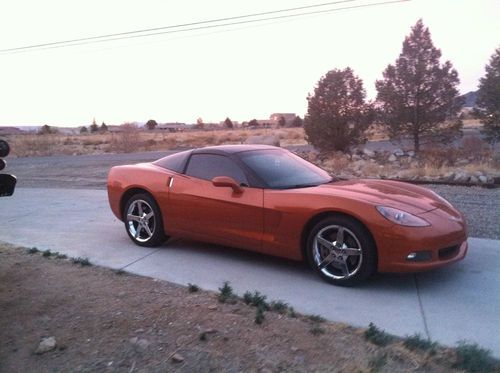

2011 Chevrolet Corvette Grand Sport Convertible 3lt Black Low Miles on 2040-cars

Dallas, Texas, United States

Vehicle Title:Clear

For Sale By:Dealer

Engine:6.2L 376Cu. In. V8 GAS OHV Naturally Aspirated

Body Type:Convertible

Fuel Type:GAS

Make: Chevrolet

Model: Corvette

Trim: Grand Sport Convertible 2-Door

Doors: 2

Drivetrain: Rear Wheel Drive

Drive Type: RWD

Number of Doors: 2 Generic Unit (Plural)

Mileage: 12,603

Sub Model: Z16 Grand Sport 3LT

Number of Cylinders: 8

Exterior Color: Black

Interior Color: Tan

Chevrolet Corvette for Sale

2000 corvette frc rolling chassis(US $10,000.00)

2000 corvette frc rolling chassis(US $10,000.00) 2007 chevrolet corvette z51 coupe 2-door 6.0l(US $28,000.00)

2007 chevrolet corvette z51 coupe 2-door 6.0l(US $28,000.00) 2003 z06 corvette, 50th anniversary(US $27,500.00)

2003 z06 corvette, 50th anniversary(US $27,500.00) 1980 chevrolet corvette

1980 chevrolet corvette 2000 chevrolet corvette coupe! headsup selective ride-control bose/12cd 42kmiles(US $19,900.00)

2000 chevrolet corvette coupe! headsup selective ride-control bose/12cd 42kmiles(US $19,900.00) 2012 chevrolet corvette grand sport 4k miles*automatic*leather*1owner*we finance(US $48,973.00)

2012 chevrolet corvette grand sport 4k miles*automatic*leather*1owner*we finance(US $48,973.00)

Auto Services in Texas

Z`s Auto & Muffler No 5 ★★★★★

Wright Touch Mobile Oil & Lube ★★★★★

Worwind Automotive Repair ★★★★★

V T Auto Repair ★★★★★

Tyler Ford ★★★★★

Triple A Autosale ★★★★★

Auto blog

Chevy's latest Silverado videos assume we're idiots

Mon, Jul 6 2015UPDATE: This article has been revised to reflect that any mention of materials used in a future Chevrolet Silverado is speculation. Can we have a sound, rational debate about the merits of aluminum versus steel? According to Chevrolet's latest marketing videos pitting the Silverado against the Ford F-150, the answer is no. The tone of all three ads is almost Orwellian: steel good, aluminum bad. Of course, this will all be a hilarious joke when an aluminum-bodied Silverado comes in 2018. That's an if, as a member of the General Motor public relations team has reminded me that any articles regarding future product are pure speculation. Until then Chevy needs to sell the current Silverado, with its body comprised chiefly of steel, against the Ford F-150's lightweight aluminum panels. Instead of touting the merits of the "most-dependable, longest lasting pickup," the strategy seems to center around negative propaganda towards the 13th element. The tone of all three ads is almost Orwellian: steel good, aluminum bad. Of the three videos, the most fair is Silverado vs. F-150 Repair Costs and Time: Howie Long Head to Head. Basically: aluminum costs more than steel, it's more difficult to repair, and requires special equipment for body shops. In terms of Chevy versus Ford, the blue oval truck costs more and takes longer to repair - an average of $1,755 more and 34 more days in the shop, according to the ad. But why stop there when you can have pitchman Howie Long raising an eyebrow at random facts? When Silverado Chief Engineer Eric Stanczak says of the Ford, "It's manufactured in a way that combines aluminum, rivets, and adhesive in a process that's different than Silverado." Long responds, "Huh. Interesting." At the end of the video, Long says "I'd be interested to know what happens to insurance costs." Note he's not saying anything substantive. If Chevy's legal team could sign off on some facts about insurance rates, it would be in this ad. On our Autoblog Cost to Own calculator, there is no significant difference in projected insurance costs between the two trucks. But at least that ad has facts. The other two videos are pure hype. In Cages: High Stength Steel, real people are asked what they think of aluminum and steel in a room with two cages. Then a bear is released into the room, and the subjects scurry to the safety of the steel cage.

GM raises 2023 guidance on strong sales, higher profits

Tue, Apr 25 2023General Motors beat first-quarter profit estimates and raised its full-year earnings and cash-flow guidance after vehicle demand at the start of the year surpassed expectations. Its shares rose in premarket trading. GM made $2.21 a share in adjusted profit in the first quarter, compared to a consensus forecast of $1.72 a share. Revenue rose 11% to $39.99 billion, it said Tuesday, which was more than the $39.24 billion analysts expected. The stronger results stem from rising sales in the US, even in the face of higher interest rates and inflation. GM executives said demand was strong enough to revise 2023 guidance upward, boosting profit estimates for the year by $500 million to between $11 billion and $13 billion. “We did it with strong production and inventory discipline and consistent pricing,” GM Chief Financial Officer Paul Jacobson said on a call with journalists. “All in all, weÂ’re feeling confident about 2023.” The Detroit automaker raised per-share full-year guidance to between $6.35 and $7.35, up from $6 to $7 a share, and said free cash flow would also increase by $500 million to a range of $5.5 billion to $7.5 billion. GMÂ’s shares pared a gain of as much as 4.4% before the start of regular trading Tuesday, rising 3.5% to $35.50 as of 6:55 a.m. in New York. The stock was up 1.9% for the year as of the close on Monday. North American Strength The automakerÂ’s sales were particularly strong in North America, where first-quarter earnings rose before interest and taxes rose to $3.6 billion. Vehicle sales rose 18% to 707,000 in the region. Jacobson said the company originally expected to sell 15 million vehicles in the US this year, slightly less than the 15.5 million annualized rate automakers foresaw in the first quarter. North American demand was enough to offset a weak performance in China, GMÂ’s second-largest market. The automaker continues to struggle in the country, where its vehicle sales fell 25% to 462,000 vehicles in the quarter. Profits from its joint ventures in the market slumped 65% to $83 million. The market has struggled overall in the wake of Covid-19 restrictions and foreign automakers have had to overcome a growing preference for Chinese brands by competing on price, squeezing profit margins. The situation in China probably wonÂ’t significantly improve until the second half of the year, according to Jacobson. GM remains on target to sell 150,000 electric vehicles this year, the CFO said.

CES 2020 and Carlos Ghosn | Autoblog Podcast #609

Thu, Jan 9 2020Welcome to a new decade of the Autoblog Podcast. In this week's episode, Editor-in-Chief Greg Migliore is joined by Senior Editor Alex Kierstein and Senior Editor, Green, John Beltz Snyder. First they talk about their early impressions of CES 2020 in Las Vegas, in particular how interesting Sony's Vision-S Concept is. Then they talk about the intriguing saga and daring escape of former Nissan boss and global fugitive Carlos Ghosn. After that, they turn their attention to what they've been driving, including the Genesis G70, Chevy Blazer and Hyundai Santa Fe. Finally, they help a listener pick a new fun toy to replace an unloved Porsche Cayman in the "Spend My Money" segment. Autoblog Podcast #609 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown CES 2020 And that excellent Sony Vision-S Concept What's going on with Carlos Ghosn? Cars we're driving:2020 Genesis G70 2.0T Sport RWD 2020 Chevrolet Blazer Premier AWD 2020 Hyundai Santa Fe 2.0T AWD Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video: