by dealerships who represent General Motors-owned brands. They entered 2020 with a thinner inventory than a year earlier due to the 40-day United Auto Workers (UAW) strike that paralyzed the company late in 2019, and the 0%, 84-month offers announced in March have sapped supply. Ram wasn't affected by a strike, but it has relied heavily on generous incentives to move trucks off lots. Ford, on the other hand, limited incentives to 2019 models. Inventory levels differ greatly from region to region. The national average for the Silverado stood at an 82-day supply in March 2020, down from 120 in March 2019. Ram stores had a 114-day supply of the 1500 (compared to 134 a year earlier), while Ford bucked that trend with a 111-day supply versus 84 in 2019. Don't panic if you're in the market for a truck; we're not facing a complete drought. Automotive News added that America's light-duty pickup inventory could fall to 400,000 units by the end of May, and drop further to 260,000 units in June. For context, there were about 700,000 light-duty trucks in stock in May and June of 2019. That's unquestionably a sharp drop, but there will still be over a quarter of a million trucks to choose from.